A rebound in PSU banks and real estate names helped Indian equities pare early losses; VIX jumped 7%.

Indian equity benchmarks ended flat on Monday, recovering most of their losses in the afternoon session.

The Sensex ended 77 points lower to close at 81,373, while the Nifty 50 fell 34 points to finish at 24,716 in a choppy session.

The broader markets outperformed, with the Nifty Midcap index gaining 0.6% and the Smallcap index ending 1% higher.

Meanwhile, the India Volatility Index (VIX), a key gauge of market fear, surged 7%.

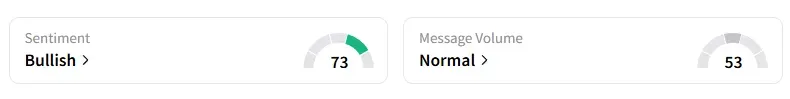

However, retail investor sentiment surrounding the Nifty 50 remained ‘bullish.’

On the sectoral front, technology and metals were the biggest laggards, while strong buying in PSU banks and real estate stocks helped market recovery.

Indian Overseas Bank surged 6% while Indian Bank, Union Bank, and Central Bank of India gained 4% each and Bank of Baroda rose 2%, ahead of key monetary policy decisions later this week.

Real estate names too saw significant action: Omaxe rallied 16%, Brigade rose 7%, Prestige Estates gained 5%.

Tata Steel and JSW Steel ended over 1% lower after the U.S. decided to double tariffs on imported steel and aluminium to 50%.

May auto sales were a mixed bag. Hero Motocorp was the top Nifty loser (-2%), followed by a 1% fall in Bajaj Auto and Tata Motors as sales missed street estimates. M&M gained 1.5% after reporting 17% growth in May sales.

FMCG stocks witnessed buying after the Indian government slashed the customs duty on edible oil by 10%. Britannia and Godrej Consumer gained over 2% while HUL and Dabur rose 1%.

Fiem Industries rose 10% and Astrazeneca surged 17%, driven by strong fourth-quarter results, while Nykaa and Inox Wind ended 5% lower on weak earnings.

Mphasis shares fell 3% on reports of losing one of its biggest clients, FedEx.

Niva Bupa shares ended 10% lower after a block deal.

Globally, European markets traded lower as global trade tensions and rising geopolitical concerns weighed on sentiment. Dow Futures pointed to a weak opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <