A senior Pentagon official told the Washington Post that the Trump administration wants to reallocate about $50 billion to the president's other priorities.

Major defense contractor stocks traded in the red after the bell on Wednesday after several reports said that Donald Trump’s administration wants to develop a plan to cut 8% of the defense budget each of the next five years.

According to a Washington Post report, citing a memo and officials familiar with the matter, U.S. Defense Secretary Pete Hegseth has ordered senior leaders at the Pentagon and throughout the U.S. military to draw up the plan by Monday.

The report added that the memo includes a list of 17 categories that the Trump administration wants to be exempted, which include operations at the southern U.S. border, modernization of nuclear weapons and missile defense, and buying of submarines, one-way attack drones, and other munitions.

A senior Pentagon official told the Washington Post that the Trump administration wants to reallocate up to $50 billion to the President's other priorities.

The Pentagon's budget for fiscal year 2025 was $850.7 billion, primarily to deter threats from China and Russia.

According to the report, the Trump administration is seeking lists of thousands of probationary Defense Department employees who are expected to be fired this week. The layoffs are being overseen by the Elon Musk-headed Department of Government Efficiency (DOGE).

The iShares U.S. Aerospace & Defense ETF (ITA) declined 0.11% in aftermarket trade.

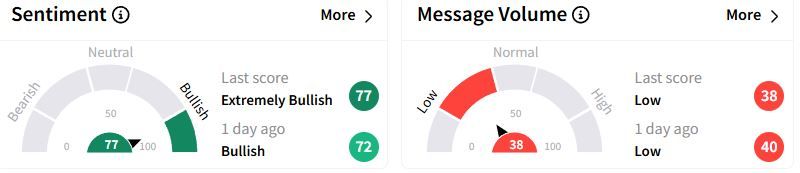

However, retail sentiment on Stocktwits moved to ‘extremely bullish’ (77/100) territory from ‘bullish’(72/100) a day ago, while retail chatter was ‘low.’

Lockheed Martin shares declined 0.2% in after-hours trade.

Musk has previously criticized the aerospace and defense firm’s F-35 fighter jet program.

Lockheed had forecast its 2025 revenue below Wall Street’s estimates in January.

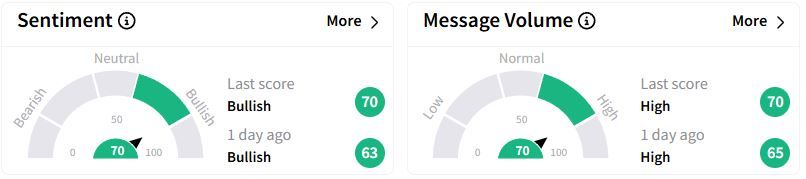

Retail sentiment on Stocktwits stayed in the ‘bullish’ (77/100) territory with a higher score than a day ago, while retail chatter was ‘high.'

RTX Corp. (RTX) shares were down 0.3%.

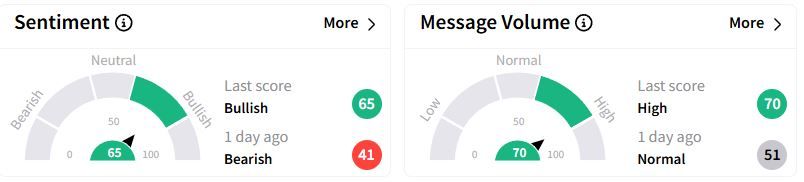

Retail sentiment on Stocktwits flipped to the ‘bullish’ (65/100) territory compared with ‘bearish’ (41/100) a day ago, while retail chatter was ‘high.’

Shares of Palantir, seen as a key defense beneficiary, fell 5.2% in after-hours trading after a regulatory filing revealed that CEO Alex Karp has a new trading plan to sell up to 9.98 million shares by September 12.

While some investors saw the pullback in defense stocks as a buying opportunity, others were surprised that Palantir faced a sharper decline than its peers.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<