The company anticipates recording a material non-cash impairment charge for certain long-lived assets.

- On October 24, the company released preliminary financial results for the third quarter (Q3), stating that it anticipated revenue to reach around $70 million.

- The company anticipates recording a material non-cash impairment charge for certain long-lived assets.

- Beyond Meat will now release its Q3 earnings on November 11.

Beyond Meat, Inc. (BYND) has announced a delay in releasing its third-quarter (Q3) financial results, with the company now planning to share the report after market close on Tuesday, November 11.

The Q3 earnings had previously been scheduled to be released on November 4.

Preliminary Figures And Impairment Charges

On October 24, the company released preliminary financial results for Q3, stating that it anticipated revenue to reach around $70 million, aligning with its previously shared guidance range of $68 million to $73 million.

Despite the stable revenue, Beyond Meat faced pressures on its profitability. The company expects its gross margin for the quarter to fall between 10% and 11%, taking into account approximately $1.7 million in costs associated with the suspension and major scale-back of operations in China.

Excluding the charges, the gross margin is estimated between 12% and 13%. Beyond Meat’s stock traded over 13% lower on Monday, after the morning bell.

The company also anticipates recording a material non-cash impairment charge for certain long-lived assets. A preliminary assessment under ASC 360 indicated that the carrying value of some assets is not fully recoverable from projected future cash flows. Although the charge is expected to be significant, management has yet to finalize its amount.

As a result, the numbers may shift materially when the final audited figures are released.

How Did Stocktwits Users React?

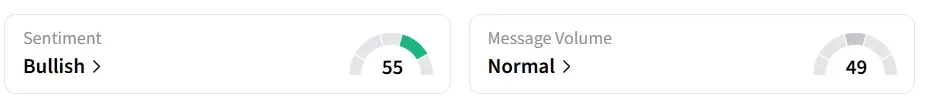

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory. Message volume shifted to ‘normal’ from ‘high’ levels in 24 hours.

The ticker gained significant buzz on Stocktwits. A bullish user sounded positive despite the delayed earnings.

Beyond Meat’s stock has lost 61% in 2025 and over 76% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<