Amid the market volatility, sub-small-cap stocks drew retail traders’ attention in a big way.

The U.S. stock market snapped a three-session run on Wednesday, dragged lower by a sell-off in technology stocks and apprehensions ahead of President Donald Trump’s press conference to discuss auto tariffs.

The Nasdaq Composite fell by over 2% and the S&P 500 Index slipped 1.12%.

Amid the ongoing volatility, the following software stocks witnessed the biggest surge in retail chatter over the 24 hours that ended late Wednesday.

DatChat, Inc. (DATS) - 7,677% increase in message volume

Shares of New Brunswick, New Jersey-based DatChat, a secure messaging metaverse and social-media company, traded in a $3.5646-$4.42 range on Wednesday before settling unchanged at $3.78.

The lackluster trading came amid broader market volatility and as traders stepped to the sidelines following DatChat stock’s 75% rally on Tuesday.

On Tuesday, DatChat said its Myseum Social Media platform for storing and sharing digital photos and content was available as a download on Apple iOS and Android devices. Myseum was launched in the first week of March.

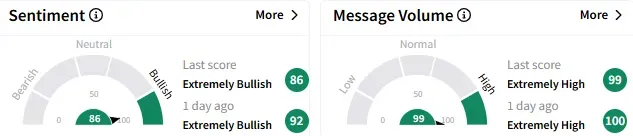

On Stocktwits, retail sentiment toward DatChat stock remained ‘extremely bullish’ (86/100), and the message volume stayed ‘extremely high.’

A bullish watcher said they added more stock following Wednesday’s stock pause.

Zscaler, Inc. (ZS) - 1,050% increase in 24-hour message volume

San Jose, California-based cybersecurity company Zscaler’s stock fell nearly 2% on Wednesday amid the tech sell-off.

Notwithstanding the negative move, retail remained ‘extremely bullish’ (75/100) on the stock, although the message volume tapered off to ‘normal’ levels.

A bullish user highlighted the $216 resistance level at which Zscaler stock floundered on Wednesday. In the session, it traded in a $209.65-$216 range.

Earlier this month, Zscaler reported forecast-beating quarterly results and issued upbeat forward guidance.

Airship AI Holdings, Inc. (AISP) - 875% increase in 24-hour message volume

Redmond, Washington-based Airship AI provides artificial intelligence (AI)-driven data management surveillance platforms.

The micro-cap’s stock fell 2.32% on Wednesday, with the downside accompanied by below-average volume.

The Airship AI stock generated a ‘bullish’ reaction (62/100) from retailers on Stocktwits, although the message volume on the stream reduced to ‘normal.’

A watcher said they might initiate a small position on the next pullback. They see government contracts as a massive catalyst for the AI surveillance play.

Auddia, Inc. (AUUD) - 633% increase in 24-hour message volume

Boulder, Colorado-based Auddia is a developer of an AI Platform for the audio and podcast markets. Its flagship product is faidr, which enables consumers to listen to various AM/FM radio stations with commercial breaks replaced with personalized audio content.

Last week, the nano-cap firm announced the addition of a new AI model in its faidr mobile application.

Retail sentiment toward Auddia stock tempered to ‘bullish’ (67/100) by late Wednesday from the ‘extremely bullish’ mood that prevailed a day ago. The message volume stayed ‘high.’

A watcher said the daily chart looked bullish.

Another user predicted a move toward the $0.50 level.

Vocodia Holdings Corp. (VHAI) - 600% increase in 24-hour message volume

Vocodia stock bucked the market downturn and rallied over 13% on Wednesday after the conversational AI company announced the upcoming release of its powerful new platform designed specifically for the developer market. The platform is expected to open to users within 30 to 45 days.

Retail sentiment toward the nano-cap stock remained ‘extremely bullish’ (97/100), with the buoyant sentiment accompanied by ‘extremely high’ message volume.

A bullish user said the stock will break out and gap up.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<