Ark Invest purchased over 74,000 shares of Bullish on Thursday, extending its buying streak to 10 consecutive days.

- In an interview at Bitcoin Investor week, she stated that ARK Invest is concentrating on the “highest conviction names” in AI, robotics, energy storage, and blockchain.

- Her investment in Bullish over the last 10 days comes up to around $60 million based on the stock’s closing price each day.

- She warned of rising counterparty risk in traditional financial sectors and pegged Bitcoin as a hedge against both inflation and deflation.

- According to Wood, Jerome Powell and potential missteps in Fed policy are the biggest risks facing the market right now.

Cathie Wood’s ARK Invest continued to march on its buying spree of Bullish (BLSH) shares for a tenth straight day, this time picking up 74,323 shares for around $2.3 million, based on Thursday’s closing price.

According to Wood, ARK is currently focused on the “highest conviction names” while traditional players are following algorithmic moves and focusing on the most cash-rich stocks. Her investment in Bullish over the last 10 days comes up to around $60 million based on the stock’s closing price each day.

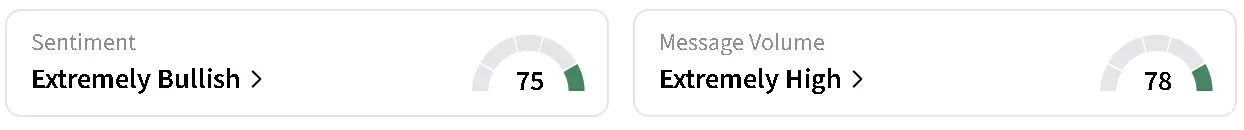

BLSH’s stock fell 0.95% in after-hours trade, following a dip of 0.53$ in the regular session. On Stocktwits, retail sentiment around the Peter Thiel-backed company remained in ‘extremely bullish’ territory amid ‘extremely high’ levels of chatter over the past day.

ARK Doubles Down On ‘High Conviction’ Names

“What's happening in the last week or so in particular reminds me of the early days of COVID,” she said during an interview at Bitcoin Investor Week. “Nobody knew what to do, and so algorithms just sold everything off, except for the safest stocks – the most cash rich and cash flow generative companies.”

Woods said that, unlike during COVID, the market is unlikely to see massive fiscal stimulus after lockdowns were lifted and people returned to normal life. “So we're not going to come out of this with a big boom, but they're selling the baby with the bath water again,” said.

According to Wood, this gives active managers like ARK Invest an opportunity to concentrate their holdings on “high conviction” names across robotics, energy storage, AI, blockchain technology, and multionics technology. “We’re in an environment where we’re ready for prime with all of these technologies,” she said.

Powell Is The Biggest Threat To Markets

In the interview, Wood stated that Federal Reserve Chair Jerome Powell is the “biggest risk” facing markets right now. She said policymakers may be misreading economic signals and relying on backward-looking data. “They could miss this and will be forced into a response when there's more carnage out there. I think that's what I'm worried about right now,” she said.

Bitcoin Is A Hedge Against Inflation And Deflation

Wood added that Bitcoin (BTC) is going to do well regardless of whether there’s inflation or deflation, serving as a hedge against both.

In addition to trading below its IPO debut, BLSH’s stock is also being pressured by the downtrend in Bitcoin (BTC). The apex cryptocurrency tumbled 1.7% in the last 24 hours to around $66,000. On Stocktwits, retail sentiment around Bitcoin flipped to ‘bearish’ from ‘bullish’ over the past day and chatter fell to ‘normal’ from ‘high’ levels.

“We’re in the flip side of the bubble,” Wood said, contending that many of these technologies, including blockchain and Bitcoin, are now commercially viable after years of development and cost declines.

Read also: Bitcoin Unlikely to Deliver 500x Returns, Grayscale Chairman Says – But These 2 Privacy Tokens Could Outperform

For updates and corrections, email newsroom[at]stocktwits[dot]com.<