The rising use of autonomous rides through Waymo has a direct impact on Uber’s core business – ride-hailing.

- The rising use of autonomous rides through Waymo has a direct impact on Uber’s core business – ride-hailing.

- Waymo currently offers services in five cities, with expansion planned across several other cities in the near future.

- However, Waymo’s autonomous rides pale in comparison to the number of trips completed by Uber drivers.

Uber Technologies Inc. (UBER) shares fell nearly 6% on Wednesday, making the stock the worst performer on the S&P 500 index, after Waymo announced growing momentum in its autonomous ride-hailing services.

Waymo, backed by Alphabet Inc. (GOOG, GOOGL), revealed on Wednesday that it had more than tripled the number of fully autonomous rides in 2025 compared to the previous year. The firm said it has served over 14 million trips so far in 2025, delivering over a million rides every month. It also projected that this number would surge to a million rides every week by the end of 2026.

Uber shares were up 0.5% in Thursday’s pre-market trade, while Alphabet’s Class A shares edged lower by 0.4%. Retail sentiment on Stocktwits around Uber trended in the ‘bullish’ territory, while users felt ‘bearish’ about Alphabet at the time of writing.

The UBER stock is now down 10% over the past month.

Rising Competition

The rising use of autonomous rides through Waymo has a direct impact on Uber’s core business – ride-hailing. Waymo currently offers services in five cities, with expansion planned across several other cities in the near future.

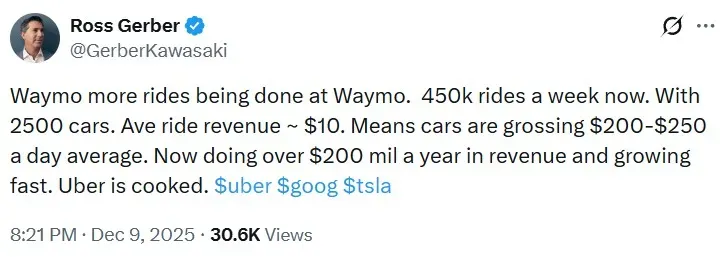

Ross Gerber, CEO of Gerber Kawasaki, pointed to Waymo’s growth pace. “Waymo more rides being done at Waymo. 450k rides a week now. With 2500 cars. Ave ride revenue ~ $10. Means cars are grossing $200-$250 a day average. Now doing over $200 mil a year in revenue and growing fast. Uber is cooked,” he said in a post on X.

Retail Unfazed

However, retail users on Stocktwits remain unfazed by the decline in the UBER stock.

One user pointed out that while Uber was the worst performer on the S&P 500 index on Wednesday, there is good news as well. “Price is sitting directly on this zone at which it has bounced numerous previous times. It could see some relief off this level!,” the user said.

Another user said the sell-off in UBER stock following the Waymo news is “way overdone.”

One bullish user pointed out that UBER is a defensive stock during an economic downturn, adding that the company’s platform provides income for people who need a job.

Moreover, Waymo’s autonomous rides pale in comparison to the number of trips completed by Uber drivers. While Waymo is on track to cross 20 million rides by the end of 2025, Uber drivers completed 11.27 billion trips in 2024 alone.

UBER stock is up 40% year-to-date, while GOOGL stock is up 69%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<