The Bitcoin miner has expanded operations with a major Paraguay acquisition, but investors remain cautious as Q3 earnings approach.

Hive Digital Technologies (HIVE) stock traded flat in pre-market trading on Tuesday as investors awaited the Bitcoin miner’s third-quarter earnings, which are scheduled to be announced after market close.

Analysts expect the company to report a loss of $0.10 per share on revenue of $28.24 million.

In January, Hive mined 102 BTC, bringing its total Bitcoin holdings to 2,657 BTC, valued at approximately $271 million as of Jan. 31, based on Bitcoin’s closing price of $102,000.

The company’s Bitcoin reserves grew 34% year-over-year (YoY), but decreased month-over-month after Hive sold a portion of its holdings to finance capital investments, including the acquisition of Bitfarms’ 200-megawatt hydro-powered mining assets in Paraguay.

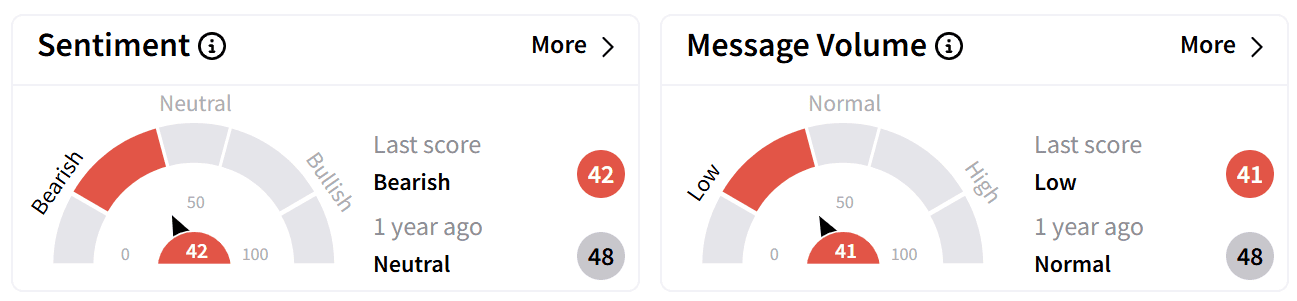

On Stocktwits, retail sentiment around the stock dipped to ‘bearish’ from ‘neutral’ a day ago as chatter also decreased to ‘low’ from ‘normal’ levels.

Some traders speculated the stock could decline further if earnings miss expectations.

Despite Bitcoin’s price more than doubling over the past year, Hive’s stock has fallen 21% during the same period and is down more than 4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Astera Labs Stock Slides As Strong Q4 Earnings Fail To Offset Cost Pressures, But Retail Sentiment Hits Year-High