In a recent interview on The Rundown, Wood said the focus on stablecoins last year took the wind out from under Bitcoin but the apex cryptocurrency is poised to rise again.

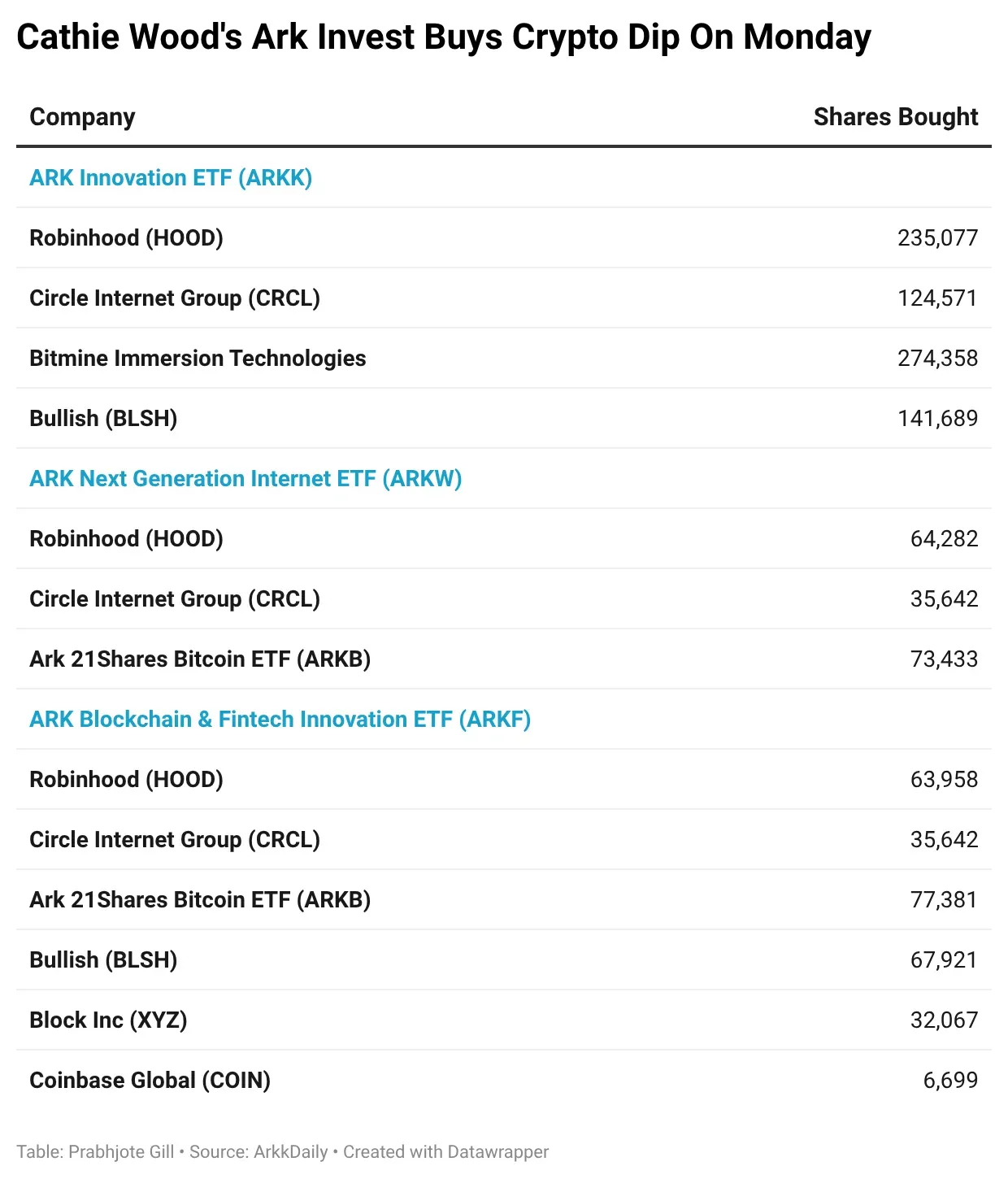

- Ark Invest picked up more of Robinhood, Bitmine Immersion Technologies, Bullish, Coinbase Global and other crypto-linked equities as they fell on Monday after Bitcoin’s flash crash over the weekend.

- Ark Invest added to its positions in crypto stocks across its ARKK, ARKW and ARKF ETFs.

- All three rose in overnight trading after posting losses during the regular session, but retail sentiment around them on Stocktwits remained mixed.

Cathie Wood backed Bitcoin (BTC) over gold in a recent interview, while ARK Invest used Monday’s pull back in the market to buy the dip in crypto-linked equities.

“I think if I were a betting person, and I can’t give advice necessarily, but I would make a shift from gold to Bitcoin, because I do think the knocks on Bitcoin in the last year have been stablecoins taking some of the role that Bitcoin was going to to play in emerging markets,” she said in an interview on The Rundown, reiterating her $1.5 million target on the apex cryptocurrency.

Following the interview, on Monday, Ark Invest added Robinhood (HOOD), Circle Internet Group (CRCL), Tom Lee’s Bitmine Immersion Technologies (BMNR) and crypto exchange Bullish (BLSH) to its flagship ARK Innovation ETF (ARKK). It also acquired more shares of the Ark 21Shares Bitcoin ETF (ARKB) and Robinhood for its ARK Next Generation Internet ETF (ARKW).

In addition, the fund bought Block Inc (XYZ) and Coinbase Global (COIN) for its ARK Fintech Innovation ETF (ARKF). All of the stocks rose in overnight trading amid broader recovery in the crypto market, with HOOD among the top trending tickers on Stocktwits.

ARK ETFs Gain In After-Hours Trade

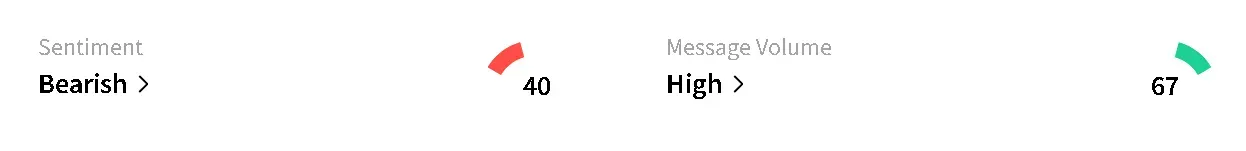

ARKK gained 1.40% in overnight trading, after edging 0.68% lower in regular trade on Monday. On Stocktwits, retail sentiment around the ETF remained in ‘bearish’ territory over the past day with chatter at ‘high’ levels.

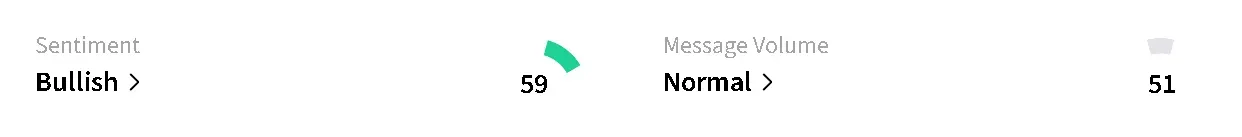

Meanwhile, ARKW rose 0.60% after hours following a dip of 1.63% in regular trade. Retail sentiment improved to ‘bullish’ from ‘neutral’ over the past day with chatter steady at ‘normal’ levels.

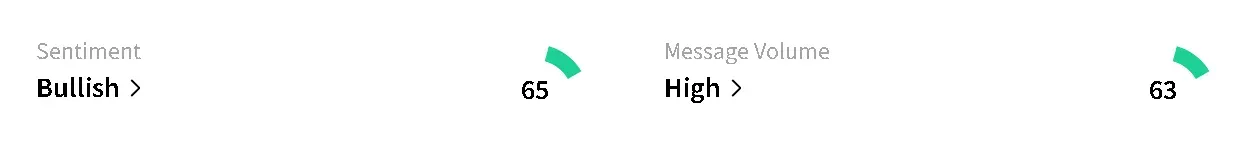

ARKF edged only 0.47% higher after hours after dropping 1.59% in the regular session. Retail sentiment around the ETF remained in ‘bullish’ territory over the past day with chatter at ‘high’ levels.

One user on the platform applauded the fund for sharing its daily trades, with a bullish position on BMNR.

Stock Moves Mirror Crypto Recovery

Robinhood’s stock fell to a six-month low on Monday, dropping nearly 10% in the regular session. After hours, the shares edged 0.36% higher alongside the recovery in Bitcoin (BTC), Ethereum (ETH) and other major tokens.

On Stocktwits, retail sentiment around HOOD’s stock improved to ‘extremely bullish’ from ‘bullish’ territory with chatter rising to ‘extremely high’ from ‘high’ levels over the past day. Platform data showed that message volumes surged over 1,000% in that time frame.

Cathie Wood also joined other institutional investors like UBS and Vanguard in buying the dip in BMNR’s stock on Monday. The shares fell 9.16% in regular trade before recovering 1.93% after hours. On Stocktwits, retail sentiment around BMNR’s stock remained in ‘bearish’ territory but chatter rose to ‘high’ from ‘normal’ levels over the past day. The company now holds 4.2 million Ethereum (ETH) with around 2.9 million of it staked, a positioning to show that it believes in the long-term durability of the leading altcoin.

USDC (USDC) stablecoin issuer Circle’s stock rose 1.33% in after hours trade, with Coinbase’s stock gaining 0.86%. Shares of Bullish and Block edged 0.66% and 0.13% higher respectively.

Read also: MSTR Stock Rebounds From 14-Month Low While Bitcoin Recovers – HOOD, BMNR Stabilize After Nearly 10% Drop

For updates and corrections, email newsroom[at]stocktwits[dot]com.<