Lucid’s interim CEO, Marc Winterhoff, explained that the recent expiration of U.S. federal EV tax incentives accelerated many purchases into the third quarter, leaving fewer buyers now.

- Winterhoff said the dip in new orders is affecting both American and European markets.

- The company delivered 4,078 units in the third quarter, a 23% increase over the previous quarter (Q-o-Q).

- Lucid posted $336.6 million in revenue for Q3, missing the analysts’ consensus estimate of $349.5 million.

Lucid Group Inc. (LCID) has reportedly cautioned that demand for electric vehicles is cooling in both the U.S. and Europe, a setback the EV maker’s interim CEO said is already evident.

Speaking to Bloomberg Television on Wednesday, Marc Winterhoff, Lucid’s interim CEO, explained that the recent expiration of U.S. federal EV tax incentives accelerated many purchases into the third quarter, leaving fewer buyers now.

EV Demand Slips Across Regions

Winterhoff said the termination of tax incentives created a noticeable dip in new orders, affecting both American and European markets, according to the report.

“We are still working through our backlog, so we are a little bit insulated,” Winterhoff said. “But definitely, there is a slowdown, there’s no question about it.”

Lucid’s electric vehicle offerings include the Air sedan and Gravity SUV, which are known for strong performance, sleek styling, and efficient energy use. The company builds both models at its facilities in Arizona and Saudi Arabia.

The company delivered 4,078 units in the third quarter, a 23% increase over the previous quarter (Q-o-Q). However, its third-quarter (Q3) production gained only 0.7% QoQ to 3,891 vehicles.

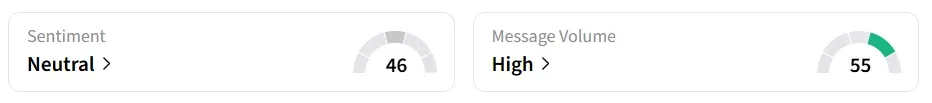

Lucid stock inched 0.2% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘high’ message volume levels.

Weakening Momentum

In November, Lucid stock hit an all-time low after launching a cheaper version of its Gravity SUV to broaden its customer base. The new Gravity Touring has a starting price of $79,900, making it more affordable than the Grand Touring version, which begins at $94,900.

The company reported $336.6 million in revenue for Q3, missing the analysts’ consensus estimate of $349.5 million, according to Fiscal AI data. Lucid also lowered its production outlook for the year to about 18,000 vehicles, citing supply chain problems that have slowed Gravity manufacturing.

Morgan Stanley downgraded Lucid to Underweight from Equal Weight, and slashed the price target to $10 from $30, citing that the sector is entering a prolonged slowdown, according to TheFly.

The firm warned that an “EV winter” is likely to carry into 2026 and that it expects growth in electric-vehicle adoption to soften further amid persistent cost pressures, shifting consumer sentiment, and tightening credit conditions.

LCID stock has gained over 58% year-to-date and over 47% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<