Invesco expects QQQ to begin trading as an open-ended fund from December 22.

- For investors, a 10% reduction in the expense ratio means more of their investment works for them to generate returns, and less money is used to pay the ETF.

- The conversion of Invesco QQQ from a unit investment trust ETF to an open-ended structure will improve transparency for investors.

- The company stated that this will allow it to enhance reporting, including semi-annual updates, and increase the board’s oversight.

Invesco (IVZ) on Friday announced a 10% decrease in the expense ratio for the Invesco QQQ Trust Series 1 ETF, following a shareholder approval to convert it from a unit investment trust ETF into an open-ended structure.

As a result, the investor fees will be reduced from 0.2% to 0.18%. Invesco expects QQQ to begin trading as an open-ended fund from December 22.

"I want to thank the shareholders who voted to transform Invesco QQQ into a modern ETF format. We are proud to deliver a ten percent reduction in fees to QQQ investors while creating more flexibility to utilize tools that could deliver better outcomes for investors," said Andrew Schlossberg, President and CEO of Invesco.

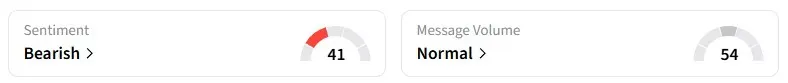

Invesco shares were up more than 1% in Friday morning’s trade. Retail sentiment on Stocktwits around the company trended in the ‘bearish’ territory at the time of writing.

How Are Investors Affected?

For investors, a 10% reduction in the expense ratio means more of their investment works for them to generate returns, and less money is used to pay the ETF.

An ETF’s expense ratio is the annual percentage fee paid by investors to cover fund management and operating costs. This is deducted directly from the fund’s assets, which impacts the investor’s returns over time.

Expense ratio covers management fees, administrative and marketing costs, among other expenses.

Why Is This Important?

The conversion of Invesco QQQ from a unit investment trust ETF to an open-ended structure will improve transparency for investors. The company stated that this will allow it to enhance reporting, including semi-annual updates, and increase the board’s oversight.

For shareholders, the conversion will not result in any tax consequences, the company added.

How Does It Benefit Invesco?

During Invesco’s second-quarter (Q2) earnings call, management stated that converting QQQ into an open-ended ETF could boost net revenue and adjusted operating income by about four basis points.

According to Bloomberg's analysis, this would unlock nearly $180 million in annual revenue for the company. Invesco QQQ has $399.38 billion in assets under management (AUM).

Retail sentiment on Stocktwits around Invesco remained in the ‘bearish’ territory on Friday.

IVZ stock is up 54% year-to-date and 60% over the past 12 months. The Invesco QQQ Trust ETF (QQQ) was up 1.04% at the time of writing. Retail sentiment on Stocktwits around the ETF trended in the ‘bearish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<