Barclays trimmed roughly 1.2 million shares on Wednesday and dropped below the 5% reporting threshold.

- Barclays cut its stake in Churchill Capital Corp X to 4.31%, down from 8.63% in November.

- The disclosure comes ahead of a Thursday shareholder vote on Churchill X’s proposed merger with quantum technology firm Infleqtion.

- Infleqtion announced a NASA partnership on Tuesday to launch the world’s first quantum gravity sensor into space.

Shares of Churchill Capital Corp X (CCCX) fell over 5% in after-hours trading on Wednesday after a new regulatory filing showed that Barclays reduced its ownership in the company ahead of a key shareholder vote on its proposed merger with quantum technology firm Infleqtion.

CCCX stock extended gains for a second straight session in regular trading after surging more than 13%.

Barclays Cuts Stake Below 5%

In a new filing on Wednesday, Barclays reported ownership of 1.8 million shares, representing 4.31% of Churchill Capital Corp X’s outstanding stock as of Dec. 31, 2025.

The filing marks a reduction from Barclays’ prior disclosure in November, when the bank reported ownership of 3 million shares, or 8.63% of the company. The latest filing shows that Barclays trimmed its position by roughly 1.2 million shares, bringing its stake below the 5% reporting threshold.

SPAC Merger Vote Approaches

The disclosure comes as Churchill Capital Corp X prepares for a shareholder meeting on Thursday to seek approval for its previously announced business combination with Infleqtion. The transaction is expected to close in the first quarter of 2026.

Churchill Capital Corp X and Infleqtion signed a definitive merger agreement last September that would take the quantum technology firm public under the ticker INFQ. The deal could generate more than $540 million in gross proceeds, including over $125 million from a private investment in public equity (PIPE). The SPAC is backed by veteran Wall Street dealmaker Michael Klein.

NASA Deal Sparks Sharp Rally

The ownership update follows a sharp rally in Churchill Capital Corp X shares earlier this week. The stock ended over 15% higher on Tuesday to mark its best day in about three months after Infleqtion announced a partnership with NASA to send the "world’s first quantum gravity sensor" into space.

Under the deal, Infleqtion and NASA will work on the Quantum Gravity Gradiometer Pathfinder mission, which aims to place the sensor aboard a dedicated satellite in low Earth orbit, with a planned launch in 2030. Infleqtion will design and integrate the sensor’s quantum core, which uses ultracold atoms to deliver highly precise gravity measurements.

The project is led by NASA’s Jet Propulsion Laboratory and has secured more than $20 million in funding. The mission is designed to demonstrate technology capable of measuring subtle changes in Earth’s gravitational field, with potential applications in tracking water, ice, land, and natural resources.

Infleqtion’s Quantum Strategy

Infleqtion has positioned itself as a broad-based quantum technology company, offering quantum sensors, quantum clocks, RF antennas, gravimeters, and other inertial-sensing equipment. In a November interview with Stocktwits, the company said quantum technologies extend beyond computing alone, highlighting sensing products that are already delivering performance improvements over classical systems.

The company has said it holds a record 1,600 commercial physical qubits and is targeting 100 logical qubits by 2028, which could enable commercially useful quantum applications.

Government customers account for more than 50% of Infleqtion’s revenue, with contracts tied to energy grids and clocks.

How Did Stocktwits Users React?

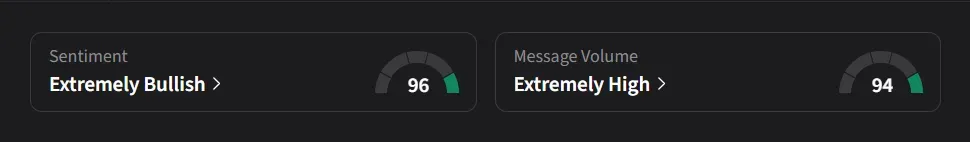

On Stocktwits, retail sentiment for CCCX was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “$CCCX isn’t just another SPAC — the quantum future might be priced into it right now. With the merger advancing, a planned NYSE relisting as INFQ, and real tech milestones in quantum computing, sensing and government contracts, traders are flocking back in.”

Another user said, “believe it or not, bullish. Somebody wants your shares for cheap, and unfortunately, they got them. $20 incoming”

CCCX stock has risen 40% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<