AI-driven memory demand pushed Micron’s revenue and margins sharply higher, giving it clearer growth visibility and stronger profitability than Oracle and Broadcom after earnings.

- Strong pricing, a favorable mix, and operating leverage drove expanding margins, in sharp contrast to margin pressure at Oracle and Broadcom.

- Management offered clearer forward visibility, citing tight supply and sustained AI demand into 2026, reinforcing confidence in Micron’s medium-term growth.

- Retail sentiment turned decisively bullish after the earnings beat, with Stocktwits users shifting from neutral to extremely bullish as confidence in Micron’s AI-driven growth strengthened.

Micron is all set to end the year as the best-performing S&P 500 chipmaker, with the earnings report likely adding another leg to the rally. The stock touched a record high of $264.75 just last week, but the rally soon lost momentum, sliding into a five-session losing streak.

The 8% after-hours surge in Micron’s stock stands in stark contrast to the moves triggered by earnings reports from artificial intelligence (AI) chipmaker Broadcom (AVGO) and AI-leveraged database giant Oracle Corp. (ORCL). Broadcom stock still hasn’t rebounded to its pre-earnings level, losing about 20% since its fourth-quarter earnings release last Thursday.

Micron’s Fundamental Surge

Boise, Idaho-based Micron clocked a record revenue for the first quarter of fiscal year 2026, which ended Nov. 27. The $13.64 billion Micron’s quarterly revenue amounts to roughly three-fourths of Broadcom’s and about 85% of Oracle’s, but its year-over-year (YoY) revenue growth, however, far outpaced these companies.

| Micron (FYQ1) | Broadcom (FYQ4) | Oracle (FYQ1) | |

| Revenue | $13.64B | $18.02B | $16.06B |

| YoY Growth | +57% | +28% | +14% |

Data Source: Company releases<

Micron’s revenue growth had actually slowed since the middle of last year, but the numbers in 2025 have shown a significant spike as AI-related demand for memory chips boomed.

Source: Fiscal.ai<

In prepared remarks on the earnings call, CEO Sanjay Mehrotra said the company benefited from “strong execution” across end markets and a tight supply environment. It was a record performance across DRAM, NAND, high-bandwidth memory (HBM), and data center revenue.

Mehrotra attributed the strong performance to the ongoing structural shift in the memory market, which has increased demand for advanced memory for real-time contextual processing.

“Memory is now essential to AI's cognitive functions, fundamentally altering its role from a system component to a strategic asset that dictates product performance from data center to the edge.”

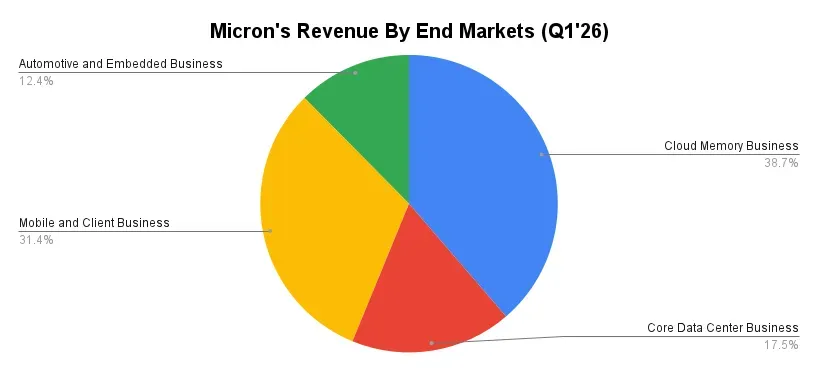

Earlier this month, the company announced its decision to exit the consumer business, citing a focus on AI-related memory and storage. The Q1 revenue composition is as follows:

Data Source: Company<

Micron — A Compelling Margin Growth Story

CFO Mark Murphy said gross margin will continue to expand in the second quarter, helped by higher prices, lower costs, and a favorable mix. The company provided a ballpark mark of 68%, plus or minus 100 basis points, for the second-quarter gross margin.

Source: Fiscal.ai<

Micron’s margins stand out sharply, eclipsing Oracle’s 29% and Broadcom’s 42%. Broadcom’s gross margin contracted sequentially by 50 basis points (bps), while Micron’s expanded by 11 bps.

In his earnings review, Baird analyst Tristan Gerra said he expects DRAM and NAND pricing to rise 20% sequentially as the company is in the process of putting together long-term agreements with key customers. The analyst expects shortages to last through next year.

Micron Shines With Better Visibility

While Oracle’s attempts to win investors by flaunting its $523.3 billion remaining performance obligation fell flat due to its opaqueness with the timing of recognition, Micron’s management said on the earnings call that it expects the tight market conditions, a function of strong demand and supply constraints, to persist beyond the calendar year 2026.

Oracle’s customer concentration also raised alarm bells for investors, whereas Micron has exposure to a range of end markets and companies.

Broadcom’s management, meanwhile, was measured in their forward commentary. CEO Hock Tan quantified orders for the next 18 months at $73 billion and later clarified in a reply to an analyst's question that it represented the base-case scenario.

Micron estimates capital spending (capex) for fiscal year 2026 is $20 billion, with the majority of the expenditure weighted to the second half of the year. Gerra does not see the huge number as a cause for concern.

“At 26% of projected F2026 revenue, [it] fits well within the historical range of 13-49%. Incremental capex will primarily be in support of HBM capacity along with 1-gamma DRAM supply, which uses EUV lithography at a 10nm node.”

Retail Confidence On The Rise

Micron’s stock has elicited mostly ‘bullish’ sentiment from among the retail users of the Stocktwits platform. In the wake of the fiscal Q1 print, retail’s mood, which had slipped to the ‘neutral’ zone amid the broader market weakness and anticipation ahead of the report, rebounded strongly, climbing into the ‘extremely bullish’ territory.

A bullish user has already set their sights on Micron’s stock reaching $300 by the March quarter. Ahead of the earnings, the stock settled Wednesday’s session down 3% at $225.52. The user’s expectations imply a 33% run over the next three months.

Another user saw the earnings as confirmation that Micron’s growth is solid and resounding, and the earnings growth is explosive. They also foresaw significant upward revision to the already “rosy estimates.”

Baird’s Gerra was among the earliest analysts to raise the price target for the stock to $443 from $235. The analyst reiterated Micron as one of Baird’s top large-cap ideas, citing the “AI-driven double-digit bit demand growth medium term, a secular improvement in mix, the best fundamentals in the company's history and improving relative to peers, and market share lead in high-margin segments such as LPDDR5.”

The analyst sees a deja vu with respect to HBM chips.

“HBM remains a more stable growth component of Micron's mix, reminiscent of the early days of NAND, which sustained 50-60% bit growth for several years.”

According to the analyst, Micron’s share of the HBM market is stabilizing around 20%. Even after Samsung’s HBM4 enters the market, the analyst expects pricing to remain rational, given the ongoing shortages.

According to Koyfin, the average analyst price target for Micro before accounting for the post-earnings price adjustments is $255.97, implying a roughly 14% upside from the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<