The company’s bookings climbed to a record $18.3 million, ending 2024 with a cash position of $178 million.

D-Wave Quantum, Inc. (QBTS) shares climbed sharply on Thursday after the quantum computing company issued an upbeat revenue guidance for the current quarter. The fourth-quarter results were mixed, but bookings hit record highs.

The Palo Alto, California-based company reported an adjusted loss of $0.08 for the fourth quarter of the fiscal year 2024, worse than the Finchat-compiled consensus estimate for a loss of $0.06. However, it was narrower than the year-ago loss of $0.10 per share.

D-Wave’s revenue fell 21% year over year (YoY) to $2.3 million but exceeded the consensus estimate of $2.23 million.

Bookings, a key performance metric, hit a record $18.3 million.

The company noted that the adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss was $15.3 million compared to the year-ago loss of $10.9 million.

It ended the quarter with a cash balance of $178 million.

CEO Alan Baratz said, “With record bookings, a record cash position and an unequivocal demonstration of our quantum system outperforming classical on a real-world problem, our progress toward achieving that mission is clear.”

D-Wave said it expects first-quarter revenue to exceed $10 million, with a significant portion of it coming from the sale of an Advantage annealing quantum computer. This was sharply higher than the $2.55-million consensus estimate.

The company announced Wednesday that its annealing quantum computer outperformed one of the world’s most powerful classical supercomputers, sending its stock higher by over 8%.

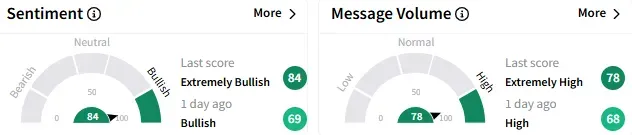

On Stocktwits, retail sentiment toward D-Wave stock improved to ‘extremely bullish’ (84/100) from the ‘bullish’ mood seen a day ago. The message volume also increased to ‘extremely high’ levels.

A bullish watcher highlighted the stock’s outperformance despite the challenging market.

Another user said the company now has the “first-mover advantage.”

The earnings release has helped D-Wave stock extend its gains. By Thursday afternoon, the stock was up 16.63% at $6.79. After a staggering 840%+ gain in 2024, the stock has pulled back by about 30% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<