CEO Jeff Miller said that full-year international revenue is expected to decline by mid-single digits year-over-year, primarily due to reductions in activity in Saudi Arabia and Mexico.

Halliburton (HAL) CEO Jeff Miller said on Tuesday that the oilfield services market will be softer than previously expected over the short to medium term, primarily due to activity reductions in the North American region.

“In North America, multiple operators, even large and established customers, are now planning meaningful schedule gaps in the second half of 2025,” Miller said on a post-earnings call.

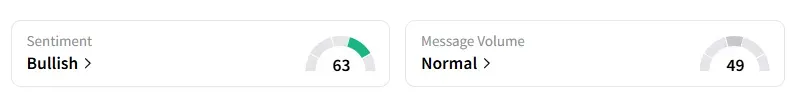

Retail sentiment on Halliburton, however, improved to ‘bullish’ from ‘bearish’ with message volumes at ‘normal’ levels, according to Stocktwits data.

Shares of Halliburton were down 1% in early trading after the CEO said the company expects full-year North America revenue to decline in the low double digits year-over-year.

He added that full-year international revenue is expected to contract by mid-single digits year-over-year, primarily driven by activity reductions in Saudi Arabia and Mexico.

Last week, SLB (SLB) CEO Olivier Le Peuch flagged that customers are selectively adjusting their activities, prioritizing key projects, and planning cautiously, particularly in offshore deepwater markets.

Both companies have noted that volatility driven by trade and tariff uncertainty, decline in crude prices, and macro uncertainty has resulted in lower spending and drilling.

Halliburton’s second-quarter revenue was $5.51 billion, compared with Wall Street expectations of $5.41 billion, according to data compiled by Fiscal AI.

The company’s adjusted profit came in at $0.60 per share, compared with analysts’ estimates $0.56.

A Stocktwits user expressed skepticism on the stock’s potential near-term performance.

Halliburton shares have declined 22% year-to-date and have fallen over 36% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<