Technical charts indicate buying interest near support zones, but analysts await a decisive close above ₹73.

IDFC First Bank shares traded subdued on Monday as the street parsed its June quarter (Q1 FY26) earnings performance.

SEBI-registered analyst Harika Enjamuri said the private lender continued to scale up its top-line performance, with consolidated revenue reaching ₹9,642 crore, But rising costs and pressure on financing margins remain visible, as financing losses widened to ₹1,656 crore in Q1. Also, the financing margin slipped to 17%.

Despite these pressures, the bank’s other income showed healthy growth, reaching ₹2,227 crore, helping offset some of the financing drag. Net profit rose to ₹453 crore in Q1, while total expenses surged to ₹23,571 crore in FY25.

Enjamuri noted that while the bank has shown consistent revenue growth and diversification through robust other income streams, profitability continues to be impacted by rising cost structures and persistent negative financing margins, which require close monitoring for sustainable bottom-line improvement.

On the technical side, she noted that the IDFC First Bank stock was consolidating above a critical support zone of ₹68.60–70.50 on its daily chart, which aligned with the 9-day and 70-day moving averages, suggesting short-term buying interest.

However, the RSI on the daily chart (40.62) indicated that the stock is still under slight bearish momentum, though not oversold. On the weekly chart, the trend remains structurally intact, with a rising long-term trendline, and the price has successfully rebounded from it.

The moving averages (9, 70, 100) are converging near the ₹69–72 zone, acting as a support cluster. If ₹68.50 holds firm, the stock could move towards ₹75.50 and potentially ₹81.30 in the coming sessions, according to Enjamuri. However, failure to hold ₹68.50 could trigger a retest of ₹64 and even ₹62.

Overall, she remains cautiously bullish, but confirmation of strength is needed with a close above ₹73.

Analyst Manish Kushwaha observed that its long-term ascending trendline was indicating a strong uptrend. The price has taken support on this trendline multiple times, suggesting that it has been well respected.

However, the price broke below the ascending trendline, signaling potential weakness. He identified a resistance zone near ₹74–75. With the rebound at ₹69.19, price action suggested that buyers are active at this support level. He added that volume spiked on the recent bearish candles, indicating strong selling pressure. However, the bounce near ₹69 occurred on moderate volume, suggesting that the reversal is not yet strong.

The RSI is at 42.83, which is below the neutral level of 50 and is heading toward the oversold zone at 30. It is not yet oversold, so there may still be room for downside, although it is approaching support levels, according to Kushwaha.

He shared two outlooks. If the price reclaims and closes above ₹72–73 with volume, the bias is bullish. On the other hand, the outlook will be bearish if the price breaks and closes below ₹69, especially with high volume. Additionally, if the RSI drops below 40 with increased selling, it would signal further downside toward ₹65 or even ₹60.

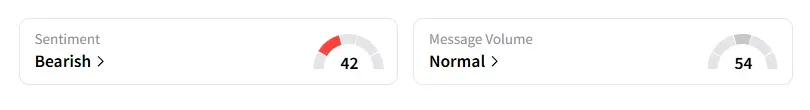

Data on Stocktwits shows that retail sentiment remains ‘bearish’ on this counter.

IDFC First Bank shares have risen 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<