Despite record annual revenue, Adobe faces stalled growth, rising competition from Figma and Canva, and investor doubts about whether its AI bets will reignite momentum.

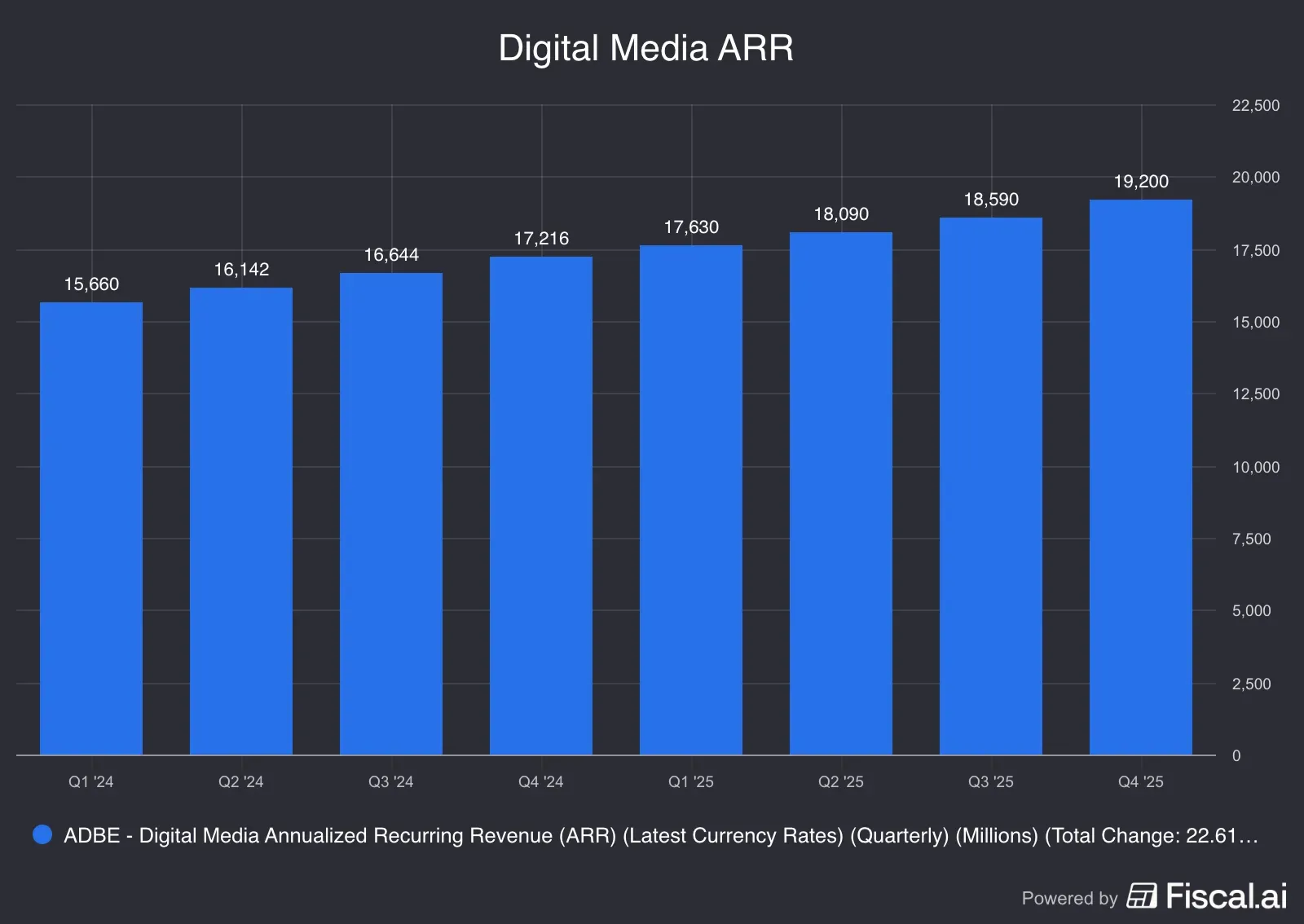

- Digital Media ARR rose 11.5%, but overall fundamentals and GenAI payoff remain under scrutiny.

- Figma and Canva’s rising adoption threatens Adobe’s dominance of creative tools.

- Analysts see value at current valuations, yet timing for a sentiment rebound is uncertain.

Adobe’s reign as the top design firm is no longer guaranteed, with a raft of competitors buffeting it from every side. The topline growth and the bottom line have plateaued in recent quarters despite the company's embrace of artificial intelligence (AI) in a big way. Is the creative juice running dry?

Stuck In Downtrend

The 2025 revenue marked a record, but investors haven’t come around to view Adobe as a “must-have” stock. After a consolidation move early this year, Adobe's stock traced a downward trajectory. Although recovering from the Trump tariff bottom in early April, it is once again locked in a broadly downward-trending channel.

Source: Koyfin<

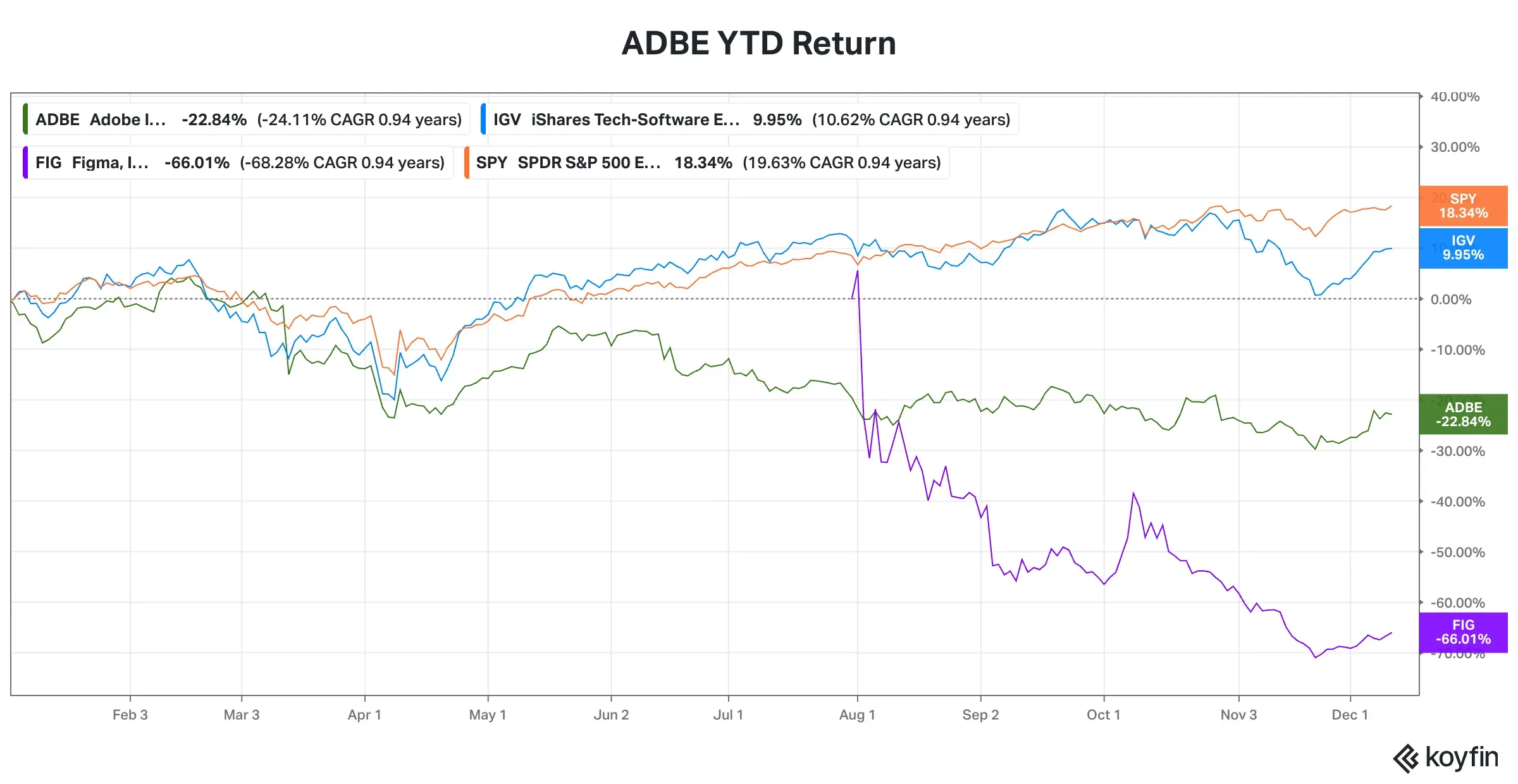

Adobe has generated negative stock returns this year, sliding over 22%, underperforming the broader market and the software industry. Its stock, however, did not fare as badly as that of smaller rival Figma, which had a stellar debut on Wall Street in late July, only to slump by more than 66% as the year heads to a close.

Source: Koyfin<

Lackluster Fundamentals

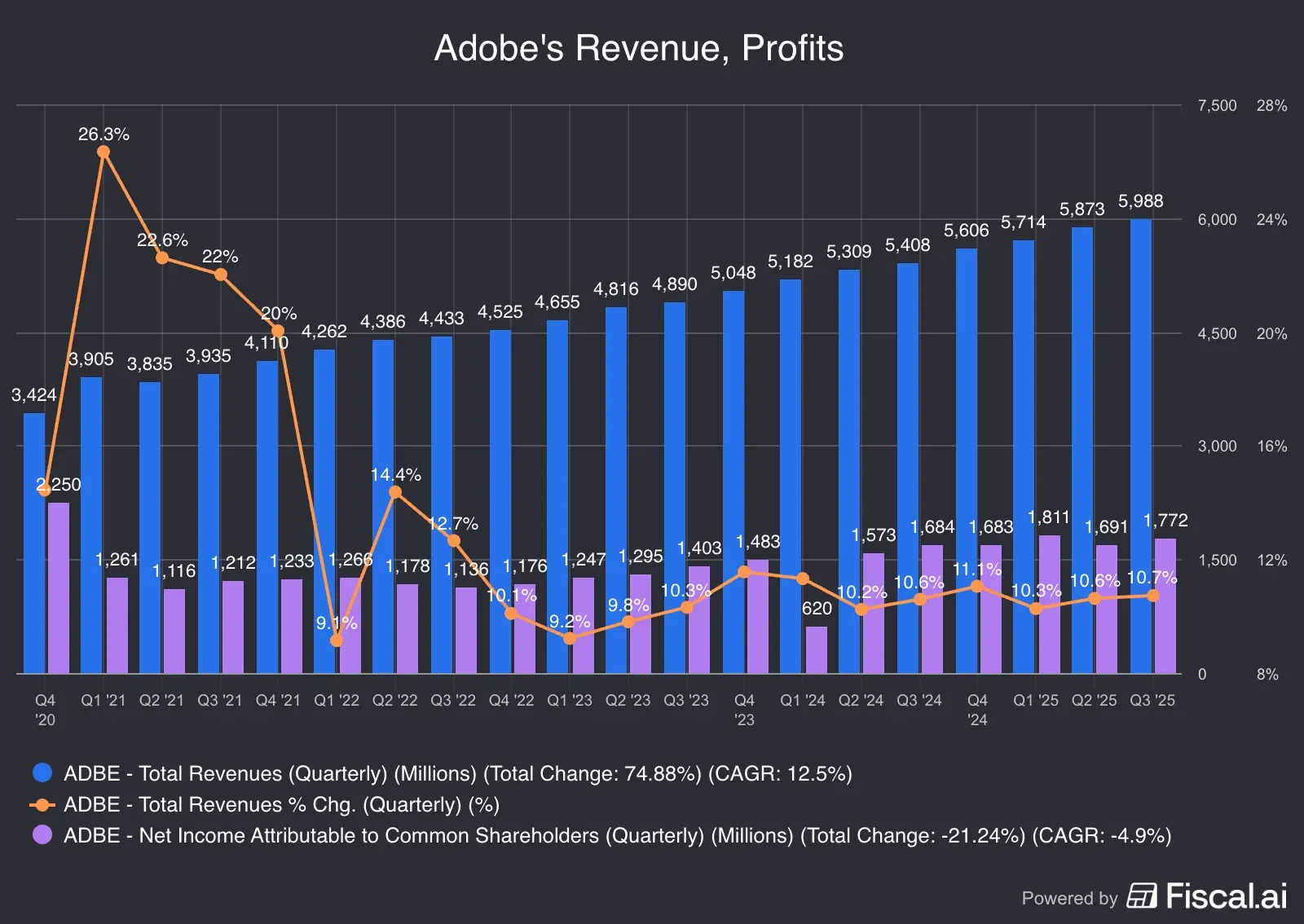

The topline growth has not picked up pace, remaining around 10% since the fourth quarter of 2022, and the bottom line has plateaued since recovering from a sharp dip in the first quarter of last year.

Source: Fiscal.ai<

While downgrading Adobe’s stock rating to ‘Equal-Weight’ from ‘Overweight’ in late September, Morgan Stanley’s Keith Weiss expressed concerns about the ability to adopt generative AI (GenAI) successfully. The analyst noted that annual recurring revenue (ARR) growth in the Digital Media business, which provides creative software tools such as Photoshop and Illustrator via Creative Cloud, and document solutions such as Adobe Acrobat, diverged directionally from the pace and quality of innovation embedded in the product portfolio.

The analyst suggests the variance may stem from direct GenAI monetization lagging initial investor expectations and a sizeable portion of the Adobe ARR base lacking confidence that GenAI advancements are a net positive.

The annual results reported Wednesday after the close showed that the company exited 2025 with Digital Media ARR of $19.20 billion, marking 11.5% YoY growth. This business fetches roughly three-fourths of Adobe’s revenue.

CEO Shantanu Narayen, however, sounded upbeat. In a statement, the corporate chief said, “By advancing our innovative generative and agentic platforms and expanding our customer base, we are excited to target double-digit ARR growth in FY2026.”

It remains to be seen whether Firefly, Adobe’s creative GenAI models and web apps, which it has integrated across its entire product portfolio, will gain further traction and drive growth. On the earnings call, President of Digital Media Business David Wadhwani said:

“We are attracting new creators to Adobe through the Firefly application, which can be purchased through our Firefly Standard, Pro and Premium subscription plans.”

Is Figma, Canva Hurting Adobe?

Relatively new entrants such as Figma and Canva are on a roll, bringing in their unique strengths to the design software space. Adobe once attempted to buy Figma for about $20 billion, but then called off the deal due to antitrust concerns. According to the BCG Matrix, Adobe has an estimated 58% share in the creative software industry.

But rivals are catching up. Morgan Stanley analyst Elizabeth Porter sees Figma as the “industry standard” in product design software. The analyst highlighted the company’s real-time collaboration platform as its competitive advantage, helping to accelerate the process of turning ideas into digital products.

Consolidating workflows and expanding beyond UX designers to developers, marketers, and product managers provides a long runway to increase penetration from 4% currently, in an estimated total addressable market (TAM) of about $26 billion, the analyst said.

Still privately held, Canva, though a smaller rival, is seen as a serious emerging threat to Adobe. The company, widely rumored to go public in 2026, relaunched its Affinity creative suite, comprising Photo, Designer, Publisher, as one all-in-one Affinity app that is free for everyone. Canva’s strength is in graphics.

An AlphaSense report stated that Figma’s real advantage is its UI/UX design space, which boasts around 80-90% market share, while another report puts the estimate at about 41%.

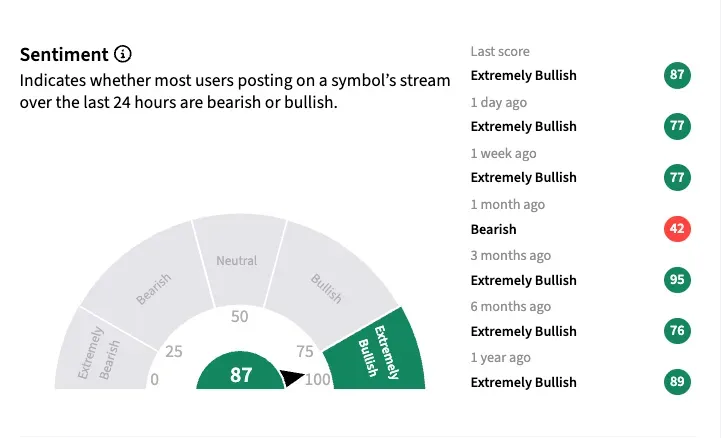

Retail Views Diverge With Investors

Adobe stock has primarily elicited ‘extremely bullish’ sentiment from among retail traders on the Stocktwits platform this year.

Morgan Stanley’s Weiss summarized his investment thesis on Adobe in his September note as follows:

“While we continue to see a positively skewed risk/reward at these levels…, with ~15x P/E demonstrating compelling value for a core Software franchise, we recognize the lift needed to re-engage sentiment on shares, and with limited confidence in timing that catalyst path, we see cleaner near-term narratives elsewhere in Software and move to the sidelines.”

Stifel, which has a ‘Buy’ rating on the stock, said in a recent note that the key overhang has been the belief that AI will be a disruptive force for creative departments, according to a summary on The Fly.

But most Wall Street firms hold a bullish stance on Adobe. According to Koying, 25 out of the 40 analysts covering the stock have either a ‘Buy’ or ‘Strong Buy’ rating. While 12 analysts remained on ‘Hold,’ three rated it as a ‘Sell.’ The average price target for the stock ($444.23) implies a 30% upside over the next year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<