A bulk of Coca-Cola’s organic revenue growth benefited from pricing and higher global demand.

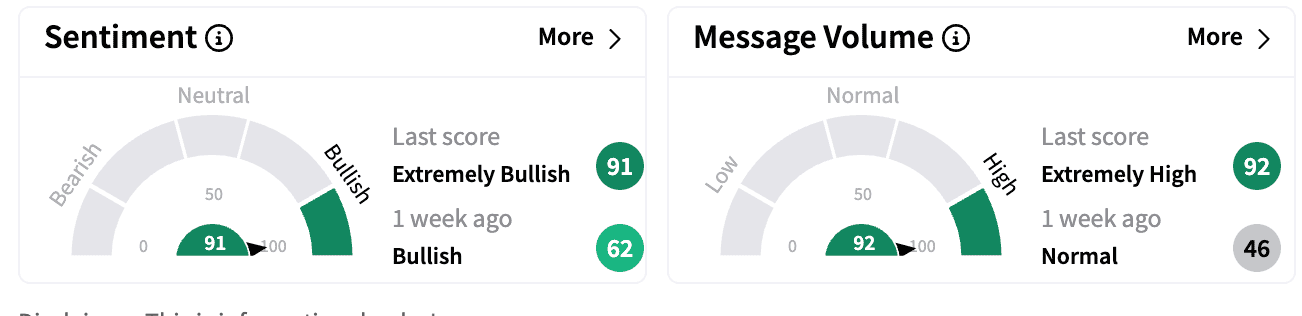

Shares of Coca-Cola ($KO) surged 4.73% on Tuesday after the beverage giant reported better-than-expected fourth-quarter results, lifting retail sentiment.

Its Q4 earnings per share of $0.55 exceeded the consensus estimates of $0.52, while revenues stood at $11.4 billion, up 14%, beating estimates of $10.68 billion.

Its organic non-GAAP revenues grew 14%, driven by a 9% growth in price mix and a 5% increase in concentrate sales, the company said. For the quarter, operating margin was 23.5% versus 21.0% in the prior year.

A bulk of Coca-Cola’s organic revenue growth benefited from pricing and higher global demand.

However, its 2025 guidance warned of price-driven growth and significant currency headwinds.

In 2025, Coca-Cola said it expects to deliver organic revenue growth of 5% to 6%, with a 3% to 4% currency headwind for comparable net revenues, based on the current rates and including the impact of hedged positions, in addition to a slight headwind from acquisitions, divestitures and structural changes. The company expects to deliver comparable currency neutral EPS growth of 8% to 10%.

“Our all-weather strategy is working, and we continue to demonstrate our ability to lead through dynamic external environments,” said James Quincey, chairman and CEO of Coca-Cola. “Our global scale, coupled with local-market expertise and the unwavering dedication of our people and our system, uniquely position us to capture the vast opportunities ahead.”

Coca-Cola portfolio includes Coca-Cola, Sprite and Fanta. Its water, sports, coffee and tea brands include Dasani, smartwater, vitaminwater, Topo Chico, Bodyarmor, Powerade, and Costa.

Coca-Cola stock is up 8.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<