According to S&P Global, transaction revenue was projected to account for 59% of Coinbase's total revenue in 2025.

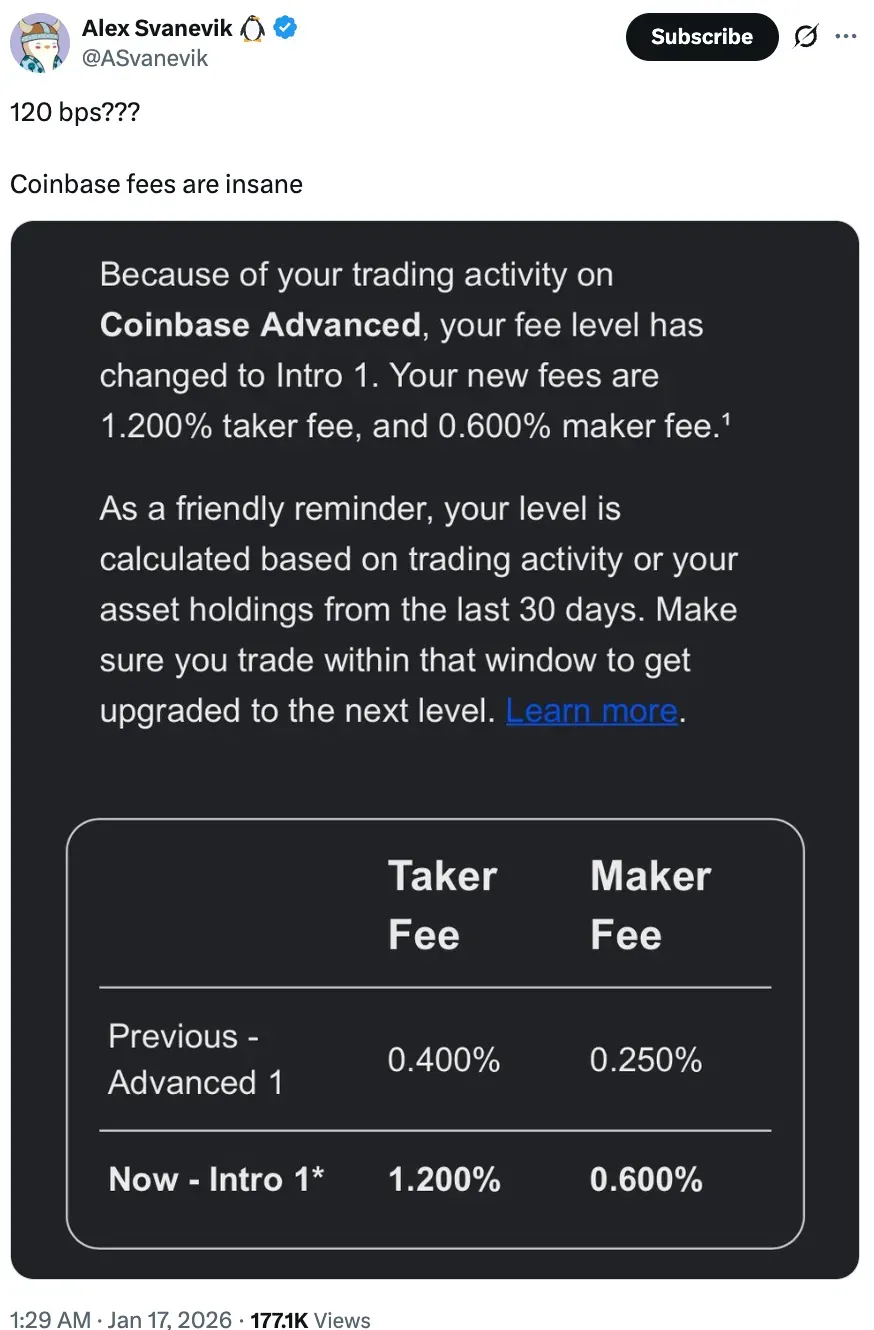

- Nansen CEO criticized Coinbase’s trading fees after a tier change on Coinbase Advanced raised taker fees to 1.20% and maker fees to 0.60%.

- Coinbase Advanced uses a tiered fee structure introduced in 2022.

- Binance's founder previously criticized market participants who complained on listing fee structure.

Nansen CEO Alex Svanevik criticized Coinbase fees while highlighting a recent change on the platform’s advanced trading tier.

In his X post, Svanevik wrote that Coinbase's prices are insane.” He shared a screenshot showing Coinbase Advanced’s fee level change from a 0.40% to a 1.2% taker fee and a jump from 0.25% to a 0.60% maker fee as his account moved into the “Intro-1” tier.

Coinbase, introduced in 2022, uses a tiered fee structure, in which trading fees vary depending on a user’s recent trading activity and asset holdings over a rolling 30-day period. Transaction fees remain a core revenue driver for Coinbase, even as the company has expanded into subscriptions, custody, and derivatives. S&P Global data shows that in 2025, transaction revenue was to make up an estimated 59% of Coinbase’s total revenue.

Coinbase (COIN) closed at $241.15 on Friday. On Stocktwits, retail sentiment around Coinbase remained in ‘bullish’ territory, accompanied by ‘high’ chatter levels over the past day.

Binance Founder Previously Criticized Fee Complaints

In late October, Binance Founder Changpeng Zhao criticized projects that complained about exchange listing fees. He wrote that if a project objects to another’s exchange fee structure, they should “make [their] own listing fees 0 and be happy. Businesses in a decentralized market are not required to adopt a single pricing model, he added.

Zhao also said that exchanges operate under different listing approaches, ranging from open listings to selective listings with deposits or airdrops, and he agreed that projects should focus on building products and serving users rather than criticizing competitors.

Binance’s standard spot trading fees begin at approximately 0.10% for both maker and taker fees.

Read also: ‘The Singularity Has Begun’—Strive’s Joe Burnett Says Bitcoin Is Built For AI Era

For updates and corrections, email newsroom[at]stocktwits[dot]com.<