Citi’s partner checks showed signs of budget flushness and adoption of “Intelligent Agreement Management,” coupled with improving web traffic data.

DocuSign, Inc. (DOCU), a cloud platform provider allowing individuals and businesses to sign and share documents electronically, is scheduled to report quarterly results after the market closes on Wednesday.

Ahead of the fourth quarter results for the fiscal year 2025, Citi analysts said they are confident in DocuSign going into the print, TheFly reported.

In a note released on Thursday, Citi maintained a ‘Buy’ rating and a $113 price target. The firm noted that partner checks showed signs of budget flushness and “Intelligent Agreement Management” adoption, coupled with improving web traffic data.

Citi expects a solid fourth-quarter billings beat but remains wary of the guidance for the fiscal year 2026.

Wall Street analysts, on average, expect adjusted earnings per share of $0.85 and revenue of $760.94 million for the quarter. That marks a 12% and 6% growth, respectively, from the year-ago EPS and revenue of $0.76 and $712.39 million.

DocuSign’s fiscal year 2025 guidance issued in early December calls for revenue of $2.959 billion to $2.963 billion, with subscription revenue estimated at $3.056 billion to $3.066 billion.

Investors may also focus on key operational metrics such as billings, which rose 9% to $752.3 million in the third quarter.

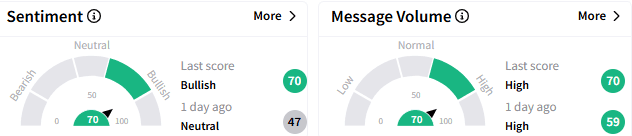

On Stocktwits, sentiment toward DocuSign stock turned to ‘bullish’ (70/100) from ‘neutral’ a day ago, with the message volume staying at ‘high’ levels.

A watcher said DocuSign is one of the best stocks to own amid the current market conditions.

DocuSign stock closed Friday’s session up merely 0.08% at $79.83. The stock has lost about 11.24% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<