Strategy (MSTR) bought 23,784 BTC from December 1 to January 6, worth $2.1681 billion.

- Bitwise Europe’s Head of Research, André Dragosch, said on X that Bitwise expects the U.S. labor market to improve in 2026.

- Bitwise Europe's Bitcoin Macro Investor report claims Bitcoin is “materially underpriced” due to expected macroeconomic conditions in 2026.

- The report characterizes Bitcoin’s December downturn as a “late-stage shakeout” with retail investors absorbing most losses.

André Dragosch of global crypto asset management Bitwise said Bitcoin's asymmetric structure and the U.S. job market's improvement in 2026 are bullish for Bitcoin.

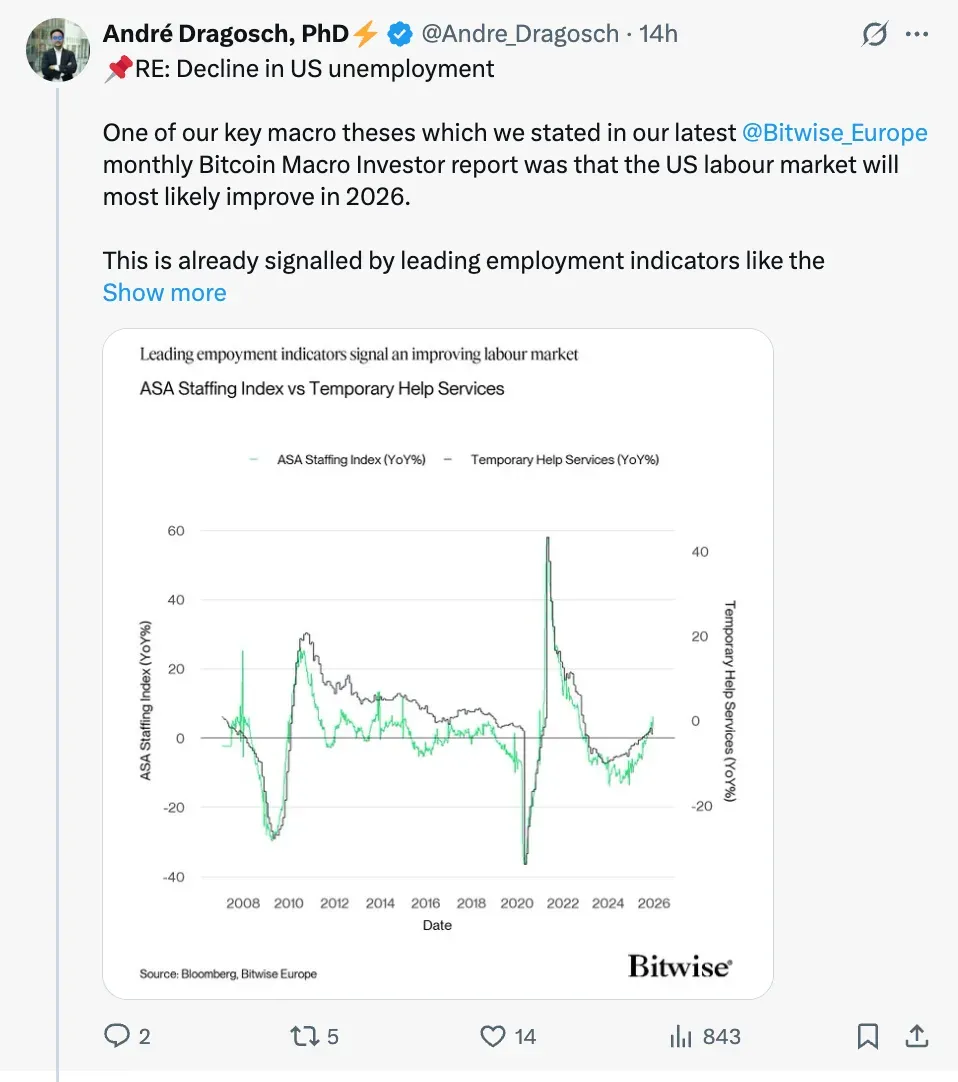

On X, Dragosch referred readers to Bitwise Europe’s new Bitcoin Macro Investor report that said Bitcoin (BTC) is “materially underpriced” given the macro backdrop anticipated in 2026. In the same thread, Bitwise expects the U.S. labor market to improve in 2026. He pointed to leading employment indicators, such as staffing and temporary help services data, which he said are already signaling a healthier job market. According to Bitwise, improving employment conditions would support consumer demand and broader economic stability. Historically, this is often considered bullish for Bitcoin.

Bitcoin (BTC) was trading at $90,361, down by 0.6% in 24 hours. On Stocktwits, retail sentiment around Bitcoin dropped from ‘extremely Bullish’ to ‘bullish’, as chatter around the apex cryptocurrency remained ‘high’ over the past day.

Retail Investors Took The Hit During December Downturn

The report talks about how the outlook for 2026 is shaped by several large economic forces. Bitwise expects interest rate cuts, more money flowing through the global financial system, a weaker U.S. dollar, and steady global growth. According to the firm, this combination has historically been supportive for risk assets such as Bitcoin.

Bitwise described December’s sharp Bitcoin decline as a “late-stage shakeout,” meaning some investors exited the market late in the cycle. The report also mentions that retail investors largely absorbed losses during the drop, while larger holders increased their positions. Bitwise added that Bitcoin’s valuation measures are now “close to cycle lows,” levels typically seen near the end of downturns.

The firm also pointed to technical and derivatives data suggesting that Bitcoin became “oversold” during the December selloff, while options market positioning remained “supportive,” which Bitwise noted can help limit further downside. Whales, defined in the report as entities controlling at least 1,000 BTC, were net buyers during the decline. For instance, Strategy (MSTR) bought 23,784 BTC from December to January 6, worth $2.1681 billion, as per its filing.

Bitwise cautioned that market recoveries take time. “Bottoming formations are a process, not an event,” the report said, noting that prices can move sideways before a clearer recovery emerges.

Read also: Ethereum Outperforms In Broad Crypto Sell-Off While Analysts Believe Bitcoin’s Four-Year Cycle Is Dead

For updates and corrections, email newsroom[at]stocktwits[dot]com.<