On-chain indicators for Bitcoin suggest the cryptocurrency is resetting and not consolidating, similar to the capitulation points in both 2018 and 2022.

- Bitcoin is below the 0.75 supply cost-basis quantile, which is an indication that there is selling pressure from institutional investors, one that reflects a late-stage bear market.

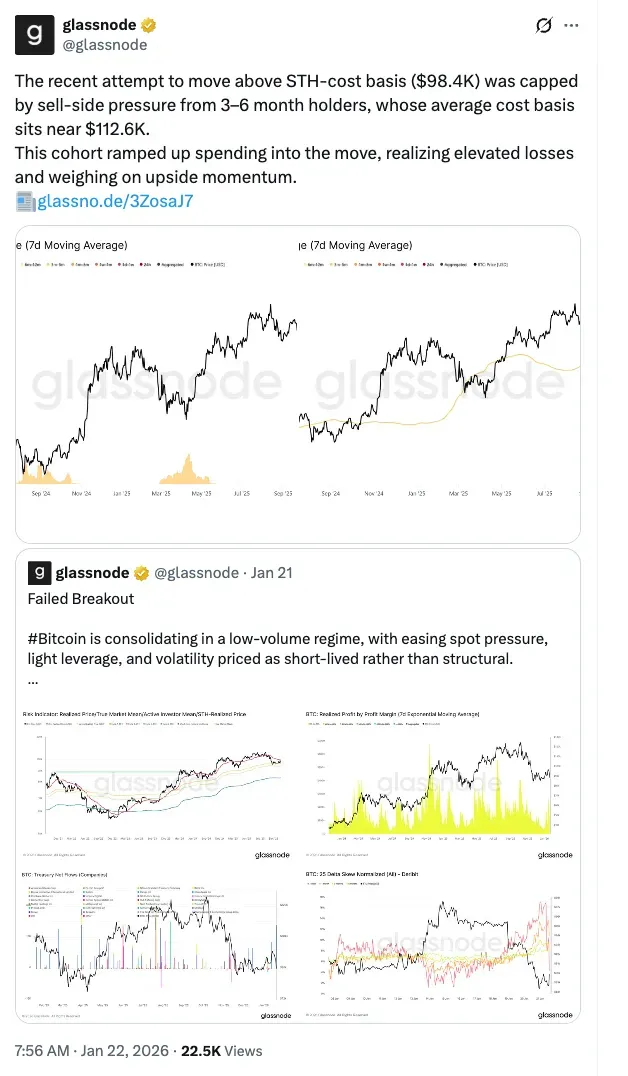

- According to on-chain signals, the 3- to 6-month holder group continues to sell Bitcoin at its new resistance range of $98,400 to $112,600, realizing losses and capping upside potential.

- The current Sharpe ratio remains below zero and continues to indicate that market volatility is still higher than actual returns, a condition seen during the 2018 and 2022 full-cycle washouts.

Bitcoin market conditions are showing patterns similar to those of the 2022 bear market. On-chain data and multiple quantitative indicators point to sustained selling pressure and a weakening market structure.

According to data by Glassnode, Bitcoin (BTC) has fallen below a key cost-basis quantile, which means that the majority of circulating Bitcoin is now held at a loss.

BTC has fallen below the 0.75 supply cost basis quantile and is unable to recapture the supply price. Currently, most of the circulating supply has a cost basis that is about 75%.

Historically, when Bitcoin trades in this area, it has increased selling pressure, as a larger number of holders who purchased at higher prices have now lost money and are more inclined to take profits as Bitcoin increases in value. Glassnode states that, “risk has shifted higher, with downside dominant unless this level is recovered.”

Glassnode further pointed out that Bitcoin was rejected in its latest attempt to retake short-term holder (STH) cost basis around $98,400 due to selling pressure from holders that fall within the 3- to 6-month time frame with an average cost basis of nearly $112,600. The report indicates that this group has started to increase its spending during the recent rally, ultimately realizing losses and stopping future price increases, a characteristic of the final stages of a bear market.

Bitcoin was trading at $89,032.99, down 1% over the last 24 hours. Retail sentiment around Bitcoin remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

The Bitcoin Sharpe Ratio

As a result of the bearish sentiment surrounding Bitcoin's price performance, the Sharpe ratio, a popular indicator of risk-adjusted return, remains in negative territory. A negative Sharpe ratio indicates that investors are being compensated with volatility rather than returns, and this typically tends to reduce institutional appetite for risk exposure.

Historically, periods with negative Sharpe ratios have coincided with drawdowns during prior market cycles, such as in December 2018 and during the market fall following the collapse of the Terra (LUNA) token and the resulting price drop across the rest of the crypto markets in 2022.

These indications point to Bitcoin not going through a multi-day consolidation but rather resetting the entire cycle, as was the case with previous Bitcoin collapses during the capitulation phase of Bitcoin market cycles. Until we see the return of the Bitcoin Achilles (the price level at which selling pressure meaningfully subsides and holders regain conviction), along with increased risk-adjusted returns after the Bitcoin asset class's return on investment (ROI).

Read also: Are Stablecoins Keeping Liquidity Alive In The Crypto Market? New Data Suggests They Might

For updates and corrections, email newsroom[at]stocktwits[dot]com.<