So far, Strategy has already accumulated about 3.2% of the total Bitcoin supply.

- Saylor estimated Bitcoin could trade near $1 million if Strategy reaches 5% ownership

- He said the next phase of accumulation will require far more capital for smaller gains.

- Strategy expects its accumulation to slow naturally as prices rise.

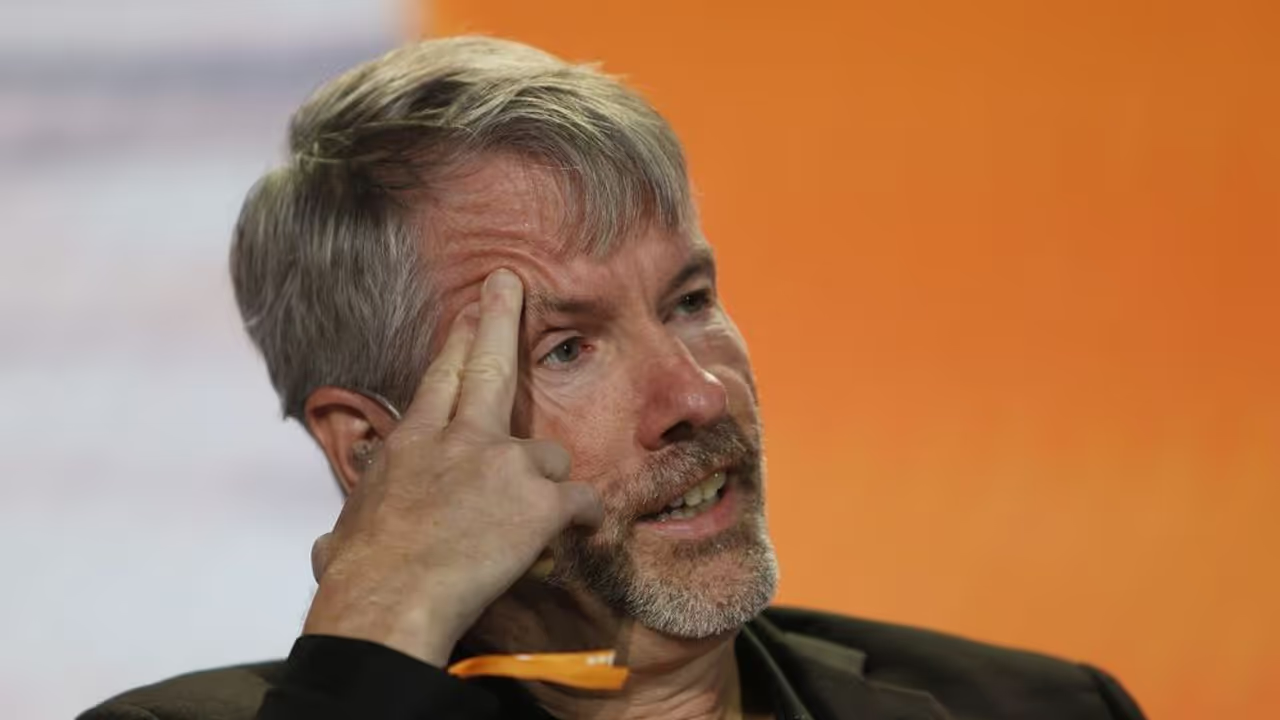

Michael Saylor said Strategy plans to slow its Bitcoin (BTC) accumulation only once the company controls between 5% and 7.5% of the cryptocurrency’s total supply, outlining a long-term ceiling driven by scarcity rather than strategy.

In an episode of The Breakdown with David Gokhshtein, the Strategy executive chairman stated that ownership thresholds of that scale would coincide with dramatically higher Bitcoin prices. If Strategy were to reach roughly 5% of Bitcoin’s circulating supply, Saylor said, the price could approach $1 million per coin. At 7.5%, he suggested Bitcoin could trade closer to $10 million, a move he attributed to structural supply constraints rather than speculative demand.

Bitcoin’s price was trading at around $89,200 on Monday morning, up 1.3% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘extremely bearish’ territory over the past day, accompanied by ‘low’ levels of chatter. BTC’s record high so far stands at over $126,000, seen in October earlier this year.

Strategy’s Accumulation Math

So far, Strategy has acquired about 3.2% of Bitcoin’s total supply, spending roughly $50 billion over the past five years. Saylor said that the pace of accumulation will become increasingly difficult to sustain as prices rise and supply tightens.

“It costs us $50 billion to get to 3.2%. The next $50 billion won’t get me 3.2%—it’ll probably get me 1% or less.” – Michael Saylor, Executive Chairman, Strategy.

He described Bitcoin buying as a process of deploying ever-larger amounts of capital against a fixed and diminishing supply, naturally slowing accumulation over time.

Scarcity And Long-Term Holders

Saylor also stated that institutional participation has so far had a limited impact on Bitcoin’s long-term holders. Despite an estimated $100 billion in inflows from asset managers such as BlackRock and roughly $50 billion from Strategy itself, he said that about 85% of Bitcoin remains held by early adopters.

Even with an additional trillion dollars in institutional inflows, Saylor estimated long-term holders could still control roughly 75% of supply. He framed that concentration as a structural feature of the network rather than a temporary imbalance.

Saylor said Strategy will continue buying Bitcoin “where possible,” but acknowledged that accumulation will eventually slow under its own weight. He suggested the firm’s holdings are likely to peak within the 5% to 7.5% range, not because of a policy shift, but because scarcity itself imposes a natural limit.

MSTR’s stock edged 0.13% higher in pre-market trade after a 4.16% gain on Friday. On Stocktwits, retail sentiment around the company trended in ‘extremely bearish’ territory, amid ‘low’ levels of chatter over the past day. The stock is down more than 45% so far this year, while Bitcoin’s price has fallen by more than 4%.

The company is expected to announce its next Bitcoin purchase before market open on Monday, following Saylor’s post on X, where he said, “Green dots beget orange dots.”

Read also: Michael Saylor Puts ‘Green Dots’ Spin To Orange Dots Signal Ahead Of Possible Weekly Bitcoin Buy

For updates and corrections, email newsroom[at]stocktwits[dot]com.<