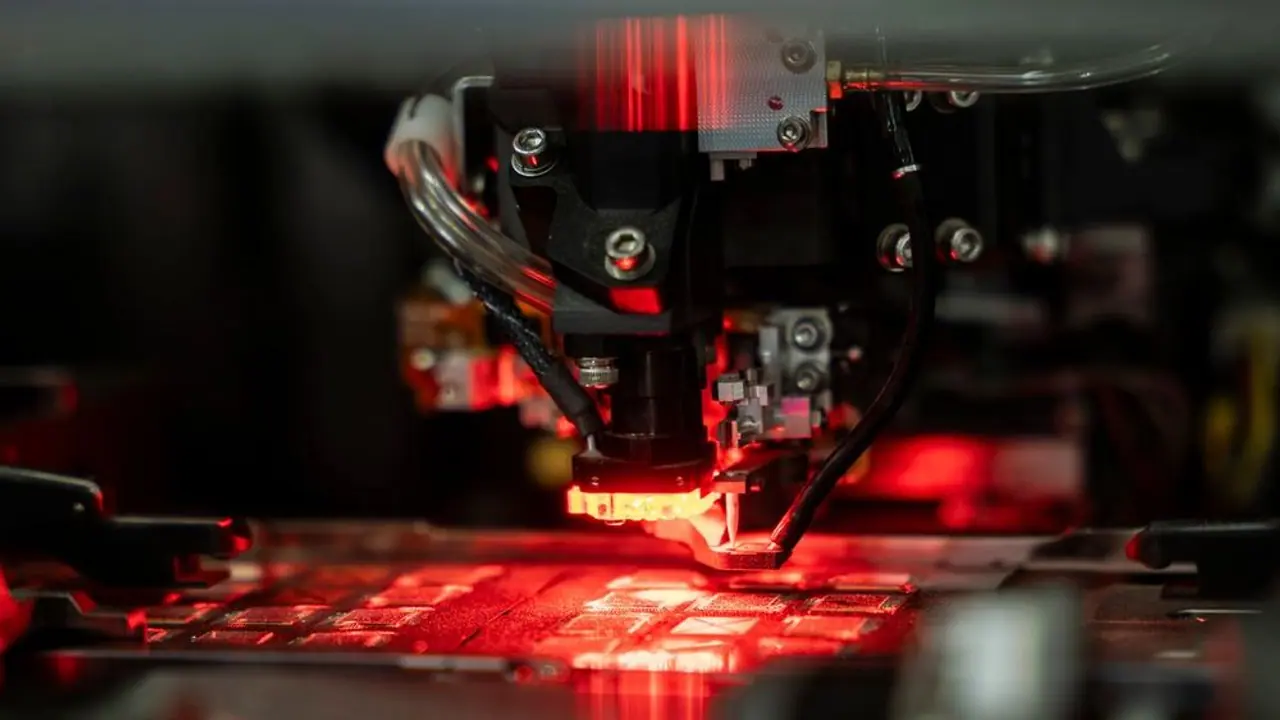

Coherent’s Illinois fabrication facility can accommodate up to 10 epitaxial tools and has previously been used to manufacture 2- to 6-inch sodium phosphide and gallium arsenide wafers.

Shares of Coherent Corp. (COHR) fell nearly 5.5% in Wednesday’s regular trading session and extended their decline during after-hours trading after the company said it would sell its epitaxial fabrication facility in Champaign, Illinois.

The company said this is part of its ongoing efforts to reduce its manufacturing footprint.

Coherent’s Illinois fabrication facility can accommodate up to 10 epitaxial tools and has previously been used to manufacture 2- to 6-inch sodium phosphide and gallium arsenide wafers.

The campus comprises four buildings and several fabrication and characterization tools.

Coherent has not identified any buyer yet.

The company also announced the launch of a new embedded optical time domain reflectometer, which can be used for real-time network diagnostics and is aimed at use in data centers and telecom networks.

Earlier this week, analysts at Raymond James upgraded Coherent to ‘Strong Buy’ from ‘Outperform’ over the company’s partnership with Nvidia Corp. on silicon photonics.

While it noted that the concerns around co-packaged optics are overblown, analysts said better clarity on the technology’s market opportunity could be a catalyst for Coherent.

Retail sentiment on Stocktwits around Coherent remained in the ‘bullish’ (67/100) territory, with message volumes at ‘normal’ levels at the time of writing.

Data from Koyfin shows the average price target for Coherent is $114.57, implying a 60% upside from current levels.

Of the 19 brokerage calls, 14 have a ‘Strong Buy’ or ‘Buy’ rating, while five have a ‘Hold’ rating.

Coherent’s stock has declined 25% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<