NVO has suffered a steep year-to-date decline amid slowing GLP-1 growth, pricing pressure, and investor disappointment over its pipeline, but year-end has brought some good news for the company.

- FDA approval of Wegovy’s oral formulation gives Novo Nordisk an early lead in a potentially large new segment of the weight-loss market.

- Pricing pressures, supply constraints, and intensifying competition from Lilly continue to be headwinds for the stock.

- Sustained stock upside will depend on pill adoption, margin discipline, and the company’s ability to reaccelerate growth after a sharp reset.

Novo Nordisk’s (NVO) year started on a sour note, as a broader stock uptrend seen since 2017 stalled and it began a steady descent, dragged by a host of factors. With the company likely to be the first to market with an oral diabetic pill following the U.S. FDA’s nod for the same, investors hope the stock may have hit bottom and is positioned to turn a new leaf in the new year.

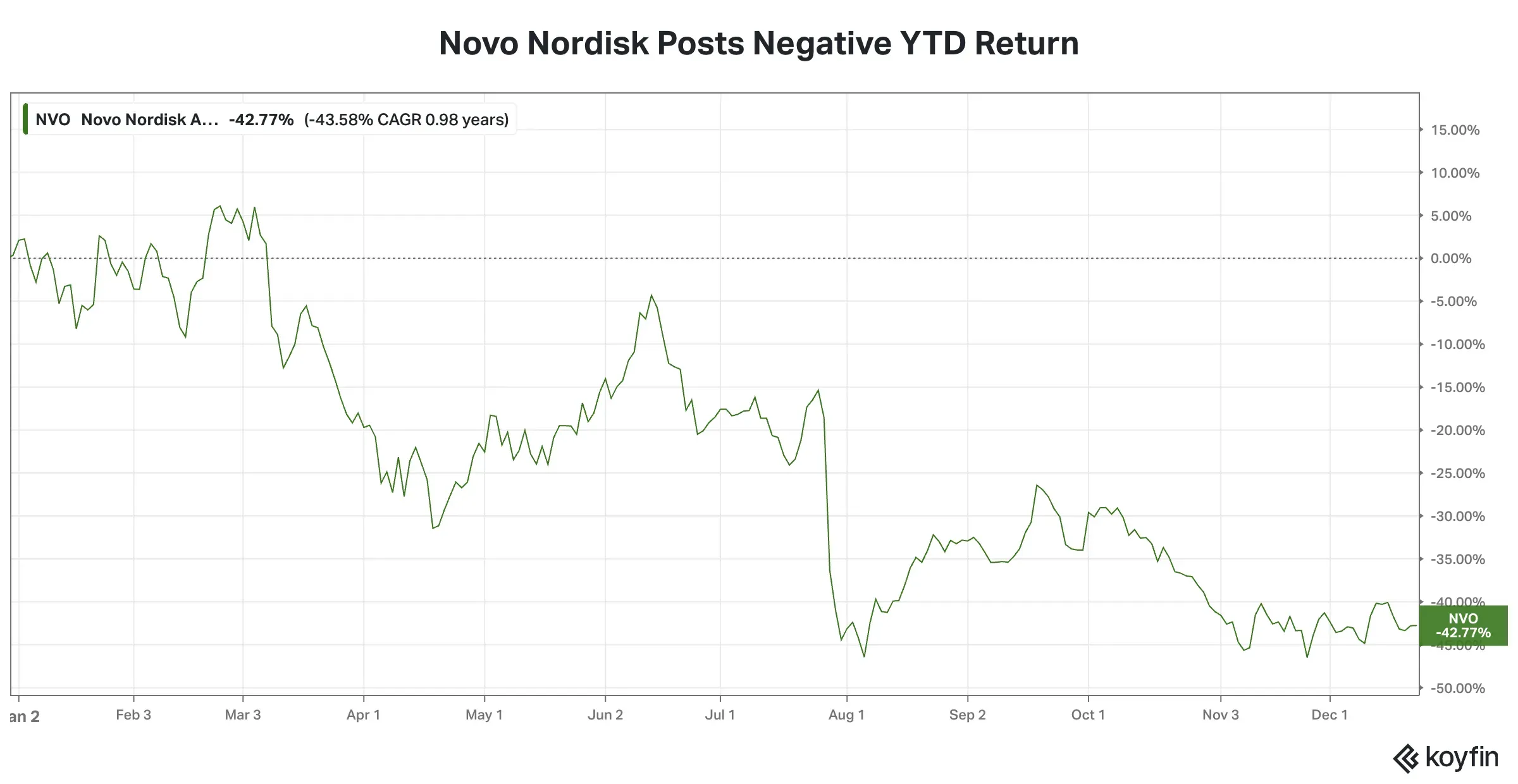

For the year-to-date period, Novo Nordisk’s stock is down nearly 43%, while from its February peak, it is down a steeper 50%. That sets it on track for its worst year since 1984, according to Koyfin data.

What Ailed NOVO Stock?

Novo may have revolutionized the obesity drug race with its semaglutide diabetes drug, which was marketed as Ozempic. Initially, Ozempic was used off-label for weight loss before the Danish company gained regulatory approval for a higher dose of semaglutide, under the brand name Wegovy, exclusively for treating obesity.

The weight-loss drug maker’s fortunes have since taken a turn for the worse. Citing lower growth for its GLP-1 treatment in diabetes and obesity, the company trimmed its 2025 forecast for the third time this year. To make matters worse, the company had to agree to a price cut for the direct-to-consumer sales in the U.S. to align with the Trump administration’s efforts to make drugs accessible and affordable.

To make matters worse, late-stage trial results for NOVO’s next-generation drug CargiSema failed to resonate with investors, exerting further downward pressure on the stock.

Weight-Loss — Panacea For Stock?

At least, the stock reaction to the FDA nod for the pill formulation of Wegovy suggests investors are optimistic about Novo Nordisk’s newest opportunity. The stock was up nearly 8% in the premarket session on Tuesday. If the premarket move holds in the regular session, the stock is on track for its best day in nearly a year. Lilly (LLY), which has taken a lead over Novo Nordisk in the obesity drug race, fell 0.71% in the premarket.

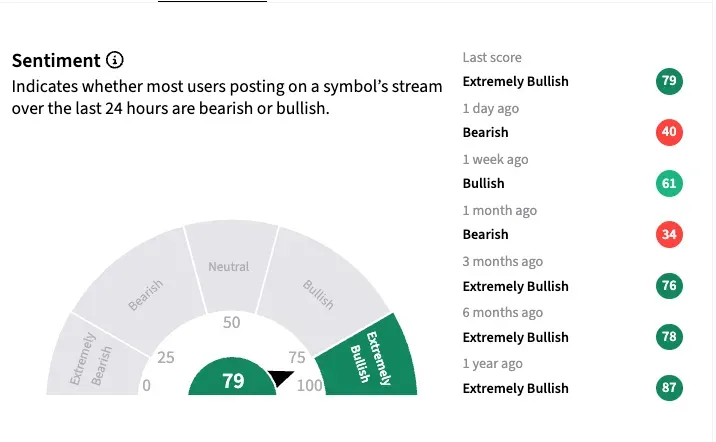

Retail sentiment toward the stock has turned ‘extremely bullish’ following the release of the data, reversing from the ‘bearish’ mood seen a day ago.

A retail watcher lauded the approval as “great” but remained cautious. “But supply, pricing, and competition still matter,” they said. Another user expects the stock to go up by 30%.

The Road Ahead For Novo Nordisk

According to McKinsey, nearly one in three adults in the U.S., or about 100 million people, meet the clinical criteria for obesity. Add to this the 900 million people worldwide, and the addressable opportunity swells. And a bulk of this target population will likely gravitate toward an oral pill.

Citing analysts, a Reuters report said, by 2030, pills may account for about 20% of the market, driven by demand from patients who prefer easier, non-invasive therapies. Christopher Chrisman, a managing director and partner at consultancy BCG, reportedly said:

“The pills will not displace or replace the injections," said Christopher Chrisman, a managing director and partner at consultancy BCG, adding some patients may prefer to continue with weekly injections. But pills offer clear advantages to some people. There's travel convenience and no need for a fridge.”

The 1.5-mg starting dose of the Wegovy pill will be available in early January. Reuters also said Novo and Lilly had agreed to offer starter doses of their weight‑loss pills at $149 per month for the U.S. government Medicare and Medicaid health insurance programs and to cash-paying customers via the White House's direct-to-consumer TrumpRx site.

Novo Nordisk now has a lead over Lilly's oral pill to be sold under the brand name “Orforglipron,” a late-stage candidate. Lilly has filed for regulatory approval of the obesity pill.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<