Disney’s $1B OpenAI partnership offers strategic AI entry and content advantages, but investor sentiment remains muted as the stock trades sideways despite potential long-term benefits.

- Disney becomes Sora’s first content-licensing partner and invests $1B in OpenAI, gaining AI capabilities and future equity rights.

- OpenAI gets funding relief amid massive projected losses; Disney seeks engagement boost across streaming and parks.

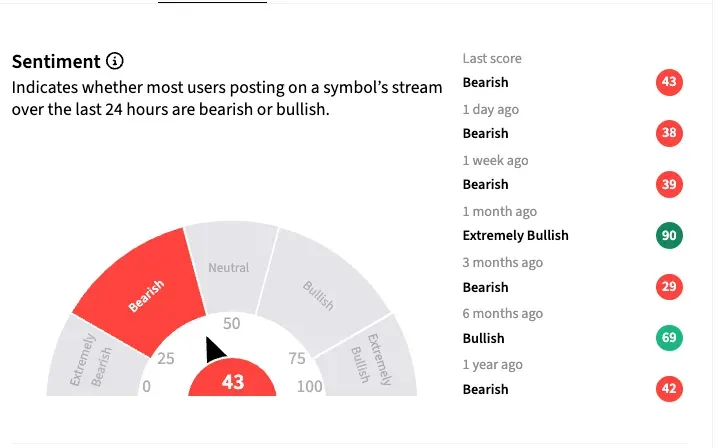

- Disney shares remain muted, up just 0.5% YTD, with retail sentiment still bearish.

The Mouse House has finally jumped on the artificial intelligence (AI) bandwagon, teaming up with the technology’s ‘OG’ innovator, OpenAI. The moot point is whether this partnership is a substantial “win-win” opportunity or merely a headline-grabbing alignment.

At least, investors have taken the news positively, as seen from the Disney stock rising 2.4% on Thursday.

Disney’s Deal Snippets

-Disney becomes Sora’s first content licensing partner, as part of a three-year contract.

-Based on user prompts, Sora can now generate videos, drawing from a set of over 200 characters from Disney, Marvel, Pixar, and Star Wars.

-Disney becomes an OpenAI customer (will use OpenAI’s APIs to build new products, tools, and experiences, and deploys ChatGPT to its employees).

The highlight of the deal terms is a $1 billion investment Disney has agreed to make in OpenAI, which is currently raking up mammoth losses. It would also receive warrants that can be used to purchase additional equity.

Win-Win Or It So Seems?

Walt Disney CEO Bog Iger was upbeat about the partnership. Speaking on CNBC’s Squawk on the Street on Thursday, he said the company’s $1 billion equity investment is a “way-in” to AI, and would have a potential long-term impact at Disney.

“We want to participate in what Sam is creating, what his team is creating…We think this is a good investment for the company.”

For OpenAI, the $1 billion cheque – and future potential investments by Disney – are only a drop in the bucket. It is burdened by massive losses stemming from its huge investment in training AI models and the supporting cloud infrastructure.

HSBC estimates that OpenAI is on track to incur losses at least until 2030, according to a Financial Times report. Losses are seen increasing from $17.72 billion in 2025, peaking at over $108 billion in 2029, and narrowing to $77 billion in 2030.

HSBC data source via Financial Times<

In any case, a partnership and investment with a media group as iconic as Disney is a welcome development for OpenAI.

At a time when the media and entertainment industry is undergoing a significant consolidation, this AI trump card with Disney could serve it well in the near term. Theater attendances are yet to return to pre-pandemic levels, and its streaming business faces cutthroat competition. The AI-generated content may help reinvigorate engagement on the company’s streaming platforms.

Following Disney’s fourth-quarter results in mid-November, Evercore ISI analyst Kutgun Maral said the company’s FY26 outlook was conservative amid macro uncertainties. Nevertheless, the analyst said Disney's "strong track record and strategic investments position it well for sustained growth.” While lowering Disney’s stock price target by $11 to $130, Rosenblatt Securities flagged concerns about a notable deceleration in domestic parks.

In a post on X, the founder of video analytics company Delmondo, Nick Cicero, said Disney had solved two existential problems with the OpenAI deal.

-Creators making billions of views worth of unauthorized Disney content

-Kids are spending more time on YouTube than Disney+

Cicero feels the move is about revenue physics, rather than tech:

“Sora gives Disney its first scalable way to pull creator-made content into its own premium ecosystem — brand-safe, trackable, legal, and ready for CTV monetization.”

Disney Takes On Google

In an interesting turn of events, close on the heels of striking the OpenAI partnership, Disney reportedly sent a “cease-and-desist” letter to Google over the unauthorized use of its work by the latter’s Gemini large-language model (LLM), Axios reported, citing a copy of the letter it obtained.

Tracking Disney’s Trajectory

After a forgettable first three months, Disney’s stock took off strongly in May, as the company posted a second-quarter beat and raised its full-year forecast, buoyed by strong performances by its theme parks and streaming business.

The euphoria lasted through June before fading, and the stock has been stuck in a sideways trending channel since then.

Source: Koyfin<

Source: Koyfin<

The stock is barely (+0.50%) in positive territory for the year.

Retail’s Downbeat

The AI plunge hasn’t made a world of good for Disney, at least in the eyes of retail investors. On Stocktwits, retail sentiment toward the stock is stuck in ‘bearish’ as of early Friday. The mood toward the stock has largely been downbeat for much of this year.

Disney’s stock is currently trading at a discount of about 20% relative to the one-year consensus price target from analysts, according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<