The company disclosed an ongoing internal investigation into certain accounting practices and controls, primarily on revenue recognition for fiscal years 2023 through 2025.

- The company had initially forecast FY2025 revenue between $8.05 billion and $8.10 billion.

- Preliminary findings suggest that revenue for FY 2023 and 2024 may have been overstated by less than 2%, Icon said.

- Icon plans to release its Q4 and FY2025 earnings results on or prior to April 30, 2026.

Shares of Icon Plc (ICLR) fell more than 33% in premarket trading on Thursday after the company withdrew its full-year 2025 guidance and said revenue for 2023 and 2024 may have been overstated.

If the premarket level holds after the opening bell, ICLR shares would be trading at their lowest levels since May 2017.

Investigation Into Accounting Practices

The company disclosed an ongoing internal investigation by its audit committee, launched in late October 2025, into certain accounting practices and controls, primarily centered on revenue recognition for fiscal years 2023 through 2025.

As a result, Icon will not be able to report its 2025 financial results and has subsequently withdrawn its full-year guidance. Preliminary findings also suggest that revenue for FY 2023 and 2024 may have been overstated by less than 2%.

What Guidance Did Icon Withdraw?

The company had earlier forecast FY2025 revenue between $8.05 billion and $8.10 billion and adjusted diluted earnings of $13–$13.20 per share. It also reported revenue of $8.28 billion in FY2024 and $8.12 billion in FY2023.

Icon said it intends to release its fourth-quarter (Q4) and FY2025 earnings results on or prior to April 30, 2026.

“In response to the current investigation, we are implementing a series of corrective actions to enhance our internal controls over financial reporting,” CEO Barry Balfe said.

How Did Stocktwits Users React?

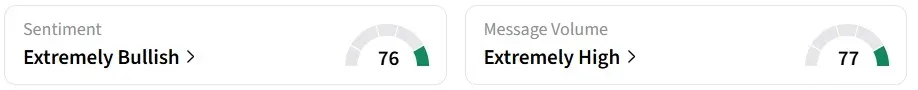

Despite the sharp selloff in pre-market, retail sentiment on Stocktwits flipped to ‘ extremely bullish’ from ‘bearish’ a day earlier, amid ‘ extremely high’ message volumes.

One user considered whether to invest in the shares for a “quick turnaround.”

Year-to-date, the stock has declined by almost 50%.

Read also: Trump and Xi’s Two-Hour Call Triggered A Rally In This Commodity - It's Not Gold Or Silver

For updates and corrections, email newsroom[at]stocktwits[dot]com.<