Analysts warn of oversold conditions but see limited upside unless Nifty decisively crosses 24,820.

Indian equity markets opened on a cautious note with the Nifty hovering below 24,700 as tariff uncertainty and weak Q1 earnings performance from heavyweights continue to weigh on investor sentiment.

At 09:45 a.m. IST, the Nifty 50 traded 5 points higher at 24,686, while the Sensex was down 15 points at 80,875. Broader markets were mixed as well, with the Nifty Midcap index rising 0.1% and the Smallcap index falling 0.1%.

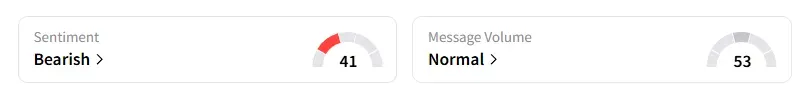

Meanwhile, the retail sentiment on Stocktwits for Nifty remained ‘bearish’.

Sectorally, IT remains under pressure, while real estate, metals, energy, and auto stocks saw some buying.

Jio Financial Services was the top Nifty gainer, rising 2% ahead of its board meeting on July 30 to consider fundraising.

Meanwhile, BEL is among the top Nifty losers, down over 1% despite a solid show in Q1. Other earnings casualties include Mazagaon Dock (-4%), and Five Star Business (-5%).

IndusInd Bank gained 1% on Q1 beat. Bernstein maintained an ‘Outperform’ rating, with a target price of ₹1,000, indicating a 24% upside. And Paradeep surged 9%, while Waaree Energies rose 4%, driven by its earnings performance.

PNC Infratech shares rose 3% after the company emerged as the lowest bidder for a ₹2,956.66 crore mining services contract for a project in Chhattisgarh.

RPSG Ventures surged over 4% after its arm acquired 70% equity stake in Manchester Originals from the England and Wales Cricket Board for £81.21 million

Omaxe rose 2% after securing ₹500 crore in funding from Oaktree Capital Management.

Watch out for L&T, NTPC, Asian Paints, Bank of India, Deepak Fertilisers, GMR Airports, Happiest Minds, Triveni Engineering, Varun Beverages, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that the Nifty index is oversold in the short-term, suggesting that pullbacks toward 24,750 could be used as selling opportunities, especially on a reversal candle. The immediate hurdle to watch is at 24,820, with the next level below this at 24,640. If there is a 15-minute close above 24,820, it could provide a short-term scalping trade for a move to 24,890. His advice is to avoid positional trading and focus on intraday setups.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) have sold over ₹6,000 crore worth of equities in the cash segment. In the F&O space, they have added fresh net index short positions, indicating a cautious-to-bearish stance. The overall Q1 earnings season so far has been below market estimates. Patel advised sticking to companies delivering strong results and trading cautiously, using a tight stop-loss.

A&Y Market Research identified intraday Nifty resistance between 24,738 - 24,800, and support at 24,461 - 24,490. For Bank Nifty, they peg resistance at 56,206 - 56,278 and support at 55,850 - 55,921.

Globally, Asian markets traded lower, while crude oil prices extended gains on hopes of a potential US-China trade truce.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<