The $125 million financing is committed to fund 19 megawatts (MW) of energy server deployments in the first tranche. HPS and IDF will acquire Bloom’s energy servers, including several advanced on-site microgrid solutions.

Shares of Bloom Energy, a firm engaged in stationary fuel cell power generation, rose over 4% on Wednesday after the company announced a $125 million project financing partnership with certain funds managed by HPS Investment Partners (HPS) and Industrial Development Funding (IDF).

HPS Investment Partners is a global, credit-focused alternative investment firm while Industrial Development Funding is an investment advisor registered with the SEC that manages capital for qualified institutional buyers.

The $125 million financing is committed to fund 19 megawatts (MW) of energy server deployments in the first tranche.

HPS and IDF will acquire Bloom’s energy servers, including several advanced on-site microgrid solutions. The funding will support the installation of Bloom equipment contracted under PPA structures.

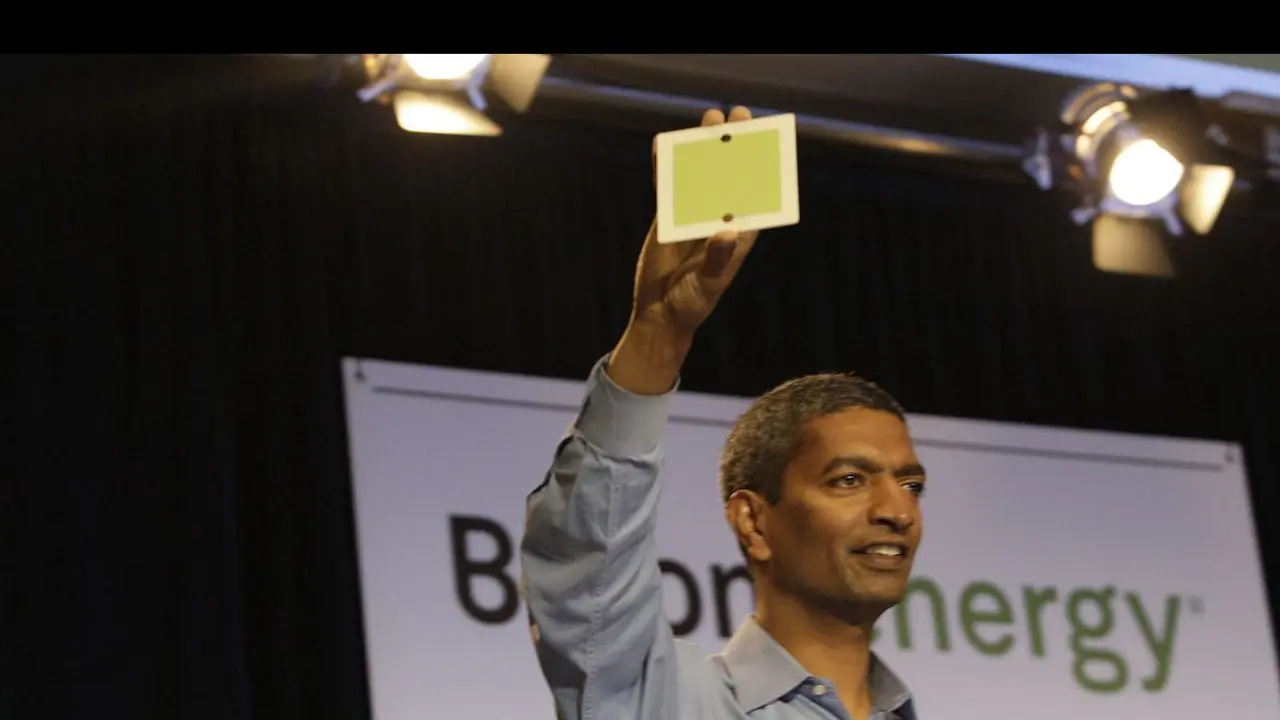

Bloom Energy’s chief commercial officer Aman Joshi said with growing demand for shorter contract lengths and larger-scale projects, the partnership enhances the firm’s ability to provide financed solutions that address customers’ power supply and reliability needs without impacting their capital budgets.

The partnership provides Bloom with new sources of debt and equity capital to create special purpose project companies that can sell electricity to customers.

On the other hand, the partnership expands opportunities for HPS and IDF to invest in the energy transition underway around the world.

Meanwhile, Roth MKM initiated coverage on Bloom Energy stock with a ‘Neutral’ rating and $25 price target.

However, the brokerage believes the stock's risk/reward is more balanced at current valuation levels, and is looking for potential pullbacks to get more constructive.

Retail sentiment on Stocktwits dipped into the ‘bearish’ territory (43/100) from ‘bullish’ a day ago, accompanied by high retail chatter.

Retail chatter on Stocktwits indicated a mixed take on the stock.

Shares of Bloom Energy have gained a whopping 65% since the beginning of the year, significantly outperforming the benchmark U.S. indices.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<