Retail sentiment flipped to ‘extremely bullish’ on Stocktwits. Analyst recommends buying with a stop loss at ₹240.

One Mobikwik shares surged 10% in early trade on Tuesday after Abu Dhabi Investment Authority (ADIA) exited its stake in the payments solutions provider via block deals. The number of shares offloaded represents 2.1% of Mobikwik’s outstanding equity.

According to block deal data on the National Stock Exchange (NSE), ADIA sold 16.44 lakh equity shares of Mobikwik on Monday at an average price of ₹238.45 per share. The total deal value of the block deal was ₹39 crore.

Other shareholders in Mobikwik:

Peak XV Partners: 9.92%

Cisco Systems: 1.54%

American Express Travel Related Services: 1.34%

Government Pension Fund Global: 3.01%

Societe Generale: 1.2%

Citigroup Global Markets: 1.12%

Analyst Take

SEBI-registered analyst Yogesh Nirwan of Wealth Guru recommended buying Mobikwik with stop loss at ₹240, for a target price of ₹270, ₹275 and ₹300. He noted good volumes and delivery buying in the stock.

What Is The Retail Mood?

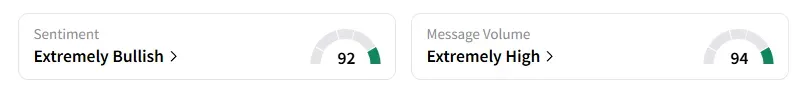

Data on Stocktwits shows retail sentiment flipped from ‘neutral’ to ‘extremely bullish’ a day ago amid ‘extremely high’ message volumes on the platform.

Mobikwik shares have declined 56% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<