Multiple brokerages slashed Carvana’s price target after the company’s fourth-quarter earnings fell below Street estimates.

- Carvana reported Q4 revenue of $5.60 billion, topping Wall Street estimates, but profit fell short.

- BofA cut Carvana’s price target, adding that investors were hoping for clearer EBITDA guidance to bolster confidence in margin expansion.

- Carvana rejected allegations from a Hindenburg Research report, which alleged the company’s turnaround was a “mirage.”

Shares of Carvana Co. (CVNA) tumbled more than 10% in pre-market trading on Thursday after bearish brokerage commentaries raised concerns about the company’s lack of clear full-year 2026 earnings guidance, following a miss on fourth-quarter profit estimates.

The company reported Q4 revenue of $5.60 billion, topping Wall Street estimates of $5.27 billion, according to Fiscal AI data. However, adjusted core profit missed expectations, coming in at $511 million. While management projected “significant growth” in retail sales and adjusted core profit for full-year 2026, it stopped short of providing a specific guidance range.

Brokerages Cut Price Targets On Limited 2026 Visibility

Wells Fargo cut Carvana’s price target to $425 from $525 while maintaining an ‘Overweight’ rating, according to The Fly. It still represents a 17% upside to Wednesday’s closing price of around $361. The firm noted that although fourth-quarter retail unit sales topped expectations, after-hours weakness stemmed from shortfalls in adjusted EBITDA and retail gross profit per unit, as well as the absence of specific first-quarter and full-year 2026 guidance.

BofA reduced its price target to $400 from $460 but reiterated a ‘Buy’ rating. Analyst Michael McGovern noted that management returned to qualitative guidance of “significant growth” in units and EBITDA for 2026 and sequentially in the first quarter, rather than offering a specific range. However, McGovern added that investors were likely hoping for clearer EBITDA guidance to bolster confidence in margin expansion, especially after fourth-quarter EBITDA came in below expectations.

BTIG cut its price target to $455 from $535 while maintaining a ‘Buy’ rating, with analyst Marvin Fong stating that while retail unit sales were strong, weaker-than-expected gross profit per unit, particularly on the retail side, dragged adjusted EBITDA below Street expectations.

Carvana Dismisses Hindenburg Allegations

Meanwhile, Carvana rejected allegations from short seller Hindenburg Research. In a January 2025 report, Hindenburg alleged the company’s turnaround was a “mirage,” citing $800 million in loan sales to a suspected undisclosed related party and accusing it of accounting manipulation and lax underwriting to inflate income.

Carvana called the claims “inaccurate, incomplete, and otherwise misleading.”

Retail Traders Turn Cautious

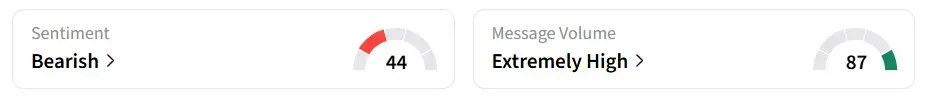

Retail sentiment on Stocktwits flipped to ‘bearish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes. CVNA was the top trending ticker on the platform at the time of writing.

Chatter was largely bearish, with one user highlighting the company’s massive debt and the lack of “real operating cash.”

Another user added, “While the headlines say record performance, the financials say deterioration.”

One user expects the stock to decline further 23%.

Year-to-date, CVNA shares have fallen 22%.

Read also: AG Stock Rises Pre-Market On Record Quarterly Revenue

For updates and corrections, email newsroom[at]stocktwits[dot]com.<