Crypto ETF investors are mostly holding on, with falling prices driving the decline in assets instead of heavy selling.

- Most of the selling is coming from longtime crypto holders, while newer ETF investors have stayed relatively steady.

- Outflows at large issuers such as BlackRock reflect market stress and positioning changes, not panic selling by ETF investors.

Crypto’s recent volatility has not led to widespread selling by ETF investors, according to executives at Bitwise and GraniteShares, even as spot crypto fund assets drop to their lowest level in nearly a year.

On Tuesday, Bitwise chief investment officer Matt Hougan said that ETF investors are largely holding through the downturn. “It’s not the ETF investors who are driving the sell-off,” Hougan said as he explained that most of the decline in assets under management is due to falling crypto prices rather than heavy redemptions.

ETF Investors Hold Through The Downturn

“Bitcoin is down more than 50% from its October 2025 peak,” he added, stating that the total outflows from spot Bitcoin ETFs have been relatively limited at around $7 billion. He pointed out that much of the selling pressure is coming from long-time crypto holders who accumulated Bitcoin years ago and are now trimming positions, rather than from newer ETF investors.

Hougan noted that about 40% of spot Bitcoin ETF holders are currently underwater, but added that “the vast majority of ETF investors showed they’re here for the long haul.”

Retail Sentiment Turns Bearish As Volatility Spikes

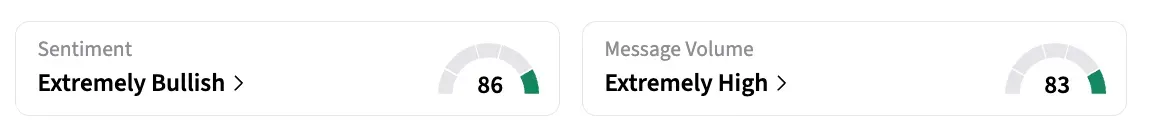

Bitcoin (BTC) traded at around $69,244.41, down by 0.8% in the last 24 hours. On Stocktwits, the retail sentiment around Bitcoin remained in the ‘bearish’ territory, with chatter at ‘extremely high’ levels over the past day.

Adding to that sentiment, Will Rhind, the chief executive of GraniteShares, said ETF investors typically hold smaller crypto allocations and are more comfortable riding out volatility. “The selling has been pretty light compared to the total assets out there,” Rhind stated.

BlackRock ETFs Alone Show $3.6 Billion Outflow

Against that backdrop, market pressure has increased in recent weeks, with Bitcoin testing the $60,000 level and Ethereum (ETH) trading near $2,000, as per records. This broader market stress has also shown up in flows at large issuers like BlackRock.

Between Feb 6 and Feb 9, BlackRock-linked crypto products like iShares Bitcoin Trust ETF and iShares Bitcoin Trust ETF recorded about $3.6 billion in net outflows.

iShares Bitcoin Trust ETF (IBIT) was trading at $39.19, down 2.29% in pre-market hours on Tuesday. On Stocktwits, retail sentiment around IBIT remained in 'extremely bullish' territory with chatter remaining in 'extremely high' levels over the past day.

Catalyst, Not A Cause

At first, investors in the market blamed Bitcoin's crash on BlackRock's IBIT ETF, saying that institutional positioning and ETF-linked flows caused the sell-off. But the evidence suggests that IBIT was more of a catalyst than the main cause of the downturn, which was mostly caused by a broader liquidity sweep and forced deleveraging in the crypto markets.

Hedging flows from banks and structured products linked to IBIT, probably made the downside momentum stronger once prices started to fall. However, the move itself was more of a general risk-off reset than a structural exit from Bitcoin by institutional investors.

Read also: White House Convenes Second Closed-Door Crypto Talks As Stablecoin Yield Fight Stalls CLARITY Act

For updates and corrections, email newsroom[at]stocktwits[dot]com<