As broader crypto markets slide, Cardano’s sentiment remains in ‘bullish’ territory over the past day.

- Ethereum outperformed the sell-off with the smallest 24-hour decline, as analysts push an uptrend incoming.

- Long-term deleveraging led to a drop below $91,000, with experts citing global liquidity and institutional flows as the primary factors rather than a traditional four-year halving cycle.

- Solana, XRP, Dogecoin, and Cardano had significant daily losses and increased long liquidations, indicating risk aversion in the crypto market.

As the larger crypto markets crashed, Ethereum had the smallest price drop in 24 hours, with macro analysts claiming Bitcoin's four-year cycle is over.

On Friday night, Ethereum (ETH) was trading at $3,081.92, leading in daily gains, down 0.01% in the last 24 hours. For Ethereum, liquidations stood at $41.0 million, as per Coinglass data. With $25.81 million longs and $15.19 million shorts, the downside pressure was more from long clean-outs than aggressive short squeezes. On Stocktwits, retail sentiment around Ethereum changed from ‘bullish' to ‘neutral’ zone, as chatter levels remained at ‘normal’ over the past day.

Ethereum is down nearly 1.8% over the past week; however, analysts remain hopeful. Veteran trader Matthew Dixon pointed out on X that Ethereum’s price structure remains constructive, despite the recent pullback. Dixon says that the current price structure of higher highs/ higher lows indicates a bullish trend rather than a downward momentum.

Bitcoin Consolidates Under $91K

Bitcoin (BTC) was trading at $90,524.79, down -0.6% in the last 24 hours. Liquidations stood at $59.28 million, as most are long side, suggesting that leverage unwound on the long side.

Bitcoin Is Driven By Macro Liquidity, Not 4 Year Cycle

The four-year Bitcoin cycle is a market pattern that happens during having. This event decreases the amount of new Bitcoin that is issued by almost half every four years. Historically, this has been followed by a bull market, a dramatic correction, and a protracted consolidation before the next cycle starts.

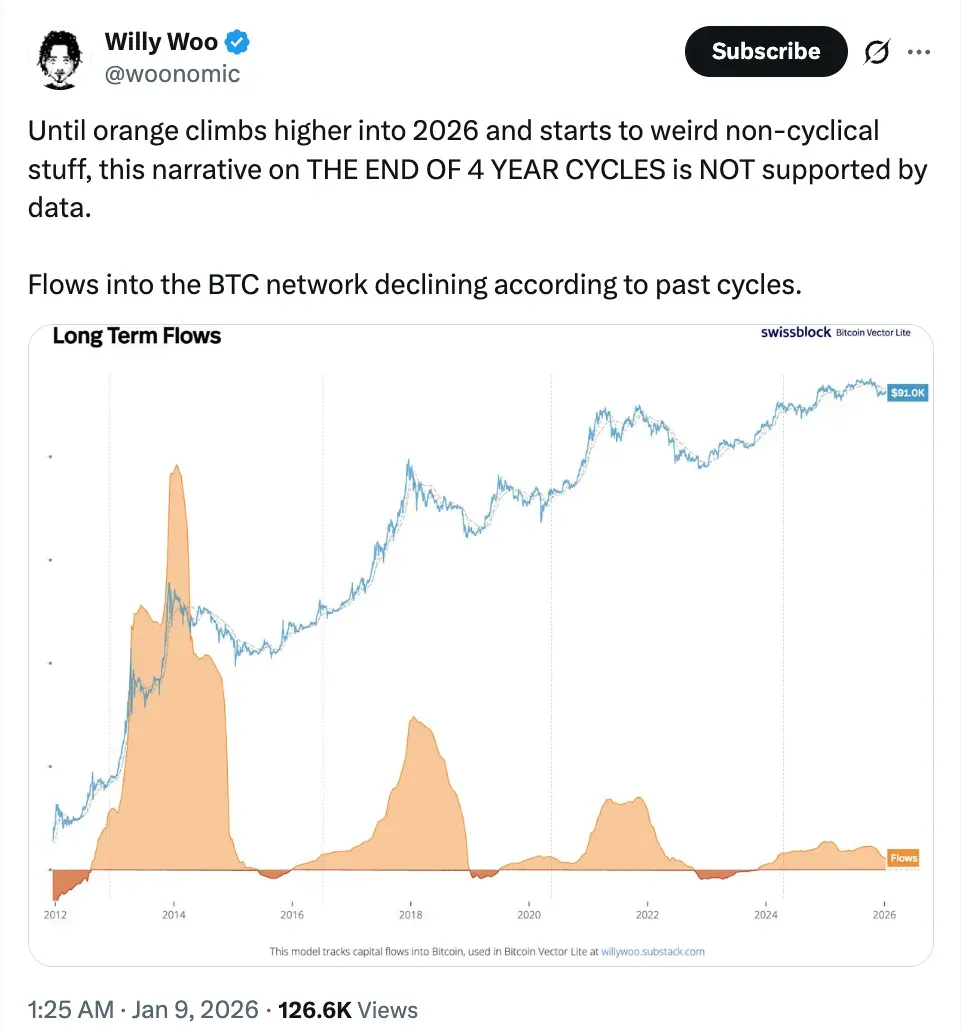

Now, many analysts believe that this four-cycle approach is becoming obsolete. For instance, Willy Woo, a popular crypto analyst, has claimed that capital flows no longer support a clear ‘four-year cycle’ structure, meaning Bitcoin is becoming a more continuous liquidity-driven market.

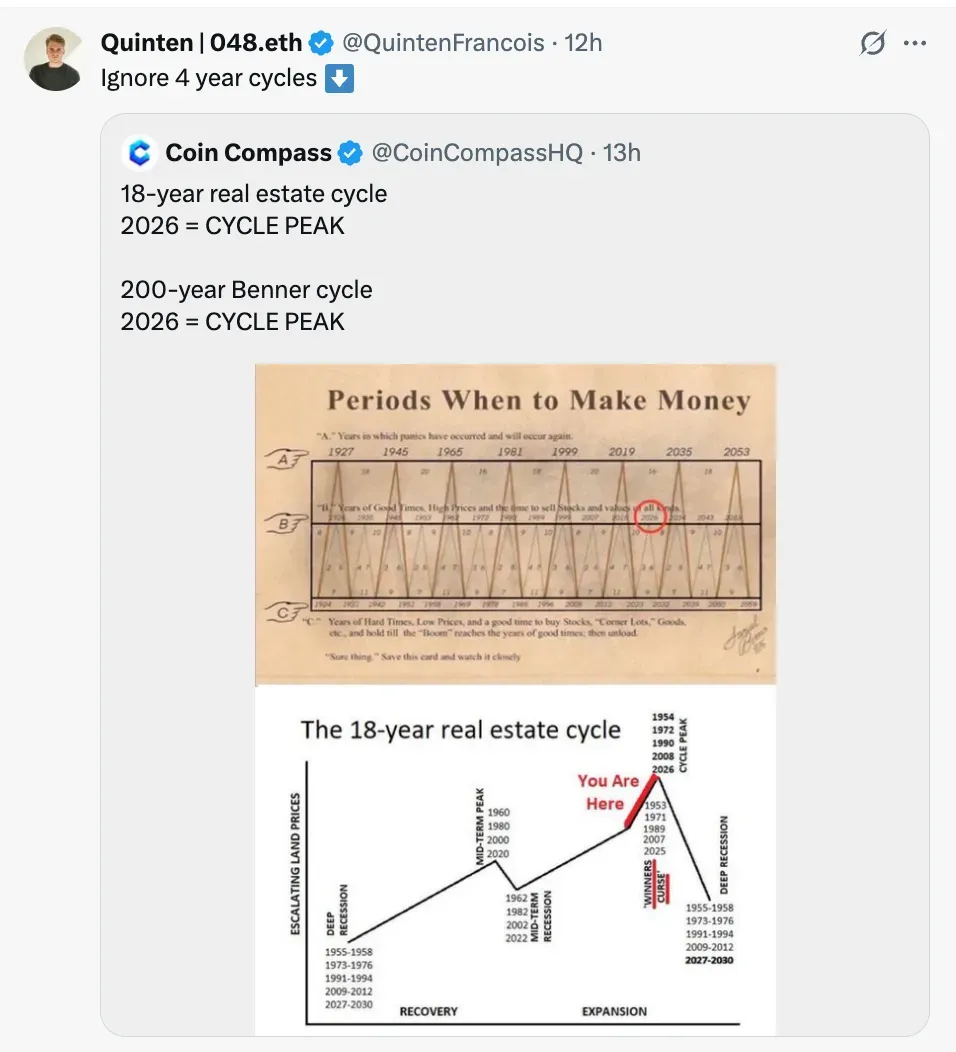

Quinten Francois, another analyst, posted on X, asking investors to ignore the four-year cycle for Bitcoin and instead look at a bigger global cycle. Some macro research firms like Bitwise said that Bitcoin is becoming more affected by global liquidity flows and institutional positioning rather than a set cycle.

Altcoins Crashed Over The Past Day

Solana (SOL) traded at $135.92, down over 3.2% in the past 24 hours, with about $11.36 million in liquidation divided between $6.72 million in longs and $4.64 million in shorts. Despite an inflow of $816.92 million in ETFs as of Friday, Solana’s price remained range-bound. On Stocktwits, retail sentiment around Solana remained in ‘bearish’ territory as chatter levels dropped from ‘high’ to ‘normal’ over the past day.

Ripple’s XRP (XRP) fell 2.19% to roughly $2.08, with liquidations reaching about $9.46 million, driven by $7.15 million in long holdings and $2.30 million in shorts. On Stocktwits, retail sentiment around XRP remained ‘bullish’ territory, with ‘extremely high’ chatter levels over the past day.

Dogecoin (DOGE) was trading at $0.139, down 1.8% in 24 hours, with about $4.37 million in liquidations, comprising $3.51 million in longs and $0.85 million in shorts. On Stocktwits, retail sentiment around Dogecoin dropped from ‘extremely bullish’ to ‘bullish’ territory, with ‘high’ chatter levels over the past day.

Cardano (ADA) was trading around $0.389, down 2.1% on the day, with total liquidations of approximately $0.81 million, split between $0.62 million in long positions and $0.19 million in short positions. The milder liquidation profile indicated a more moderate speculative stance as compared to large-cap counterparts. On Stocktwits, retail sentiment around Cardano remained in ‘bullish’ territory as chatter levels dropped from ‘high’ to ‘normal’ over the past day.

In the last 24 hours, around $205.19 million was liquidated from the crypto markets, with longs driving the momentum.

Read also: Barclays Invests In Ubyx To Build Stablecoin Settlement Infrastructure

For updates and corrections, email newsroom[at]stocktwits[dot]com.<