Barclays, Pivotal Research and TD Cowen all raised their 12-month price targets for Alphabet, underscoring sustained faith in the search giant’s growth story.

- Barclays increased its target to $360 from $315 as it kept an Overweight rating, highlighting robust fundamentals and strength in digital advertising and cloud demand.

- Pivotal Research increased its price target to $420 from $400, maintaining a ‘Buy’ rating based on the company’s search and artificial intelligence momentum.

- Alphabet said it expects to spend between $175 billion and $185 billion in 2026.

Alphabet Inc. (GOOG,GOOGL) is drawing fresh optimism as multiple Wall Street firms lifted their stock price targets following stronger-than-expected earnings and AI-led momentum.

For the fourth-quarter, the tech giant reported a revenue of $113.8 billion and earnings per share (EPS) of $2.82. Both the metrics surpassed the analysts’ consensus estimate of $111.5 and $2.64, according to Fiscal AI data.

Analysts Hike Price Targets On AI, Search Momentum

Barclays, Pivotal Research and TD Cowen all raised their 12-month price targets for Alphabet, underscoring sustained faith in the search giant’s growth story. Barclays increased its target to $360 from $315 as it kept an Overweight rating, highlighting robust fundamentals and strength in digital advertising and cloud demand, according to TheFly.

Pivotal Research increased its price target to $420 from $400, maintaining a ‘Buy’ rating based on the company’s search and artificial intelligence momentum, especially led by the performance of its Gemini AI and resilient search revenue.

TD Cowen lifted its price target to $365 from $350, signaling that continued strength in search and cloud activity supports further stock upside.

However, Alphabet Class A shares traded over 2% lower in Thursday’s premarket. Investors remain cautious after the company flagged a sharp rise in future capital spending

Capex Fears Weigh On Investors

Alphabet said it expects to spend between $175 billion and $185 billion in 2026, a figure far higher than the $119.5 billion estimate and almost twice as much as it invested the year before.

The higher capital spending plan caused a decline in the stock price. But in the earnings call, CEO Sundar Pichai expressed optimism about the revenue potential from the investments.

“We’re seeing our AI investments and infrastructure drive revenue and growth across the board.”

-Sundar Pichai, CEO, Alphabet and Google

What Are Stocktwits Users Saying

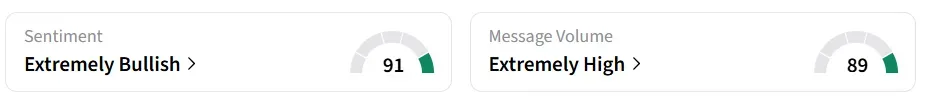

On Stocktwits, retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw a whopping 645% surge in user message count over 24 hours.

A Stocktwits user expressed optimism about the company’s AI scale and monetization.

GOOGL stock has gained 74% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<