Bank of America (BofA) said Nvidia is “deepening its competitive moat,” while JPMorgan noted that the company’s “aggressive roadmap” keeps it “1-2 steps ahead of its competitors.”

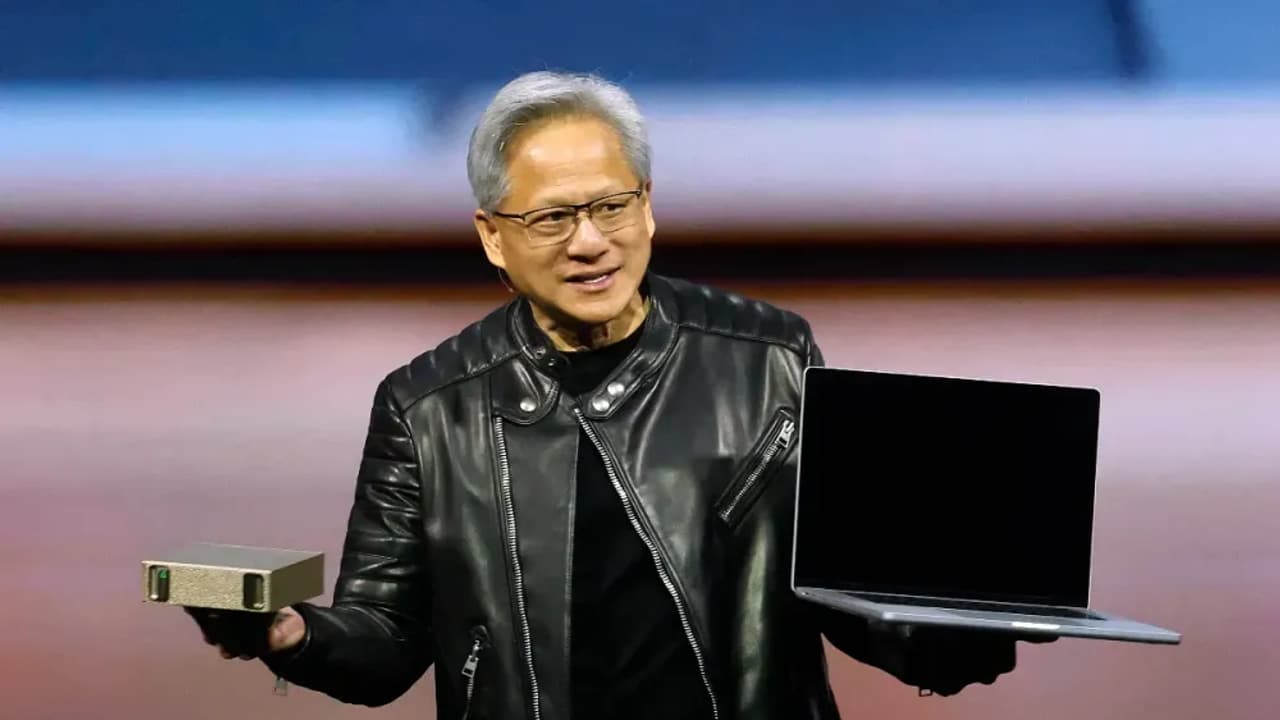

Nvidia (NVDA) shares rose as much as 1.5% in pre-market trade on Wednesday after Wall Street and retail investors reacted positively to CEO Jensen Huang’s keynote at the GTC 2025 conference.

Morgan Stanley noted that while there were "no big surprises" in the presentation – given GTC’s focus on developers rather than investors – the brokerage believes Nvidia made a compelling case for sustained AI scaling through multiple upgrade cycles.

"The discussion of very strong demand from the top four cloud customers – growing from 1.3 million Hopper GPUs in 2024 to current demand for about 1.8 million Blackwell GPUs in 2025 – all frames what we see as a positive investment picture," Morgan Stanley said, as per TheFly.

It reiterated its ‘Overweight’ rating on Nvidia with a $162 price target.

Bank of America also remains bullish, maintaining a ‘Buy’ rating and a $200 price target following Nvidia’s product and partnership announcements. It cited a post-keynote meeting with Nvidia’s CFO, reinforcing its view that the company is "deepening its competitive moat."

JPMorgan echoed similar confidence, stating that Nvidia’s "aggressive roadmap" is driving stronger economics and keeping the company “1-2 steps ahead of its competitors.” It also reaffirmed an ‘Overweight’ rating with a $170 price target.

Retail traders on Stocktwits broadly shared Wall Street’s optimism. An ongoing Stocktwits poll shows that 74% of respondents viewed the keynote positively, highlighting Nvidia’s AI leadership and long-term roadmap as key growth drivers.

While most investors were encouraged by the updates, 14% described them as “solid but not game-changing,” preferring to wait for adoption figures and further earnings clarity.

Another 7% expressed a bearish stance, citing concerns over potential AI demand slowdowns and overhyped market expectations.

Meanwhile, 5% of respondents took a wait-and-see approach, saying broader market conditions and upcoming earnings reports would provide more clarity.

The overall retail sentiment on Stocktwits around Nvidia’s stock ticked higher but remained in ‘neutral’ territory.

The stock is down over 15% in 2025 and has been trading under its 200-day simple moving average (SMA) since Feb. 27.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Jensen Huang Introduces Nvidia Dynamo At GTC 2025, Calls It ‘Operating System’ for AI Agents