HAL is likely to post a quarterly net profit of ₹1,204.9 crore and revenue of ₹4,996.1 crore, according to Bloomberg estimates

All eyes are on Hindustan Aeronautics (HAL) June quarter (Q1 FY26) earnings due later in the day. The defense PSU is likely to post a quarterly net profit of ₹1,204.9 crore and revenue of ₹4,996.1 crore, according to Bloomberg estimates. Its margin is expected to be 22.45%.

HAL stock opened marginally higher on Tuesday, before quickly turning red, as investors tread with caution.

Technical Cues

The stock is trading comfortably above its breakout retest level of ₹4,200, noted SEBI-registered analyst Rohit Mehta.

The stock recently broke a long-term downtrend, retested the breakout, and is now consolidating above the ₹3,850 - ₹4,050 support zone, a structure that keeps short-term bias constructive.

A decisive move above ₹4,500 could set the stage for further upside, Mehta said.

Fundamental Watch

Its fundamentals remain strong. The company is debt-free, reported a robust 24.5% profit CAGR over the past five years, a 27.3% average ROE, and a healthy 31.4% dividend payout ratio, the analyst said.

However, valuations are rich at 8.49 times book value, sales growth has been modest at 7.63% over five years, and working capital days have risen significantly.

In terms of ownership, promoter holding remained steady at 71.64% between March and June 2025. FIIs trimmed their stake from 12.08% to 11.90%, while DIIs increased holdings from 8.26% to 8.67%, he added.

HAL’s Q4FY25 sales declined 7.24% YoY but jumped 96.92% sequentially. Operating profit fell 10.27% YoY yet surged over 214% QoQ, the analyst noted.

Indian defense companies have been in the news lately for all the right reasons. On Monday, the stocks rallied after the government announced record defense production of ₹1,50,590 crore for FY24-25.

What Is The Retail Mood?

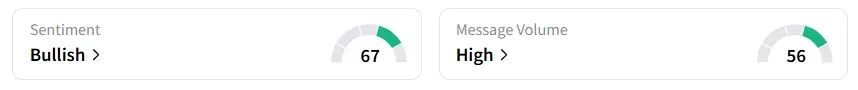

Hindustan Aeronautics is currently a top 10 trending stock on Stocktwits. Amid ‘high’ chatter on the platform, retail sentiment has remained ‘bullish’. It was ‘neutral’ a week earlier.

Year-to-date, the defense PSU has gained 6.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<