The toy maker said December turned out to be a bad month, particularly for U.S. sales.

- Mattel’s fourth-quarter revenue and profit came in below analysts’ expectations; it expects adjusted profit to fall this year.

- Mattel announces a $1.5 billion buyback plan.

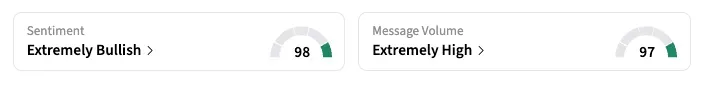

- Stocktwits sentiment for MAT shifts to ‘extremely bullish’ from ‘bullish.’

Mattel, Inc.’s shares plunged nearly 31% in after-hours trading on Tuesday, after the toymaker reported holiday results and a 2026 profit forecast that fell short of analysts’ estimates.

The maker of Barbie dolls and Hot Wheels cars said fourth-quarter sales rose 7% to $1.77 billion, below the $1.84 billion expectation – a sizable miss in what is typically the standout quarter for retailers.

Net profit declined 33% to $106.2 million. On an adjusted basis, earnings of $0.39 per share came in well below analysts’ expectations of $0.54 per share.

Consumers, as well as retail chains that buy and stock up on Mattel toys, were selective in their purchases this time. The sales shortfall prompted the company to increase discounts toward the end of the quarter, hurting its bottom line.

The company cited a shortfall in U.S. December sales, which grew less than projected. “December is historically the biggest month of the year,” Chief Executive Ynon Kreiz told the Wall Street Journal. “But because of the shift in retailer ordering patterns, orders were even more back-end loaded.”

In 2026, Mattel expects sales to grow 3% to 6%, and adjusted earnings of $1.18 to $1.30. That compares to a 1% decline in net sales and adjusted earnings of $1.41 per share last year.

Retail’s Reaction

On Stocktwits, retail sentiment for Mattel jumped to ‘extremely bullish’ (98/100) as of late Tuesday, from ‘bullish’ the previous day. Discussions were divided between those who see physical toys as losing relevance and those who believe the stock’s selloff was overdone, creating a buying opportunity.

If the after-market move holds in Wednesday’s session, it would be MAT stock’s worst performance since December 2010.

Other Updates

Mattel plans to invest about $110 million this year to expand capabilities and technologies in its toy portfolio and digital services. It has earmarked a separate $40 million for marketing to drive user acquisition for its mobile games.

Mattel said it is buying NetEase’s 50% stake in their joint venture, Mattel163, for $159 million. The unit was formed in 2018 and produces mobile games based on Mattel’s intellectual property, including Uno and Skip-Bo.

The toymaker also announced a new $1.5 billion share buyback plan that will run through 2028.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<