El-Erian noted that the Fed’s ongoing monetary policy framework review, which is set to close in the coming weeks, does not revisit the target.

Noted economist Mohamed El-Erian on Thursday questioned whether the Federal Reserve should continue anchoring policy to a 2% inflation target in a structurally shifting economy.

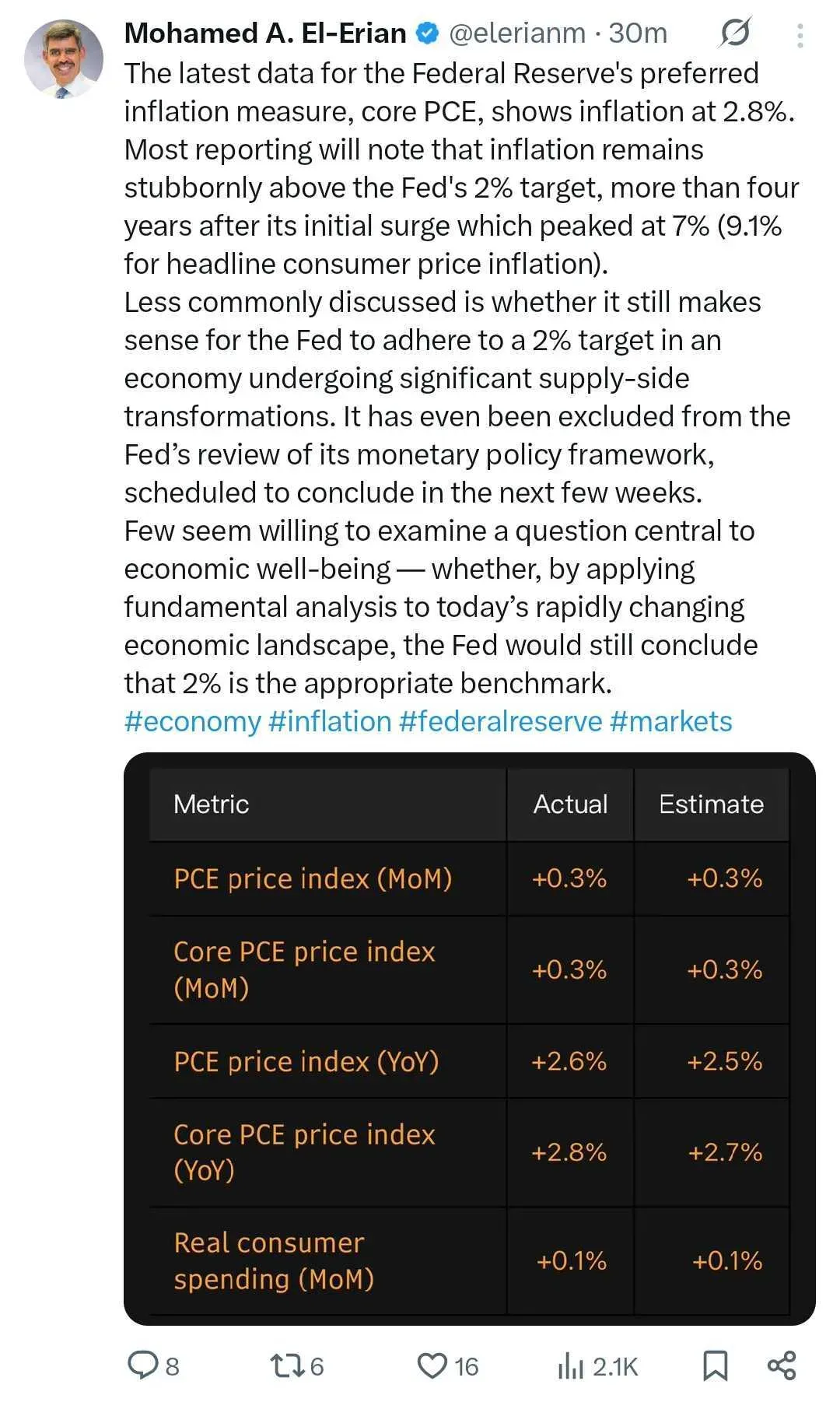

He noted that the Fed’s ongoing monetary policy framework review, which is set to close in the coming weeks, does not revisit the target despite core PCE showing inflation at 2.8%.

“Less commonly discussed is whether it still makes sense for the Fed to adhere to a 2% target in an economy undergoing significant supply-side transformations,“ he wrote in a post on X.

“Few seem willing to examine a question central to economic well-being — whether, by applying fundamental analysis to today’s rapidly changing economic landscape, the Fed would still conclude that 2% is the appropriate benchmark,” he added.

Get updates to this developing story <directly on Stocktwits.<

Read also: Bitcoin, Ethereum Rebound After Fed Rate Hold – XRP, DOGE, ADA Lead Altcoin Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.<