Crypto cooled on Friday as the CLARITY Act vote delay deepened regulatory uncertainty, with Coinbase opposing stablecoin yield bans and White House support in question.

- The CLARITY Act delay has impacted the crypto market sentiment. The Senate postponed the markup, while the White House's talk of withdrawing its support added to the uncertainty.

- Brian Armstrong, the founder of Coinbase, was one of the opponents of the bill, predicting that restrictions on passive stablecoin yield could damage crypto-native models.

- Bitcoin was steady and was trading at about $95,330, 0.2% lower for the day.

- However, many analysts remain bullish on Bitcoin and altcoins, despite the temporary setback

After a volatile day driven by both macro events and ongoing regulatory uncertainty around the Digital Asset Market Clarity Act (Clarity Act), crypto markets cooled off by Friday night.

CLARITY Act Uncertainty Weighs On Sentiment

Outside the macro picture, attention was directed towards Washington after news that an anticipated vote in the U.S. Senate on the CLARITY Act had been postponed, bringing further regulatory uncertainty.

Last week, Brian Armstrong, CEO of Coinbase (COIN), said the company would be pulling its support and cited provisions in the bill that could significantly hurt crypto-native business models. The bill would make passive yield on stablecoins illegal in a widely seen move that is to the benefit of banks versus crypto issuers. JPMorgan executives have warned in the past that yield-bearing stablecoins could cause major deposit outflows from traditional banks.

The Senate Banking Committee on Thursday postponed the planned markup hearing for the Clarity Act after Armstrong’s public opposition to it. Furthermore, Eleanor Terrett stated on Friday that the White House is considering withdrawing its support for the proposed Clarity Act framework should a proposed yield agreement satisfactory to the banks not be reached.

Market Analysts Remain Optimistic

Bitcoin (BTC) traded around $95,330, down around 0.2% in the last 24 hours after experiencing an initial spike upwards at $95,801.89 during trading hours. Bitcoin saw approximately $42.48 million in liquidations, according to Coinglass data. However, due to recent consolidation, positioning remained relatively constructive following the short squeeze seen earlier this week. On Stocktwits, retail sentiment around Bitcoin remained in ‘bullish’ territory, as chatter levels stayed at ‘normal’ levels over the past day.

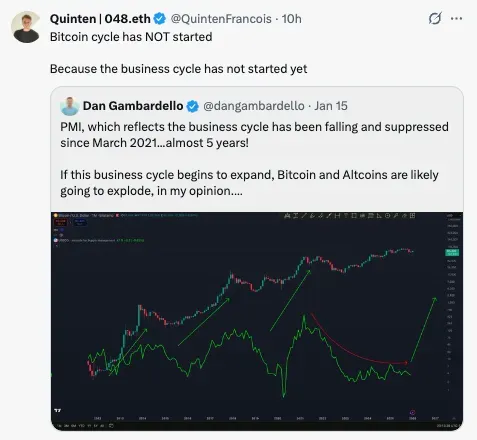

However, many analysts are hopeful that Bitcoin and altcoins are constructively bullish. On X, Quinten François said the Bitcoin cycle has not yet begun, arguing that the broader business cycle remains weak, as reflected in still-suppressed growth economic metrics such as the Purchasing Managers' Index (PMI) data.

Despite the temporary loss of momentum, James pointed to positive probability-based momentum signals in top altcoins post the largest drawdown of the cycle.

Altcoins Stay Muted

Ethereum (ETH) hovered near $3,290, down 0.3% in 24 hours, with roughly $22.04M in liquidations. On Stocktwits, retail sentiment around Ethereum remained in ‘neutral’ territory, with chatter at ‘normal’ levels over the past day.

Solana (SOL) edged up to roughly $144.45, gaining 1.7% in 24 hours, with around $7.64 million in liquidations. On Stocktwits, the retail sentiment showed ‘neutral’ territory, though overall chatter levels remained at ‘low’ over the past day.

Cardano (ADA) held around $0.3945, edging up 0.5% on the day, with liquidations near $1.08 million. Retail sentiment on Stocktwits for Cardano remained in ‘neutral’ territory, with chatter being at ‘low’ levels over the past day.

Binance Coin (BNB) traded near $937, up 0.6%, with liquidations muted at roughly $0.30 million. Despite the small gain, retail sentiment on Stocktwits remained in “extremely bearish” territory, with chatter at ‘normal’ levels over the past day.

Ripple’s XRP (XRP) hovered near $2.06, down 0.5%, with about $6.36 million liquidated. On Stocktwits, retail sentiment around XRP stayed in ‘neutral’ territory with chatter levels at ‘low’ over the past day.

Dogecoin (DOGE) slipped to about $0.1375. Down by 1.7%, Dogecoin saw roughly $3.78 million in liquidations over the past day. On Stocktwits, retail sentiment around Dogecoin remained in ‘neutral’ territory, with chatter levels at ‘low’ over the past day.

A total of $158.15 million in crypto was liquidated over the last 24 hours across the entire market.

Read also: Binance Co-Founder CZ Says Bitcoin At $200,000 Is Only ‘A Matter Of Time.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<