Both Strategy and Bitmine Immersion Technologies reported fresh crypto buys on Monday.

- MSTR’s stock rose 1.66% after hours, following a loss of nearly 7% during the session.

- Shares of Robinhood and Bitmine also recovered in overnight trading after dropping nearly 10% each during regular trading.

- Crypto exchanges Coinbase Global, Gemini Space Station, and Bullish also edged higher after the close.

Michael Saylor-backed Strategy (MSTR) slid to a 14-month low during regular trading on Monday before rebounding in after-hours action, tracking Bitcoin’s recovery toward $79,000.

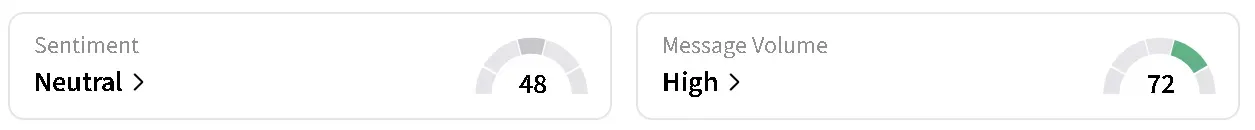

MSTR’s stock rose 1.66% after hours, following a loss of 6.73% during the session. On Stocktwits, retail sentiment around the Bitcoin proxy also recovered to ‘neutral’ from ‘bearish’ territory, with chatter steady at ‘high’ levels over the past day. The move comes after Strategy announced it had bought 855 BTC for around $75 million, bringing its total Bitcoin horde to 715,502 Bitcoin.

Bitcoin Rebounds, Sentiment Edges Higher

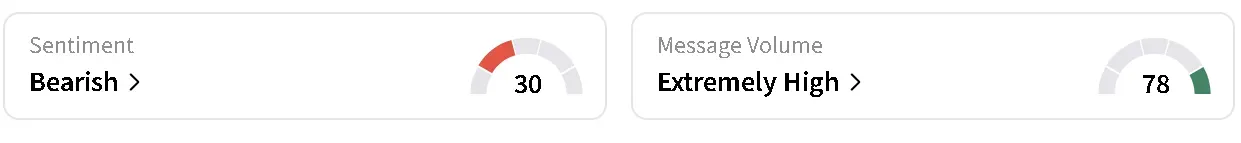

Bitcoin’s price rose 4.3% in the last 24 hours to around $78,319, paring gains from an intra-day high of around $79,100. On Stocktwits, retail sentiment around the apex cryptocurrency improved to ‘bearish’ from ‘extremely bearish’ territory with chatter remaining at ‘extremely high’ levels.

HOOD, BMNR Stocks Rise After 10% Dip

Other crypto-linked stocks also stabilized overnight. Robinhood (HOOD) and Tom Lee’s Bitmine Immersion Technologies (BMNR) moved higher after suffering a loss of nearly 10% during the session.

HOOD’s stock was among the top trending tickers on Stocktwits at the time of writing, edging 0.38% higher in overnight trade. The stock fell to a six-month low in regular trade, while Piper Sandler flagged off that its cryptocurrency trade volumes may take a hit from falling token prices.

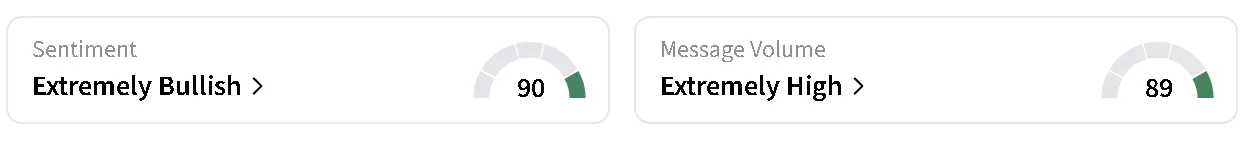

Cathie Wood’s ARK Invest bought the dip, adding nearly 365,000 shares to its flagship ARK Innovation Exchange Traded Fund (AKK) and ARK Next Generation Internet ETF (ARKW). On Stocktwits, retail sentiment around HOOD’s stock rose to ‘extremely bullish’ from ‘bullish’ territory over the past day, as chatter rose to ‘extremely high’ from ‘high’ levels.

Meanwhile, BMNR’s stock rose 1.93% after hours, following a loss of 9.16% even as the company loaded up on around 42,000 Ethereum (ETH) worth $97 million. The company now holds 4.2 million ETH with around 2.9 of it staked. Institutional investors, including Cathie Wood, Vanguard and UBS, were also reported buyers of BMNR shares during the pullback.

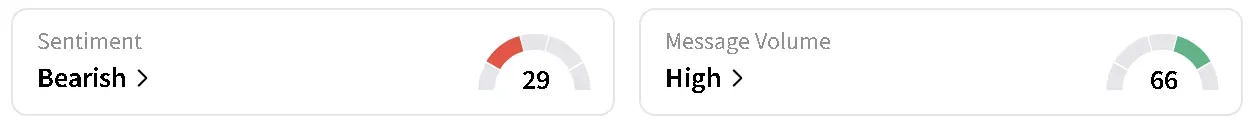

On Stocktwits, retail sentiment around BMNR’s stock remained in ‘bearish’ territory even as chatter rose to ‘high’ from ‘normal’ levels over the past day.

Crypto exchanges Coinbase Global (COIN), Gemini Space Station (GEMI), and Bullish (BLSH) also edged higher after the close. SharpLink Gaming (SBET) and Strive Asset Management (ASST), which dropped 12.27% and 11.92% respectively during regular trading, pared losses in late trading.

Read also: MSTR, BMNR Stocks Feel The Heat Even As Bitcoin Recovers To $77,000 – Crypto Faces Over $800 Million Liquidation Wave

For updates and corrections, email newsroom[at]stocktwits[dot]com.<