Multiple analysts flagged bearish indicators, advising caution unless the stock reclaims key resistance zones.

HCL Technologies shares fell nearly 4% on Tuesday, after the company reported a mixed performance for the first quarter (Q1 FY26), with minor revenue growth but margin headwinds. Analysts remain cautious in the short term, driven by its weak technical indicators on the charts.

The IT major reported a net profit of ₹4,315 crore, which is up 7% year-on-year (YoY). Revenues rose 6% to ₹28,330 crore, while EBIT margins for the quarter held steady at 18.2%.

In constant currency (CC) terms, revenue grew by 5.4% (YoY), reflecting stable demand despite some seasonal weakness. The services segment delivered CC growth of 3.1%, while the software products business posted a strong 22.5% CC growth (YoY).

Management was cautiously optimistic. CEO C Vijayakumar reaffirmed full-year guidance of 3–5% constant currency revenue growth and EBIT margins between 18–19%, citing expectations of demand recovery in the second half of FY26 through large deal ramp-ups and expanding interest in AI and digital engineering.

HCL Tech reported new deal wins worth $2.28 billion during the quarter, slightly below the $2.49 billion recorded in Q4 FY25, but maintained that the pipeline remains strong.

What Are Analysts Saying?

SEBI-registered analyst Rajneesh Sharma believes that long-term structural signals, both fundamental and technical, suggest this phase may be more recalibration than derailment and that investors will be watching for margin execution and software recovery in the quarters ahead.

On the technical charts, he identified resistance at ₹1,698.50, with support at ₹1,574.55. Sharma suggested that for the medium term, traders can look to accumulate above ₹1,574 with caution below ₹1,550. However, in the short term, the bias remains bearish unless it sees a breakout above ₹1,640

Analyst Pradeep Carpenter highlighted that HCL Tech is facing caution on its technical charts after its Q1 performance. On the daily chart, a bearish Head and Shoulders pattern is developing: A breakout above ₹1,730 could invalidate this pattern. Immediate support is seen at ₹1,550, and if the stock breaks below ₹1,300, it would confirm a bearish breakdown, with a target seen at ₹800.

Other indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) also support a wait-and-watch zone.

Analyst Varunkumar Patel noted that the stock has been trading below its 20-day and 50-day Exponential Moving Averages (EMAs) for the past three sessions, which shows weakness on the charts. Additionally, volumes have stayed above average but aligned with negative price action, suggesting that investors are not confident enough to hold the stock at current levels.

He advised taking a short position for the near term, setting a target of ₹1,550, with a stop loss of ₹1,650 over the next two-day timeframe.

Mayank Singh Chandel said that HCL Tech doesn’t look attractive for any fresh entry. Profit has declined, growth is slow, the stock is technically weak, and the overall IT sector isn’t supportive either. The stock has been facing strong resistance between ₹1,695–₹1,750, with support zones around ₹1.594–₹1.578 and a stronger one at ₹1,537–₹1,500.

Unless HCL Tech closes firmly above ₹1,750, the upside looks limited, according to him. He concluded that it is wiser to wait for a strong close above this level or watch for signs of sustained recovery before considering any buying opportunity.

And Vijay Kumar Gupta too flagged a breakdown alert on HCL Technologies. The breach of the Ichimoku cloud and major EMAs signals bearish sentiment, and he believes that the short-term outlook remains weak unless ₹1,600 is reclaimed. Support is seen at ₹1,510–1,530 (near Feb–Mar lows) and resistance between ₹1,620–1,655 (which it needs to reclaim to reverse bearish bias).

He added that while the company did declare an interim dividend of ₹12/share, it failed to arrest selloff given the negative earnings tone.

If ₹1,550 breaks, he expects more downside toward ₹1,480–1,500. A rebound attempt is possible, but only above ₹1,620 with volumes. Gupta concluded that HCL Tech is witnessing a sentiment reset. While its long-term story remains intact, short-term pain is likely to continue unless the broader IT index revives. He advised avoiding fresh entries until technical confirmation emerges.

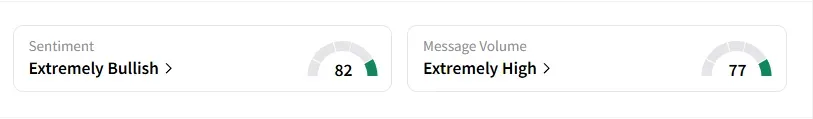

However, data on Stocktwits shows that retail sentiment is ‘extremely bullish’ amid ‘very high’ message volumes.

HCL Tech shares have fallen 18% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<