Needham downgraded Fiverr to ‘Hold’ from ‘Buy,’ citing an updated business plan that focused on higher value clients.

- The analyst said that the change in strategy will result in significant gross merchandise value declines in FY26.

- Meanwhile, BTIG lowered its price target on Fiverr to $18 from $31 and kept a ‘Buy’ rating on the shares.

- The company’s first-quarter (Q1) guidance missed estimates, with Fiverr forecasting revenue in the range of $100 million and $108 million, lower than the expected $112 million.

Shares of Fiverr International Ltd. (FVRR) slipped more than 6% on Wednesday, extending its pre-market decline, after the company’s FY26 outlook missed Wall Street expectations.

The freelance service marketplace received a downgrade from Needham and a cut in its price target from BTIG.

Analysts’ Rationale

Needham downgraded Fiverr to ‘Hold’ from ‘Buy,’ citing an updated business plan that focused on higher value clients, according to TheFly. The analyst said that this will result in significant gross merchandise value declines in FY26.

Needham said that the new strategy could be the right one, given the disruption from artificial intelligence at the low end of the market, but said that it will likely take several quarters to be able to judge. The analyst lowered the firm's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) estimates by 38% in FY26 and 63% in FY27.

Meanwhile, BTIG lowered its price target on Fiverr to $18 from $31 and kept a ‘Buy’ rating on the shares. The analyst said that the Israeli company delivered mixed Q4 results and its guidance was also well short of expectations.

While BTIG said that it acknowledges the "challenging environment" and the risk of Fiverr "being a value trap," it sees valuation metrics as typical of a highly distressed company as opposed to one with plenty of net cash and solid, although declining, free cash flow.

As per data from Koyfin, three out of 11 analysts covering the firm have a ‘Hold’ rating on the shares, while eight have a ‘Buy’ or higher rating. The average 12-month price target on Fiverr is $31.90, representing an upside potential of 158% compared to its current price of $12.36.

Earnings Snapshot

Earlier on Wednesday, Fiverr reported fourth-quarter (Q1) 2025 results, posting marketplace revenue of $71.5 million, about 2% lower than $73.5 million reported during the same period a year ago. The company reported adjusted earnings per share (EPS) of $0.86 in Q4 on revenue of $107 million, compared to Wall Street expectations of an adjusted EPS of $0.74 on revenue of $109 million, as per data from Fiscal.ai.

The company’s first-quarter (Q1) guidance missed estimates, with Fiverr forecasting revenue in the range of $100 million and $108 million, lower than the expected $112 million. Meanwhile, the company forecast fiscal year 2026 revenue of $380 million to $420 million, below analysts’ estimate of $456 million.

How Did Stocktwits Users React?

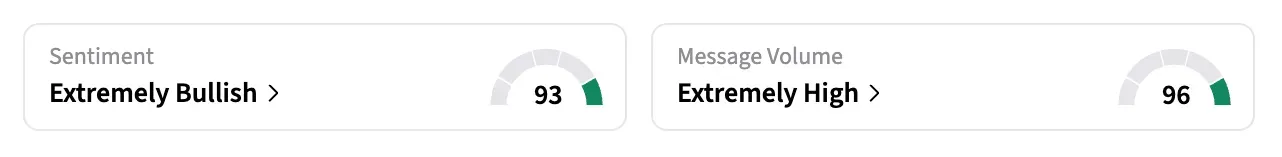

On Stocktwits, retail sentiment around FVRR shares jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volumes.

Shares of the company have declined more than 62% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<