Ethereum remains the leading blockchain by total value locked, with nearly $69 billion currently deployed across decentralized finance applications.

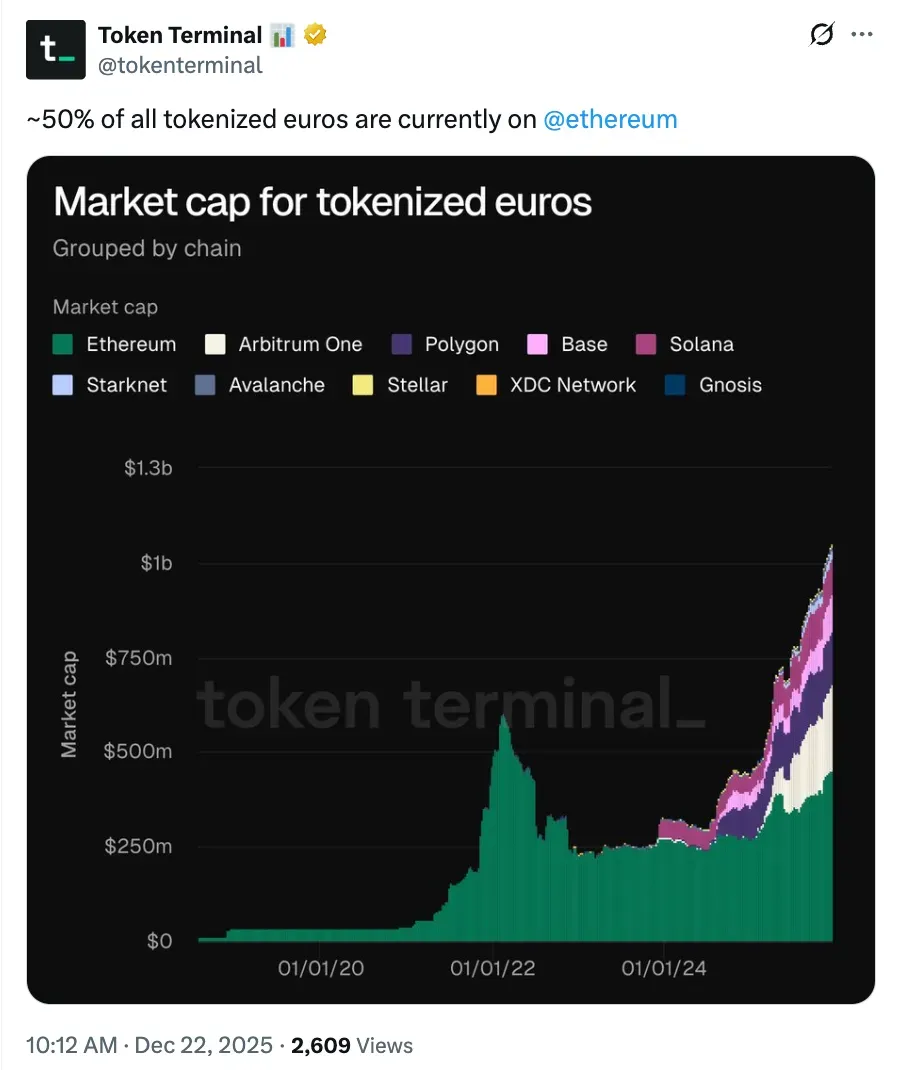

- Token Terminal data shows Ethereum hosts about 50% of all tokenized euros in circulation.

- Ethereum leads other networks, including Arbitrum, Polygon, Base, Solana, and Stellar, in tokenized euro market share.

- Artemis data shows Ethereum also holds roughly 52% of global stablecoin supply, led by USDT and USDC.

Ethereum (ETH) accounted for around half of all tokenized euros in circulation as of Tuesday, according to data shared by blockchain analytics firm Token Terminal.

In a post on X, Token Terminal said that roughly 50% of the total market capitalization of tokenized euros currently resides on the Ethereum (ETH) blockchain, outpacing other networks such as Arbitrum (ARB), Polygon (MATIC), Base, Solana (SOL), and Stellar (XLM).

Tokenized euros are blockchain-based representations of traditional euros, similar to how cryptocurrencies move, but without exposure to price swings. These assets are used for payments, trading, and settlement across crypto platforms.

Ethereum was trading at $2,960 on Tuesday, down about 2% over the past 24 hours. On Stocktwits, retail sentiment around Ethereum remained in the ‘bearish’ territory, accompanied by ‘low’ levels of chatter over the past day.

Stablecoin Payment Activity On Ethereum

According to blockchain analytics firm Artemis, Ethereum hosts about 52% of the global stablecoin supply, led by USDT and USDC, which together account for roughly 88% of the stablecoin market. The analysis examines the two largest stablecoins on the network, USDT and USDC, which together account for around 88% of the stablecoin market.

According to the report, most stablecoin transactions on Ethereum are peer-to-peer, making up 67% of all transactions over the past 12 months.

James, Head of Ecosystem at Ethereum Foundation, responded on X, saying that while most transactions are peer-to-peer, “institutions [are] sending bigger [payments],” citing Artemis data showing a 156% increase in business-to-business stablecoin volume over the past year.

Data from DeFiLlama showed that ETH continues to lead other blockchains by total value locked, with nearly $69 billion currently held in decentralized finance applications.

The network also hosts the largest stablecoin market capitalization among all chains, reinforcing Ethereum’s position as the primary settlement layer for euro-backed tokens and other fiat-linked digital assets.

Read also: Japan’s Local Governments May Soon Issue Bonds On-Chain: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com<