Indian markets ended marginally lower but broader indices saw a sharp sell-off amid weekly expiry and global jitters.

Indian equity markets ended lower for the third straight session. While the benchmark indices ended flat, the broader markets witnessed an intense sell-off amid weekly expiry and simmering geopolitical tensions in the Middle East.

The Nifty Midcap index ended 1.6% lower, and the Smallcap index was down nearly 2%.

The Sensex ended 82 points lower to close at 81,361, while the Nifty 50 fell 18 points to finish at 24,793.

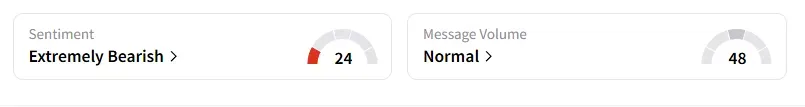

The retail investor sentiment surrounding the Nifty 50 turned ‘extremely bearish’ on Stocktwits.

Sectorally, autos were the sole gainers in Thursday's trade. The rest of the indices ended in the red, with PSU banks, real estate, metals, and media stocks seeing heavy selling.

IT stocks fell sharply after global brokerages CLSA and Morgan Stanley raised concerns over overall discretionary spending. Tech Mahindra fell nearly 2%, Infosys and TCS ended 1% lower.

Swiggy ended over 2% higher after IIFL Capital initiated coverage with a ‘Buy’ rating and a target of ₹535, implying a potential 50% upside.

After HSBC reiterated a ' Buy ' rating, Biocon shares snapped a two-day losing streak to end 1.5% higher.

IKS shares fell over 5% after a 1.5% stake reportedly changed hands in a block deal.

Siemens Energy made a strong debut, listing at ₹2,850 on NSE after its long-awaited demerger from parent company Siemens.

Globally, European markets traded weak, and Dow Futures indicated a cautious opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.