Bitcoin’s price remains nearly 25% below its record high of over $126,000 seen in October last year.

- The uptick in Bitcoin’s price followed a second consecutive day of positive flows into U.S. spot Bitcoin ETFs after a volatile stretch over the past month.

- Tuesday’s advance also came after the release of U.S. inflation data that aligned with expectations.

- Retail traders on Stocktwits are now hopeful that Bitcoin’s price may cross $100,000 by the end of the week.

Bitcoin (BTC) crossed $96,000 for the first time this year on Tuesday night, marking its highest level since November last year.

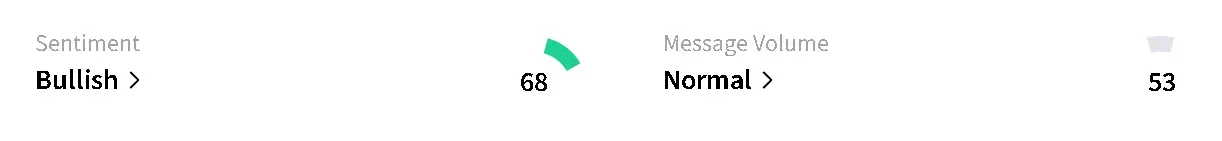

Bitcoin’s price rose 4.6% in the last 24 hours to hit an intra-day high of nearly $96,000 before paring gains to trade at around $95,400. On Stocktwits, retail sentiment around the apex cryptocurrency flipped to ‘bullish’ from ‘bearish’ even as chatter remained at ‘normal’ levels.

Retail Sees $100,000 This Week

After Tuesday's uptick, retail traders on Stocktwits are now hopeful that Bitcoin’s price may cross $100,000 by the end of the week. It still remains nearly 25% below its all-time high of over $126,000 seen in October last year.

Crypto Liquidations Spike

The sudden uptick in Bitcoin’s price and the pump provided to the broader cryptocurrency market resulted in $685 million in liquidations over the past 24 hours, the highest level this year. According to CoinGlass data, short positions accounted for nearly $600 million of the total, indicating that the market was bearish heading into the rally. Bitcoin and Ethereum (ETH) led the wipeout, with liquidations of roughly $294 million and $214 million, respectively.

Why Is Bitcoin Rising?

Bitcoin’s rally followed a second consecutive day of positive flows into U.S. spot Bitcoin exchange-traded funds (ETFs) after a volatile stretch over the past month. According to Farside Investors data, spot Bitcoin ETFs recorded $627 million in net inflows on Tuesday. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led activity, attracting $351 million.

Tuesday’s advance also came after the release of U.S. inflation data that aligned with expectations. The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 0.3% in December on a seasonally adjusted basis, following a 0.2% increase in November. The annual inflation rate stood at 2.7% before seasonal adjustment.

Read also: Binance Founder CZ Tells Traders To Stop ‘Aping’ Into Meme Coins Inspired By His Social Media

For updates and corrections, email newsroom[at]stocktwits[dot]com.<