Paramount has submitted a hostile bid, and President Donald Trump has indicated that he’s watching the deal closely.

- Paramount Skydance has written to Warner Bros shareholders, urging them to pick its “superior” offer and tender their shares.

- The high debt component in the Netflix deal has also come under scrutiny, with some analysts raising concerns about the streamer's risk profile.

- President Donald Trump has said he wants Warner Bros’s CNN to be sold as part of the deal, regardless of who the acquirer is.

With an emboldened Paramount Skydance, President Donald Trump making his presence felt even more in the mix, and investors’ concerns around the deal’s debt component, Netflix is bracing for an uphill battle – and a long one at that.

Earlier this week, David Ellison-led Paramount submitted a hostile $30-per-share bid for Warner Bros Discovery, days after it accepted Netflix’s $72 billion deal for its streaming and studio assets.

Several Moving Parts

On Wednesday, Paramount sent an open letter to Warner Bros’s shareholders, reiterating that it is the superior bid and more likely to win regulatory approvals. “It is not too late to realize the benefits of Paramount’s proposal if you choose to act now and tender your shares,” Ellison said in the letter, calling on WBD shareholders.

He noted that the cash component of Netflix’s deal is about $18 billion lower than Paramount's offer, and the streaming giant has lost one quarter of its market capitalization – or over $110 billion – since its last quarterly earnings report and amid its pursuit of WBD.

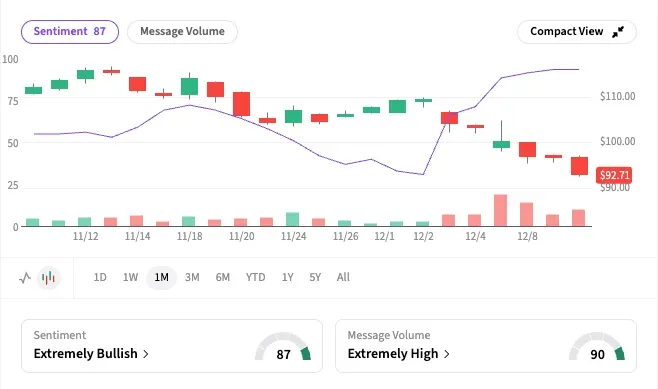

On Stocktwits, however, retail sentiment for NFLX has swung sharply up since the start of the month and was ‘extremely bearish’ in the last reading. The message volume for the ticker has risen by over 1,000% in the past 30 days.

Meanwhile, Trump is playing his own game. After previously suggesting that Netflix’s dominant market share in streaming could complicate approval of its WBD deal, he inserted himself even further into the drama on Wednesday, saying he wants the agreement to include WBD’s TV network, CNN.

Trump said: "I don't think the people that are running that company right now and running CNN — which is a very dishonest group of people — I don't think that should be allowed to continue. I think CNN should be sold along with everything."

Debt Risk

Netflix’s deal also has a significant debt component, which is now under scrutiny and raising market concerns. The offer includes $59 billion in unsecured bridge loans from Wall Street banks Wells Fargo, BNP Paribas, and HSBC, which would make it one of the largest loans of its kind ever.

Such loans are typically replaced with more permanent debt, like corporate bonds.

In an investor note, Morgan Stanley analysts said the debt is a risk, according to a Bloomberg report. They recommend selling the company’s notes due in 2034 and 2054, given the potential for Netflix to issue significant new debt and for its credit ratings to be cut. Many analysts and investors – including Moody’s, which reaffirmed Netflix’s A3 rating – see the debt risk as manageable, according to Bloomberg.

Could This Deal Break Record Timelines?

One thing is clear: this could be a long, drawn-out M&A process. Even once a definitive buyer emerges, the gauntlet of regulatory approvals could push the deal’s close out by as much as two years. In the past, companies involved in large M&A deals have mostly stuck around (see table).

AT&T’s record buyout of Time Warner and Microsoft’s Activision acquisition took nearly two years, while Comcast’s deal for Sky took just five months to close.

Potential Hiccups

On Tuesday, Needham kept a 'Buy' rating and $150 price target on Netflix but warned that buying Warner Bros. would put $83 billion of additional value at risk of disruption from GenAI storytelling.

According to a summary of the note on The Fly, Needham thinks Netflix without Warner is more global, more nimble, more tech-first, and has more flexibility with the Hollywood unions. The analyst further notes that Warner's employee count of about 35,000 is 2.5 times larger than that of Netflix, suggesting that its culture and operating practices will be hard for the streaming giant to overcome.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<