EquipmentShare.com began trading on Nasdaq on Wednesday under the ticker symbol “EQPT.”

- The company opened at $28.50, 16% higher than its offering price of $24.50 per share, which valued it at around $7.2 billion.

- The Missouri-based firm priced its 30.5 million shares at $24.50 in its initial public offering, and shareholders raised $747.3 million on Thursday.

- The company is a construction technology and equipment provider in both online and offline markets.

Construction tools company EquipmentShare.com made its Nasdaq debut on Friday, opening strong at $28.50, 16% higher than its offering price of $24.50 per share. The company’s Class A common stock began trading under the ticker symbol “EQPT.”

The Missouri-based firm priced its 30.5 million shares at $24.50 in its initial public offering, and shareholders raised $747.3 million on Thursday. Based on its opening price, the company is valued at around $7.2 billion.

EquipmentShare.com’s public listing comes a day after cryptocurrency company BitGo launched on the New York Stock Exchange.

Shares of EQPT were up over 24% at the time of writing, trading around $29.31.

Company Details

Founded in 2015 and headquartered in Columbia, Missouri, EquipmentShare.com is a construction technology and equipment provider in both online and offline markets. Its proprietary technology, T3, drives collaboration across the construction sector.

The company provides a range of solutions including a fleet management platform, telematics devices, and an equipment rental marketplace.

EquipmentShare.com is present in 373 locations across 45 states in the U.S. and has over 7,500 employees as of September 2025, according to the company. The equipment renter aims to expand from 342 rental sites to over 700 in time.

“The substantial investment in infrastructure, energy, and industrial projects over the next 10 years demands a new approach – one that is data-driven, connected, and built for scale. We believe that EquipmentShare is best positioned to connect the industry, and becoming a public company allows us to extend our impact for the customers and communities we serve,” said Jabbok Schlacks, co-founder and CEO of EquipmentShare, in a statement.

According to a filing with the U.S. Securities and Exchange Commission (SEC), EquipmentShare reported revenue of $3.76 billion in 2024. The company projects revenues between $4.33 billion and $4.37 billion in 2025. Meanwhile, the company projected net income between $5 million and $15 million in 2025, compared with $2.4 million net income in 2024.

How Did Stocktwits Users React?

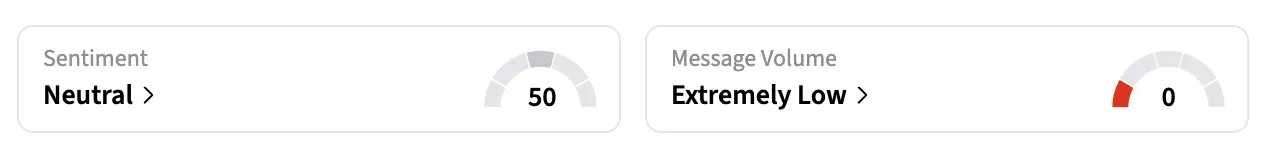

On Stocktwits, retail sentiment around EQPT shares was in the ‘neutral’ territory at the time of writing, amid ‘extremely low’ message volumes.

One user called the company the Airbnb-equivalent of the equipment industry, adding that they anticipate a 200% jump in profit by the second quarter.

Another bullish user called it a ‘nice simple business stock.’

https://stocktwits.com/RotterdamTrade/message/642714864

For updates and corrections, email newsroom[at]stocktwits[dot]com.<