The company appointed Robert Calderoni to its board, formed a Strategy Committee, and entered a cooperation agreement with Elliott Investment to strengthen business strategy.

Hewlett Packard Enterprise Co. (HPE) on Wednesday said it is making key leadership changes to help reshape its business, naming longtime tech executive Robert Calderoni to its Board and forming a new Strategy Committee.

These moves were made in conjunction with a cooperation agreement with activist investor Elliott Investment Management L.P.

Following the announcement, Hewlett Packard Enterprise stock inched 0.5% lower on Wednesday mid-morning.

Calderoni, who currently serves as Chairman of KLA Corp. (KLAC), will officially join the board on July 16, 2025.

He will chair the newly established Strategy Committee, which will evaluate HPE’s operational approaches and explore potential avenues to boost shareholder value.

The company stated that the Strategy Committee will also include directors Gary Reiner, Raymond Lane, and Charles Noski. In addition to this leadership role, Calderoni will serve on the Integration Committee, overseeing the assimilation of Juniper Networks Inc. (JNPR), which HPE recently acquired.

On July 2, HPE completed its purchase of Juniper Networks, a company specializing in AI-driven networking, signaling a move towards expanding its focus on hybrid cloud and artificial intelligence technologies.

Alongside Calderoni’s addition to the board and the launch of the new Strategy Committee, HPE has entered into a cooperation deal with Elliott that includes a framework for regular information exchange between the two parties.

The arrangement also features typical clauses covering standstill terms, voting rights, and other standard conditions.

According to a Reuters report, Elliott, which owns over $1.5 billion worth of shares in HPE, has secured the right to place one of its employees on the company’s board under a deal that runs for at least one year and restricts the firm from initiating proxy battles.

The agreement marks a notable success for Elliott, a hedge fund overseeing approximately $72.7 billion in assets.

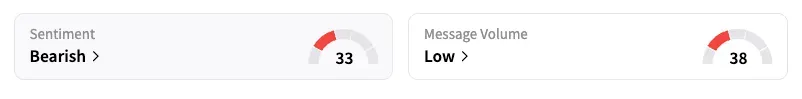

On Stocktwits, retail sentiment around HPE remained in ‘bearish’ territory.

HPE stock has lost over 5% year-to-date and over 6% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<