The biggest American bank by assets reported earnings per share (EPS) of $4.81 compared to a Wall Street estimate of $4.03. Revenue rose 10% year-over-year (YoY) to $43.74 billion compared to an estimated $41.58 billion.

Shares of JPMorgan Chase (JPM) rose over 2% in Wednesday’s pre-market session after the bank’s fourth-quarter earnings topped Wall Street estimates and net income for the full year hit record-high levels.

The biggest American bank by assets reported earnings per share (EPS) of $4.81 compared to a Wall Street estimate of $4.03. Revenue rose 10% year-over-year (YoY) to $43.74 billion compared to an estimated $41.58 billion. The lender reported a 50% YoY rise in its net income to $14 billion.

Net interest income, the difference between interest earned and expended, fell 3% YoY to $23.5 billion. Excluding Markets, NII was down 2% to $23 billion, driven by lower rates and deposit margin compression across the lines of business and lower deposit balances in Consumer and Community Banking (CCB).

Notably, Investment banking revenue rose 46% to $2.6 billion, while investment banking fees rose 49% driven by higher fees across all products. Fixed Income Markets revenue grew 20% to $5 billion during the quarter.

CEO Jamie Dimon acknowledged that the U.S. economy has been resilient but highlighted two significant risks that still exist.

“Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II. As always, we hope for the best but prepare the firm for a wide range of scenarios,” he said.

Dimon also wrote about regulation, saying that it should be designed to effectively balance promoting economic growth and maintaining a safe and sound banking system.

“This is not about weakening regulation — we maintain a fortress balance sheet, evidenced by $547 billion of total loss-absorbing capacity and $1.4 trillion of cash and marketable securities — but rather about setting rules that are transparent, fair, holistic in their approach and based on rigorous data analysis, so that banks can play their critical role in the economy and markets,” he said.

The bank’s provision for credit losses declined 5% YoY and 15% quarter-on-quarter to $2.63 billion.

For 2025, the bank expects NII of approximately $94 billion, $900 million higher than in 2024 and almost $2 billion higher than previously estimated, according to a CNBC report. Excluding markets, it expects NII at approximately $90 billion this year.

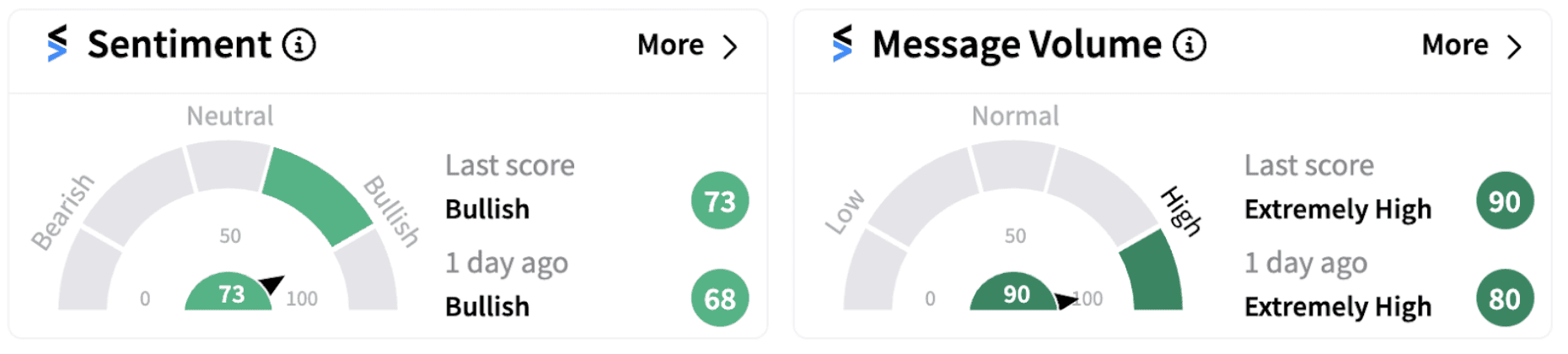

On Stocktwits, retail sentiment climbed further into the ‘bullish’ territory (73/100), accompanied by ‘extremely high’ retail chatter (90/100), which hit a year-high level.

Most retail chatter on Stocktwits indicated optimism surrounding the stock.

Notably, shares of the lender have gained over 47% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<