An analyst believes Lloyds Metals is among the strongest technical setups in the market.

Lloyds Metals and Energy shares are flashing strength on the charts, backed by a clean price structure and breakout confirmation, according to SEBI-registered analyst Mayank Singh Chandel.

Lloyd Metals shares gained 2% on Thursday, taking its weekly gain to over 11%.

Chandel notes that the stock has seen significant support between ₹1,038 and ₹907. This level acted as a strong demand zone, and the stock took support there during its pullback.

Since March 2024, the stock has maintained a bullish higher high–higher low formation.

The stock recently broke out above its all-time high, surging past the key resistance zone of ₹1,440–₹1,475 to set a new record high at ₹1,500.

Momentum indicators, especially the Relative Strength Index (RSI), remain bullish, supporting the case for further upside.

Chandel suggests that a pullback above ₹1,333–₹1,300 could offer a great entry opportunity with favorable risk-reward. He adds that any retest above these levels can act as a launchpad for the next leg of the rally.

From a fundamental perspective, the company reported March quarter revenues of ₹1,193 crore and net profit at ₹201.88 crore. It maintains a robust operating cash flow of ₹1,205 crore.

Chandel notes that the company remains profitable despite a sequential dip and that its strong cash flow supports long-term growth.

With a breakout in place, an intact bullish structure, and solid fundamentals, Lloyds Metals stands out as one of the strongest technical setups in the market.

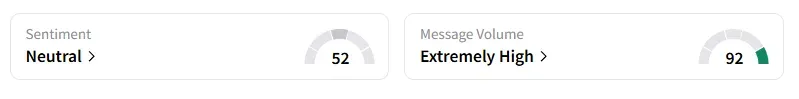

However, data on Stocktwits shows that retail sentiment on this counter turned ‘neutral’ from ‘extremely bullish’ a week ago.

Lloyds Metals shares have gained 23% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<