Bitcoin's intraday price pulled back by nearly $2000 after the token reached $90,000 on Monday.

- Powell’s video message revived debate over fiat credibility and Fed independence, pushing gold and Bitcoin back into focus.

- Analyst Dario said the fiat system is “structurally compromised” and framed the moment as bullish for precious metals.

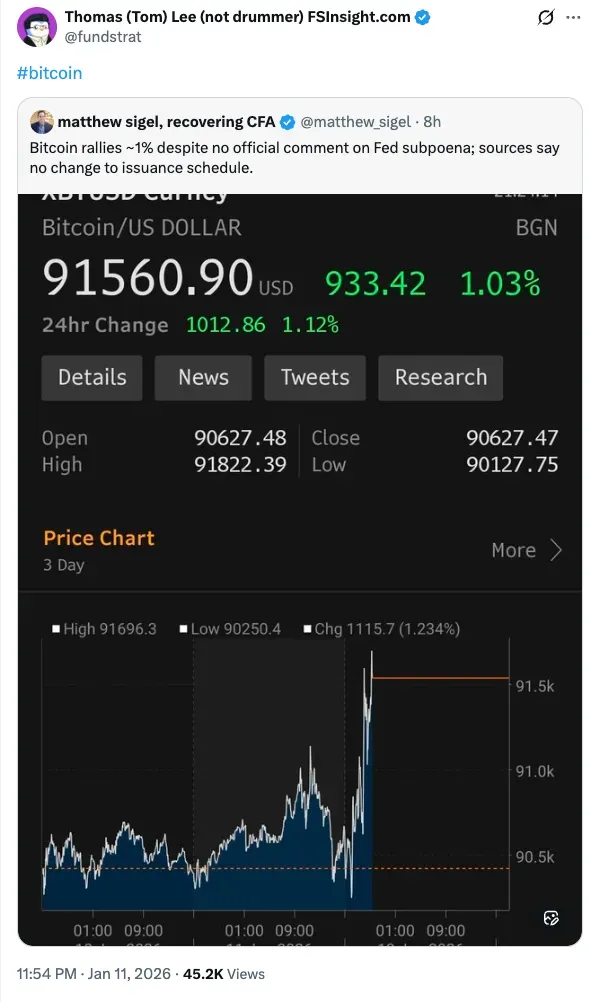

- VanEck’s Matthew Sigel said Bitcoin kept edging higher despite headlines about the Fed chair.

Federal Reserve Chair Jerome Powell’s latest video message sparked fresh debate across gold and crypto markets on Sunday. Traders and analysts linked the remarks to growing concerns around fiat credibility and political pressure on the central bank.

In a statement, Powell said that the Justice Department's subpoena concerning his previous Senate testimony was perceived as a coercive measure, asserting that the central issue revolves around the Federal Reserve's autonomy in setting interest rates, free from political interference.

The discussion gained traction after macro analyst Dario referenced Powell’s message and reacted on X. He described the moment as “the sound of the hammer hitting” and called it “the best advertisement” for gold and silver as money. Dario said the credibility of the fiat system is “structurally compromised,” arguing that markets are slowly pricing in deeper trust issues.

In a similar vein, gold advocate Peter Schiff echoed this bullish tone for precious metals. Schiff said that gold was soaring toward record highs because monetary policy remains too loose, with interest rates still too low, citing Powell’s comments.

Tether Gold (XAUT), a token backed by physical gold, traded around $4,576.23. The all-time high for this token is $4,587.30 for the past couple of hours, and the all-time low is $1,447.84 for the past 6 months.

Bitcoin Holds Firm At $90K

Bitcoin showed resilience despite the headlines. Fundstrat’s Tom Lee reposted VanEck’s Matthew Sigel’s comment, where he said Bitcoin continued to edge higher even as markets digested the Fed Chair news. In a separate CNBC interview, Lee has made bullish Bitcoin calls in recent months. He said Bitcoin could “easily” reach $200,000 before year-end.

Bitcoin (BTC) traded near $90,844, flat in the last 24 hours. On Stocktwits, retail sentiment around Bitcoin dropped from ‘bullish’ to ‘neutral’, as chatter around the apex cryptocurrency remained at ‘normal’ levels over the past day.

Gold has historically been monitored by investors during periods when concerns emerge around central bank independence. Some investors make the same case for Bitcoin due to its fixed supply and independence from central banks.

Read also: ‘No Faith In Any Given Trade’: Peter Brandt Pushes Back On Tom Lee’s $200k Bitcoin Target

For updates and corrections, email newsroom[at]stocktwits[dot]com.<